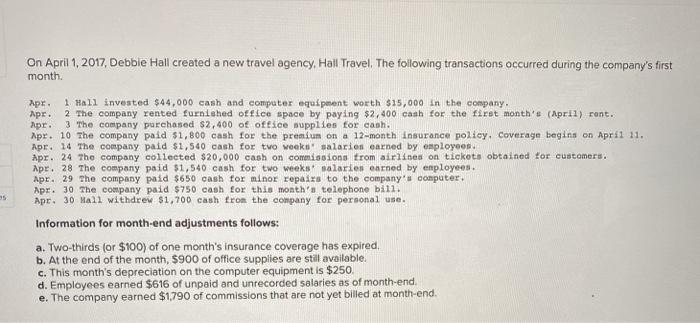

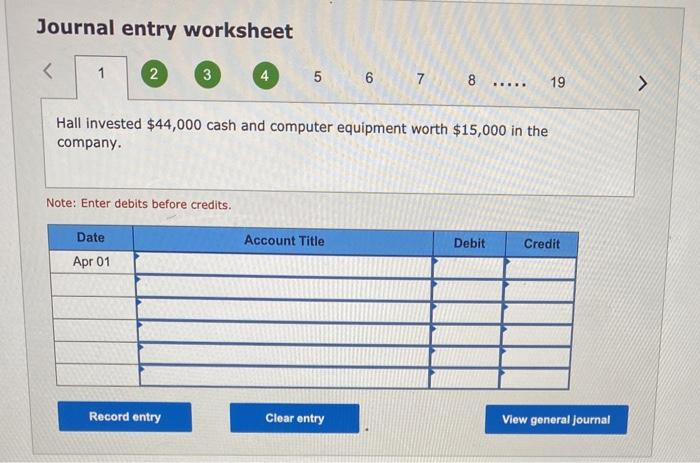

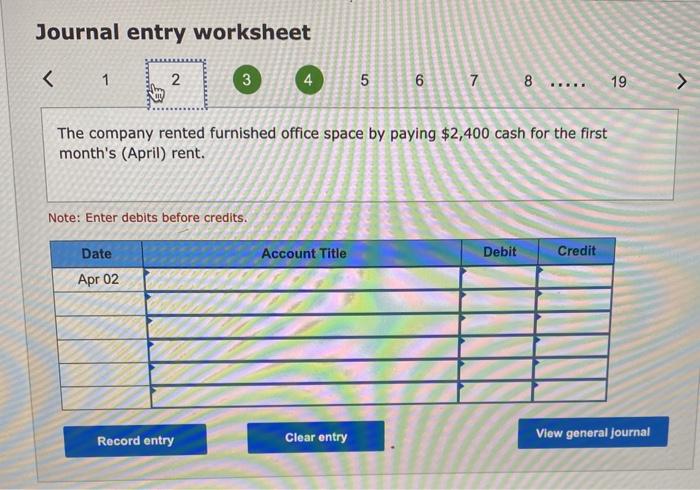

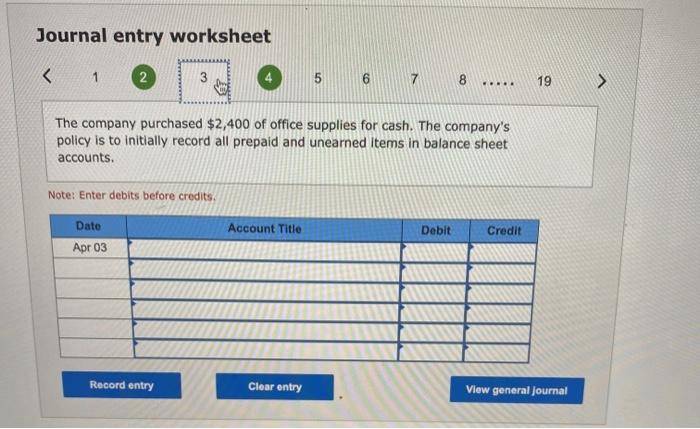

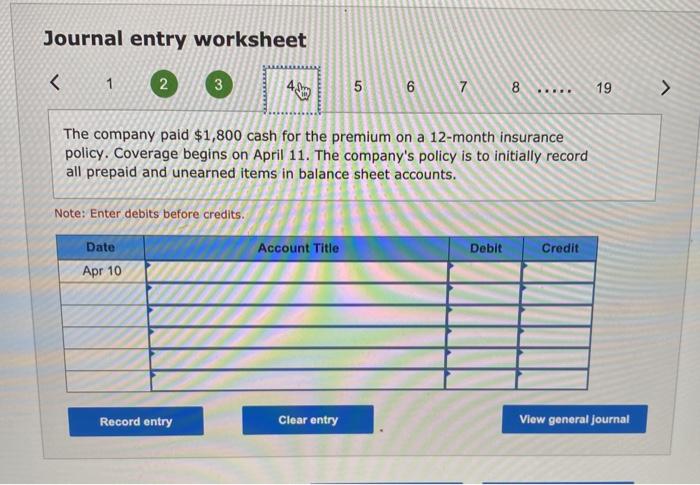

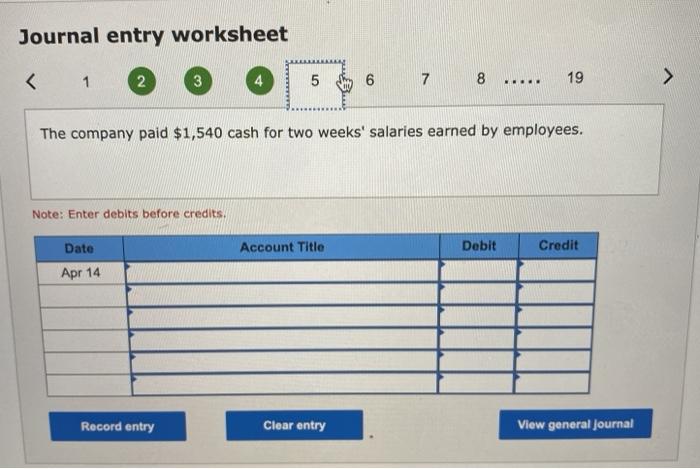

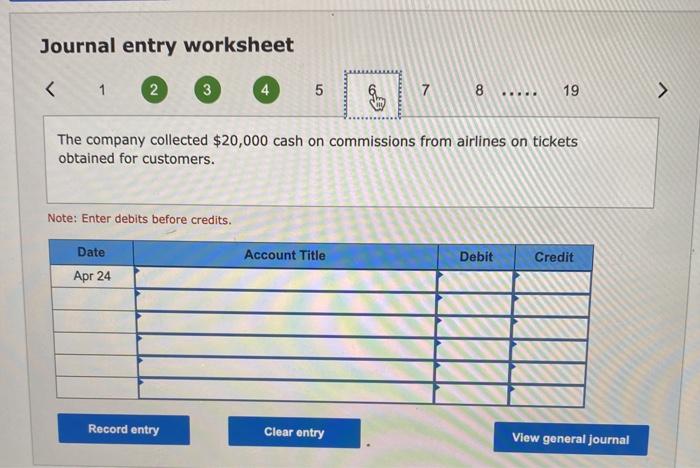

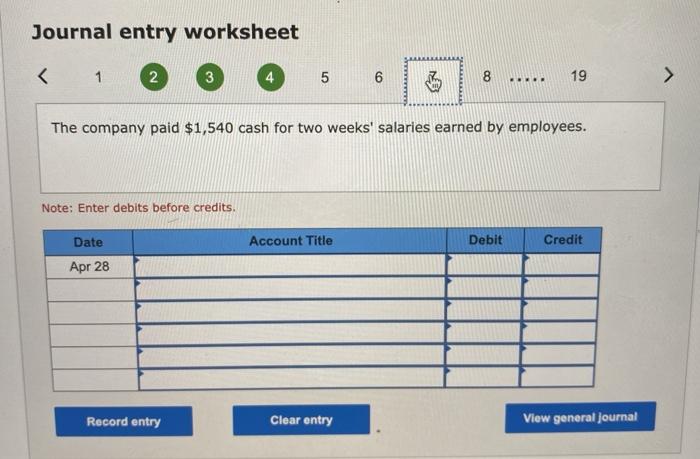

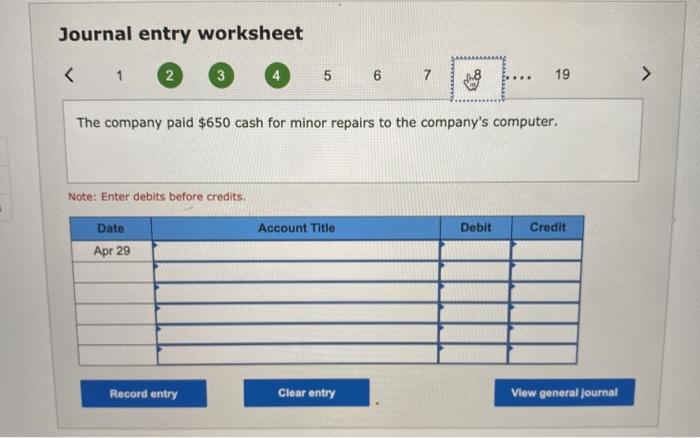

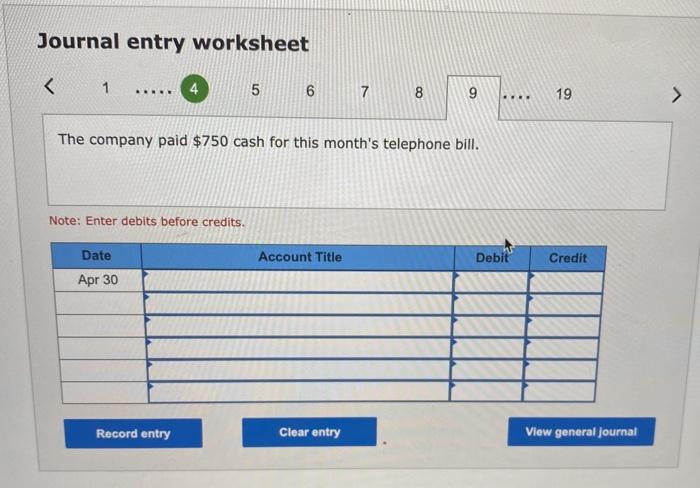

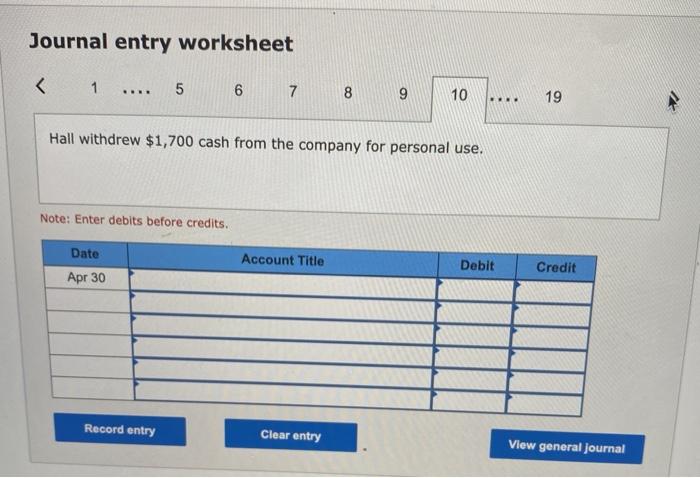

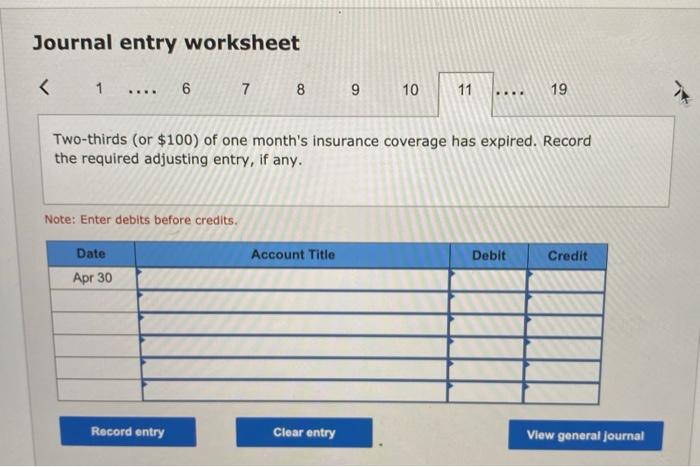

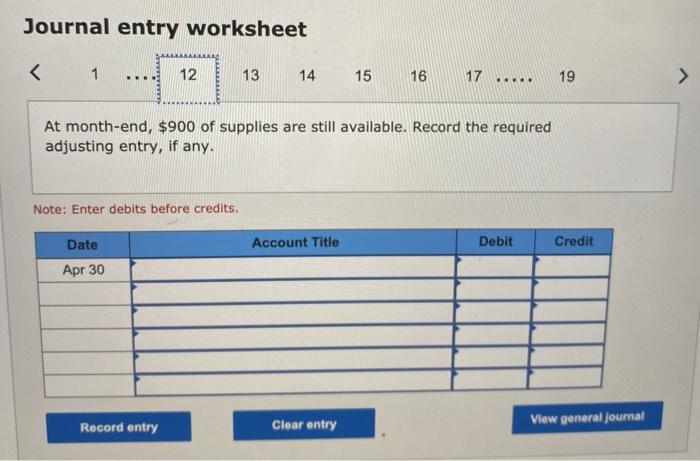

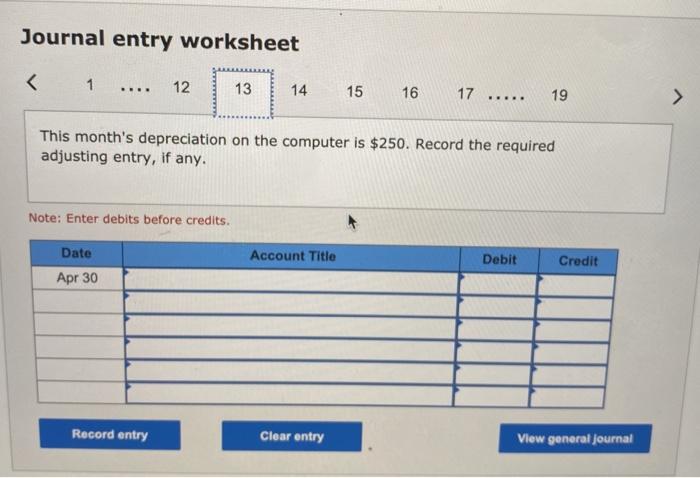

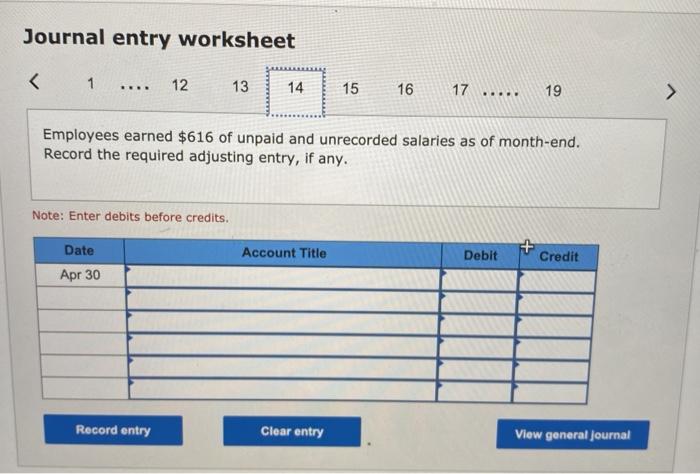

