Answered step by step

Verified Expert Solution

Question

1 Approved Answer

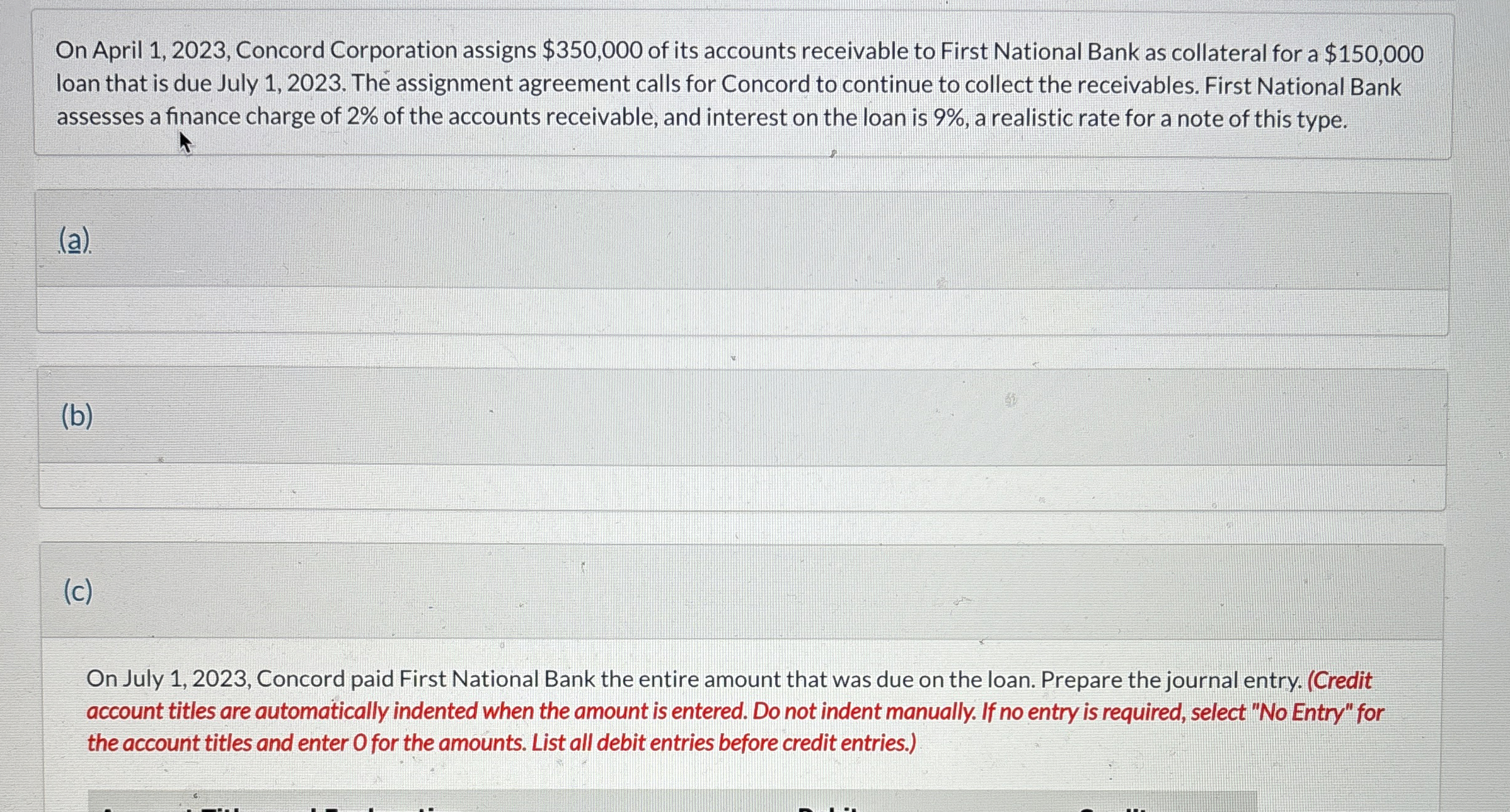

On April 1 , 2 0 2 3 , Concord Corporation assigns $ 3 5 0 , 0 0 0 of its accounts receivable to

On April Concord Corporation assigns $ of its accounts receivable to First National Bank as collateral for a $

loan that is due July The assignment agreement calls for Concord to continue to collect the receivables. First National Bank

assesses a finance charge of of the accounts receivable, and interest on the loan is a realistic rate for a note of this type.

a

b

c

On July Concord paid First National Bank the entire amount that was due on the loan. Prepare the journal entry. Credit

account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for

the account titles and enter for the amounts. List all debit entries before credit entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started