Answered step by step

Verified Expert Solution

Question

1 Approved Answer

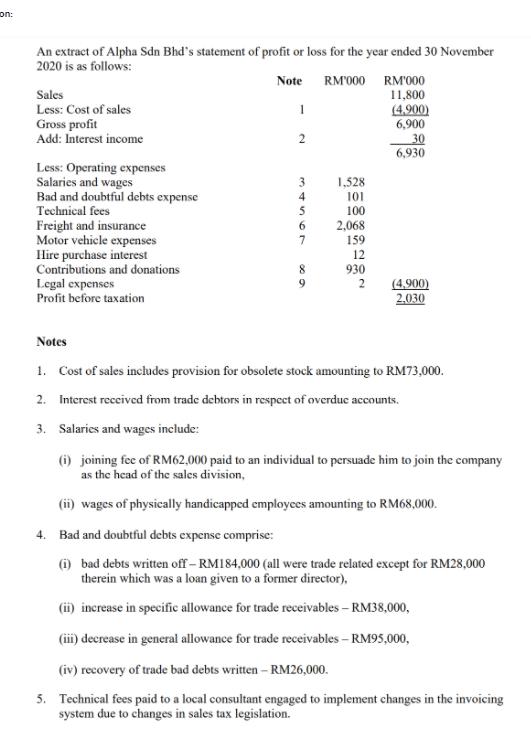

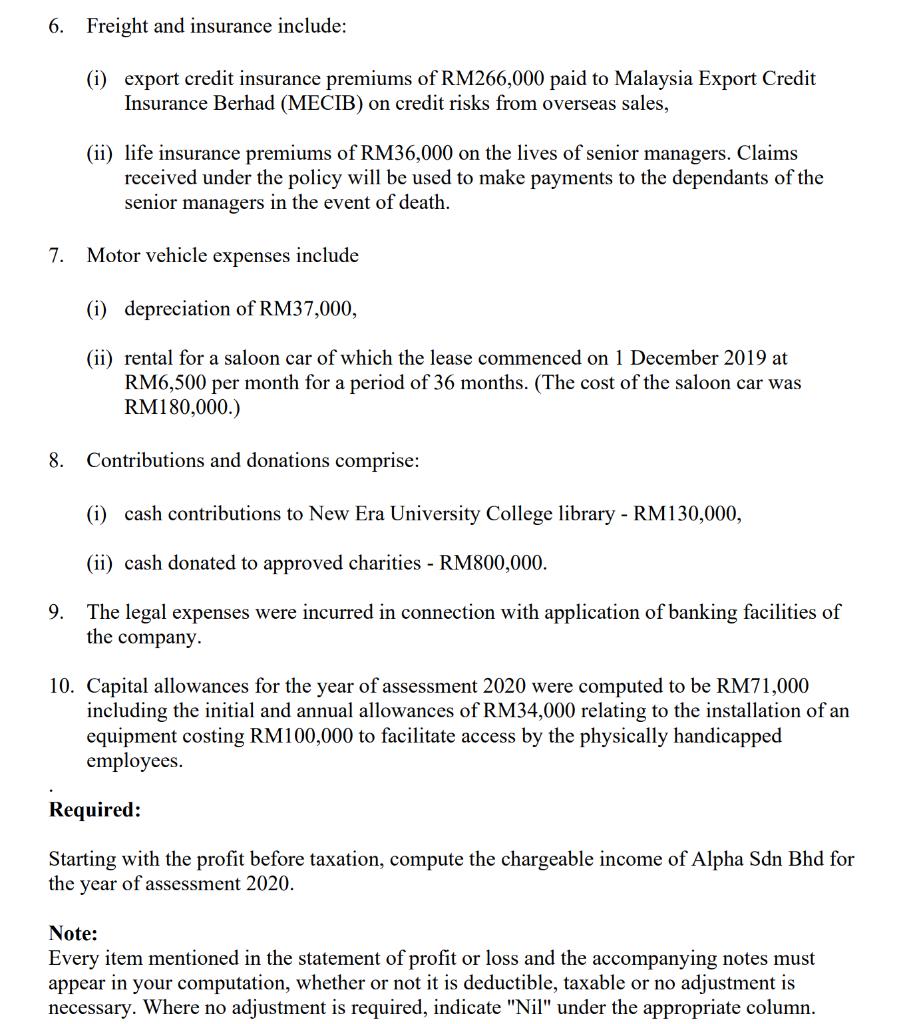

on: An extract of Alpha Sdn Bhd's statement of profit or loss for the year ended 30 November 2020 is as follows: Note RM'000

on: An extract of Alpha Sdn Bhd's statement of profit or loss for the year ended 30 November 2020 is as follows: Note RM'000 Sales Less: Cost of sales Gross profit Add: Interest income Less: Operating expenses Salaries and wages Bad and doubtful debts expense Technical fees Freight and insurance Motor vehicle expenses Hire purchase interest Contributions and donations Legal expenses Profit before taxation 1 2 34567 8 1000 9 1,528 101 100 2,068 159 12 930 2 RM'000 11,800 (4,900) 6,900 30 6,930 (4,900) 2,030 Notes 1. Cost of sales includes provision for obsolete stock amounting to RM73,000. 2. Interest received from trade debtors in respect of overdue accounts. 3. Salaries and wages include: (i) joining fee of RM62,000 paid to an individual to persuade him to join the company as the head of the sales division, (ii) wages of physically handicapped employees amounting to RM68,000. 4. Bad and doubtful debts expense comprise: (i) bad debts written off-RM184,000 (all were trade related except for RM28,000 therein which was a loan given to a former director), (ii) increase in specific allowance for trade receivables - RM38,000, (iii) decrease in general allowance for trade receivables - RM95,000, (iv) recovery of trade bad debts written - RM26,000. 5. Technical fees paid to a local consultant engaged to implement changes in the invoicing system due to changes in sales tax legislation. 6. Freight and insurance include: (i) export credit insurance premiums of RM266,000 paid to Malaysia Export Credit Insurance Berhad (MECIB) on credit risks from overseas sales, (ii) life insurance premiums of RM36,000 on the lives of senior managers. Claims received under the policy will be used to make payments to the dependants of the senior managers in the event of death. 7. Motor vehicle expenses include (i) depreciation of RM37,000, (ii) rental for a saloon car of which the lease commenced on 1 December 2019 at RM6,500 per month for a period of 36 months. (The cost of the saloon car was RM180,000.) 8. Contributions and donations comprise: (i) cash contributions to New Era University College library - RM130,000, (ii) cash donated to approved charities - RM800,000. The legal expenses were incurred in connection with application of banking facilities of the company. 9. 10. Capital allowances for the year of assessment 2020 were computed to be RM71,000 including the initial and annual allowances of RM34,000 relating to the installation of an equipment costing RM100,000 to facilitate access by the physically handicapped employees. Required: Starting with the profit before taxation, compute the chargeable income of Alpha Sdn Bhd for the year of assessment 2020. Note: Every item mentioned in the statement of profit or loss and the accompanying notes must appear in your computation, whether or not it is deductible, taxable or no adjustment is necessary. Where no adjustment is required, indicate "Nil" under the appropriate column.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To compute the chargeable income of Alpha Sdn Bhd for the year of assessment 2020 we start with the profit before taxation and make adjustments based ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started