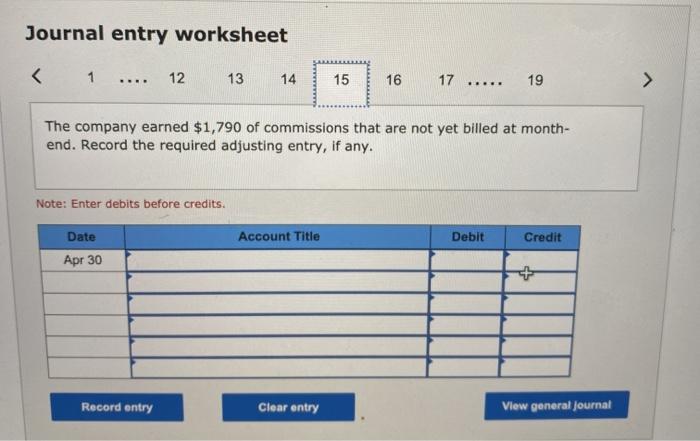

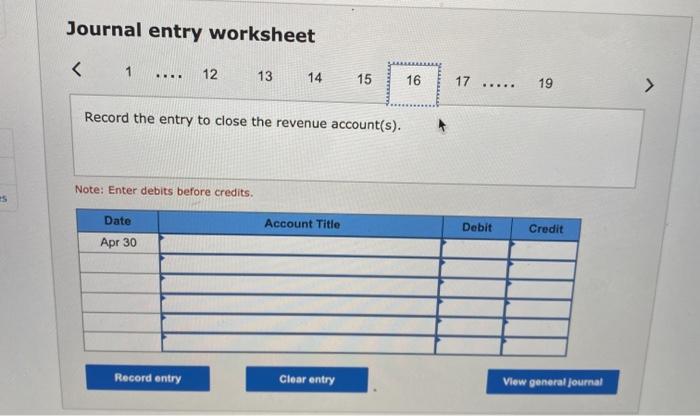

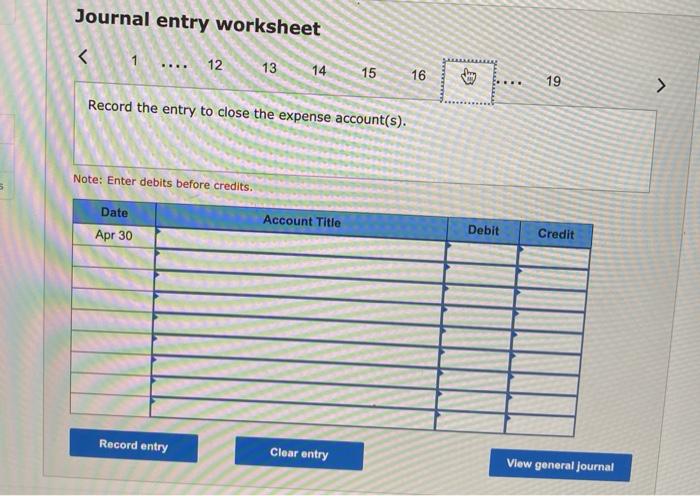

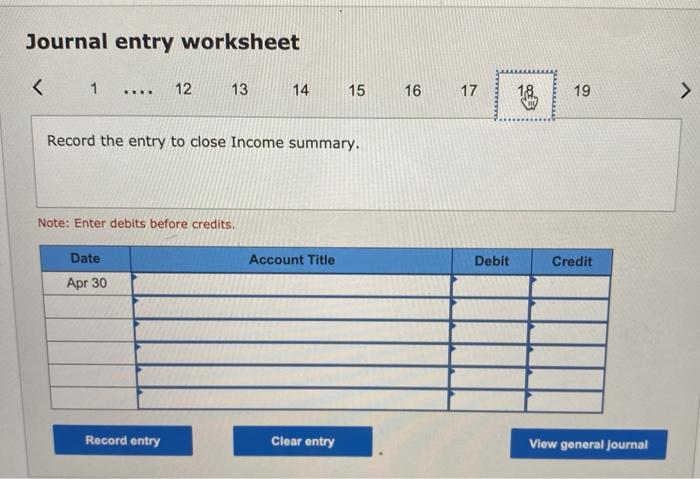

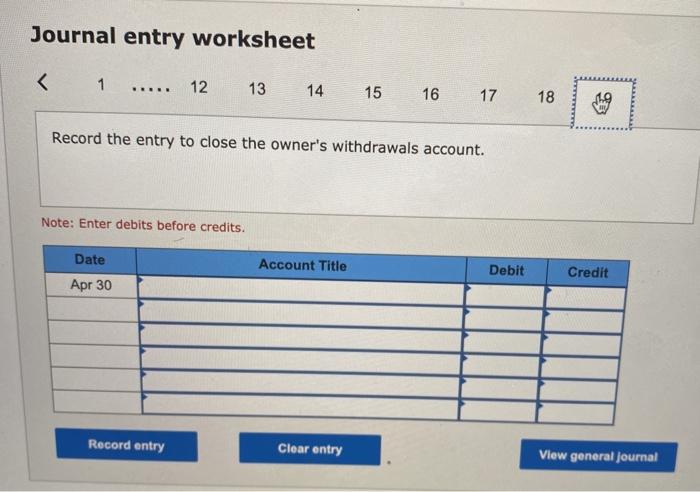

On April 1, 2017, Debbie Hall created a new travel agency, Hall Travel. The following transactions occurred during the company's first month. Apr. 1 Hall invested $44,000 cash and computer equipment worth $15,000 in the company. Apr. 2 The company rented furnished office space by paying $2,400 cash for the first month's (April) cont. Apr. 3. The company purchased $2,400 of office supplies for cash. Apr. 10 The company paid $1,800 