Answered step by step

Verified Expert Solution

Question

1 Approved Answer

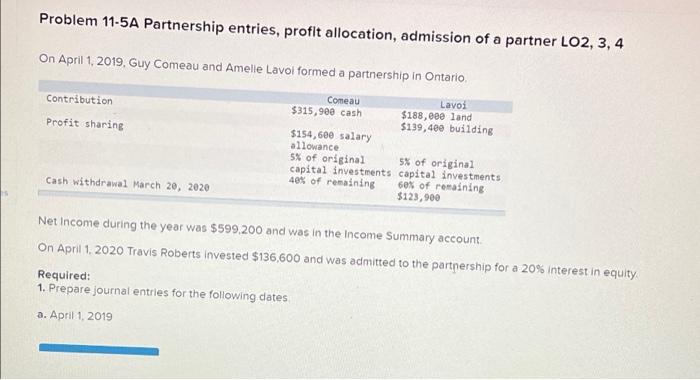

on a april 20, 2019, guy comeau and amelie lavoi formed a partnership in ontario Problem 11-5A Partnership entries, profit allocation, admission of a partner

on a april 20, 2019, guy comeau and amelie lavoi formed a partnership in ontario

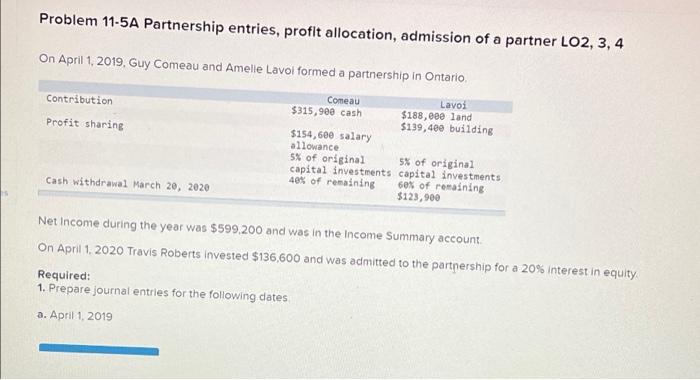

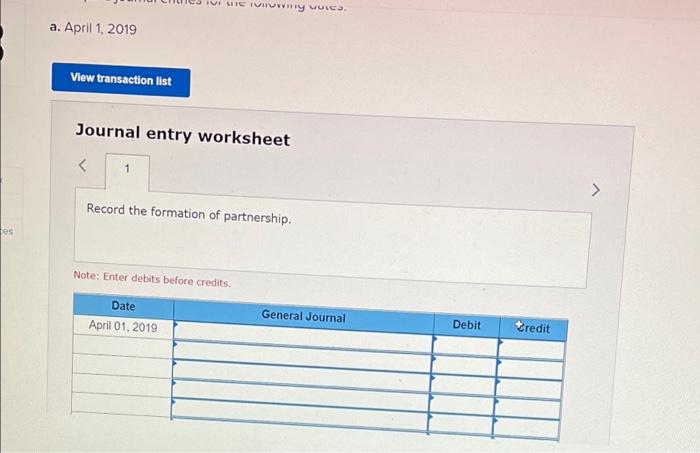

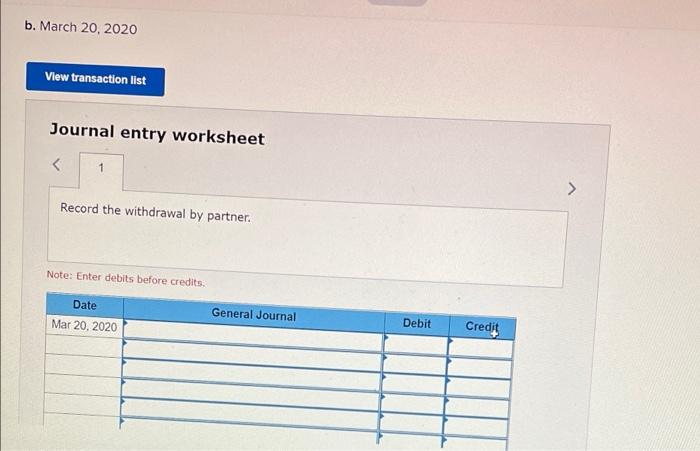

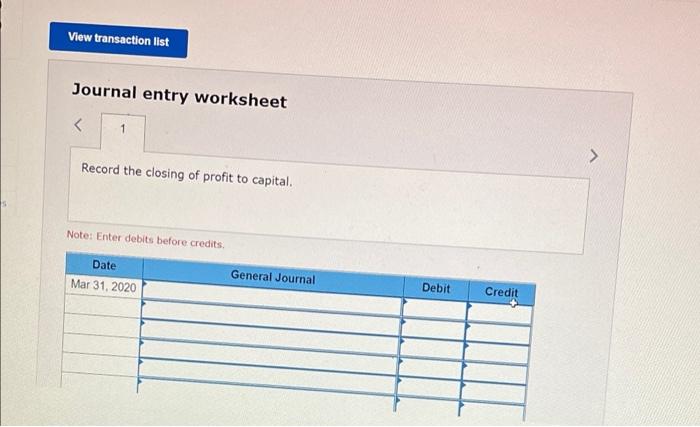

