Answered step by step

Verified Expert Solution

Question

1 Approved Answer

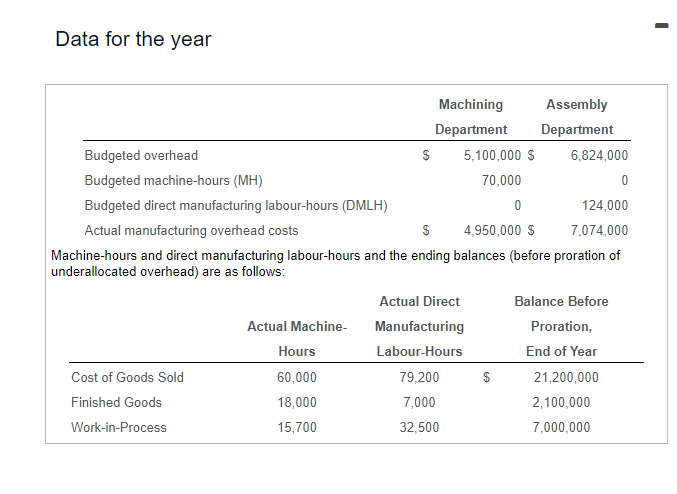

on actual direct manufacturing labour - hours using a budgeted direct manufacturing labour - hour rate. The following data are for the year: ( Click

on actual direct manufacturing labourhours using a budgeted direct manufacturing labourhour rate. The following data are for the year:

Click the icon to view the data for the year.

Required

Requirement Compute the budgeted overhead rates for the year in the Machining and Assembly Departments. Round your answers to the nearest whole dollar.

The budgeted overhead rate for the year in the Machining Department is $

The budgeted overhead rate for the year in the Assembly Department is $

Cost of Goods Sold, Finished Goods, and WorkinProcess; and c proration based on the allocated overhead amount before proration in the ending balances of Cost of Goods Sold, Finished Goods, and WorkinProcess.

We will begin with a immediate writeoff to Cost of Goods Sold.

Overallocation or

underallocation

on actual direct manufacturing labourhours using a budgeted direct manufacturing labourhour rate. The following data are for the year:

Click the icon to view the data for the year.

Required

Requirement Compute the budgeted overhead rates for the year in the Machining and Assembly Departments. Round your answers to the nearest whole dollar.

The budgeted overhead rate for the year in the Machining Department is $

The budgeted overhead rate for the year in the Assembly Department is $

Cost of Goods Sold, Finished Goods, and WorkinProcess; and c proration based on the allocated overhead amount before proration in the ending balances of Cost of Goods Sold, Finished Goods, and WorkinProcess.

We will begin with a immediate writeoff to Cost of Goods Sold.

Overallocation or

underallocation

Data for the year

tabletableMachiningDepartmenttableAssemblyDepartmentBudgeted overhead,$Budgeted machinehours MHBudgeted direct manufacturing labourhours DMLHActual manufacturing overhead costs,$tableMachinehours and direct manufacturing labourhours and the ending balances before proration ofunderallocated overhead are as follows:Actual Direct,Balance BeforetableActual MachineManufacturing,Proration,Hours,LabourHours,End of YearCost of Goods Sold,$Finished Goods,WorkinProcess,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started