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. Apr. 14 The company paid $1,540 cash for two weeks' salaries earned by employees. Apr. 24 The company collected $20,000 cash on comissions from airlines on tickets obtained for customers. Apr. 28 The company paid $1,540 cash for two weeks salaries earned by enployees. Apr. 29 The company paid $650 cash for minor repairs to the company's computer. Apr. 30 The company paid $750 cash for this month's telephone bill. Apr. 30 Hall withdrew $1,700 cash from the company for personal use. Information for month-end adjustments follows: a. Two-thirds (or $100) of one month's insurance coverage has expired, b. At the end of the month, $900 of office supplies are still available. c. This month's depreciation on the computer equipment is $250 d. Employees earned $616 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,790 of commissions that are not yet billed at month-end. Journal entry worksheet 1 2 3 4 5 6 7 8 8 .... 19 > Hall invested $44,000 cash and computer equipment worth $15,000 in the company. Note: Enter debits before credits. Date Account Title Debit Credit Apr 01 Record entry Clear entry View general Journal Journal entry worksheet The company paid $1,800 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. The company's policy is to initially record all prepaid and unearned items in balance sheet accounts. Note: Enter debits before credits. Date Account Title Debit Credit Apr 10 Record entry Clear entry View general journal Journal entry worksheet 1 2 3 5 6 7 8 19 > ... The company paid $1,540 cash for two weeks' salaries earned by employees. Note: Enter debits before credits Date Account Title Debit Credit Apr 14 Record entry Clear entry View general Journal Journal entry worksheet The company collected $20,000 cash on commissions from airlines on tickets obtained for customers. Note: Enter debits before credits. Date Account Title Debit Credit Apr 24 Record entry Clear entry View general journal Journal entry worksheet ..... The company paid $1,540 cash for two weeks' salaries earned by employees. Note: Enter debits before credits. Date Account Title Debit Credit Apr 28 Record entry Clear entry View general Journal Journal entry worksheet Record the entry to close the expense account(s). Note: Enter debits before credits. 5 Date Apr 30 Account Title Debit Credit Record entry Clear entry View general journal Journal entry worksheet Record the entry to close Income summary. Note: Enter debits before credits. Account Title Debit Credit Date Apr 30 Record entry Clear entry View general Journal Journal entry worksheet