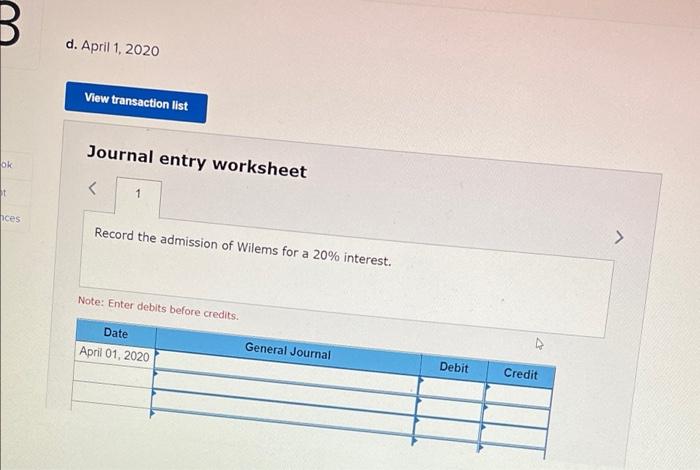

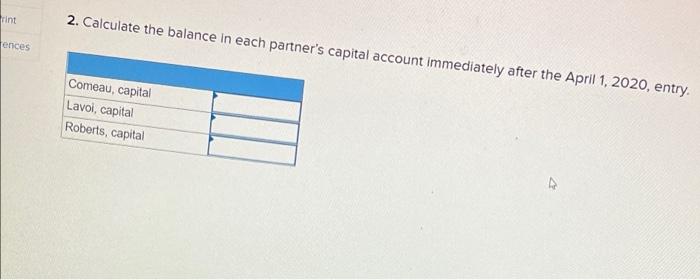

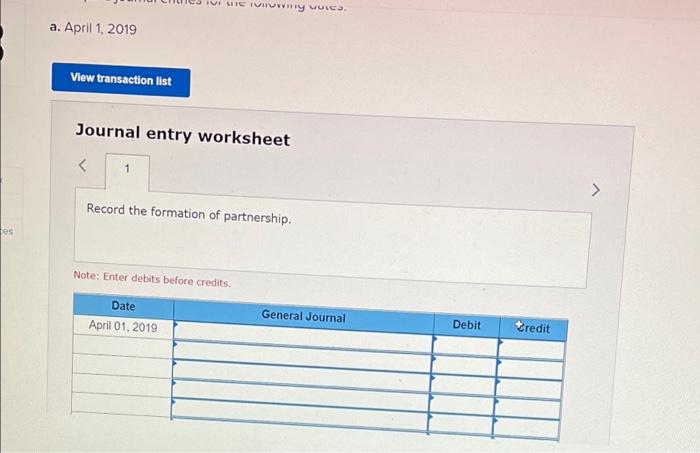

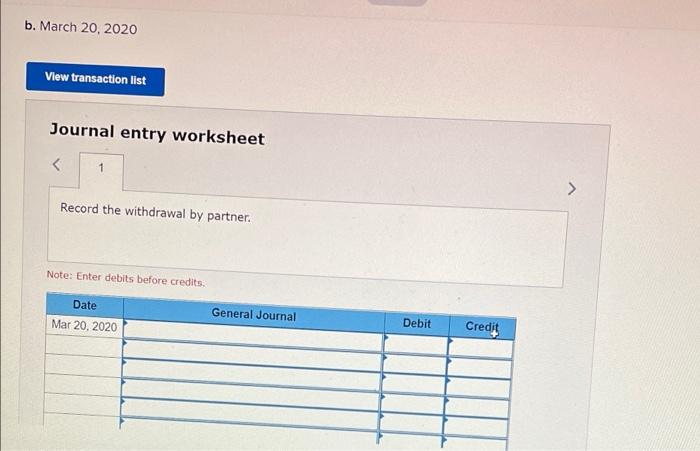

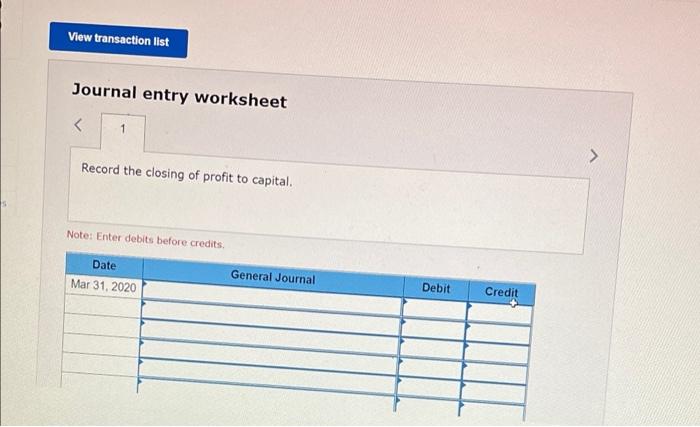

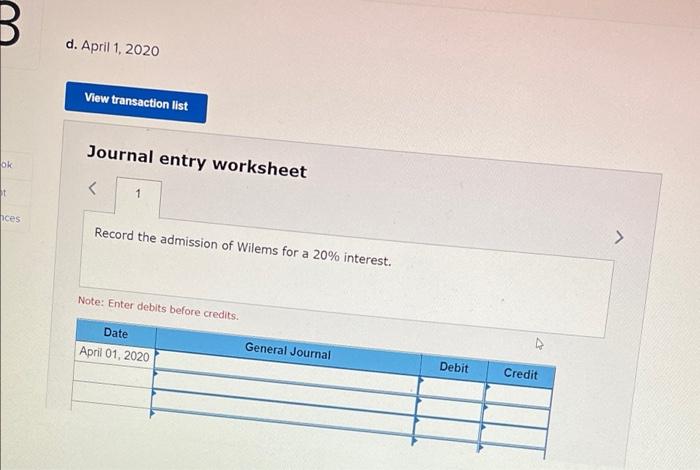

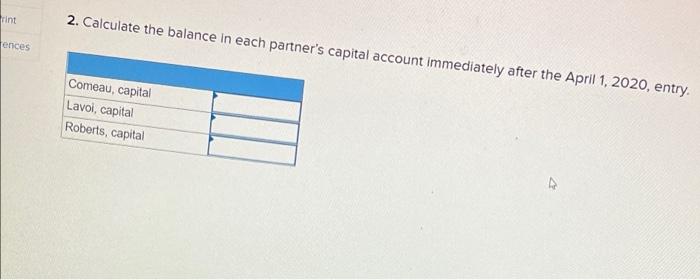

Problem 11-5A Partnership entries, profit allocation, admission of a partner LO2, 3, 4 On April 1, 2019, Guy Comeau and Amelle Lavoi formed a partnership in Ontario. Contribution Comeau $315,900 cash Lavoi $188,000 land $139,400 building Profit sharing $154,600 salary allowance 5% of original capital investments 40% of remaining 5% of original capital investments 60% of remaining $123,900 Cash withdrawal March 20, 2020 Net Income during the year was $599,200 and was in the Income Summary account. On April 1, 2020 Travis Roberts invested $136,600 and was admitted to the partnership for a 20% interest in equity. Required: 1. Prepare journal entries for the following dates a. April 1, 2019 es a. April 1, 2019 me invring voies. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started