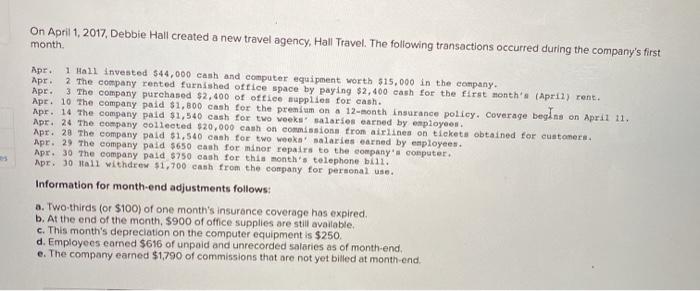

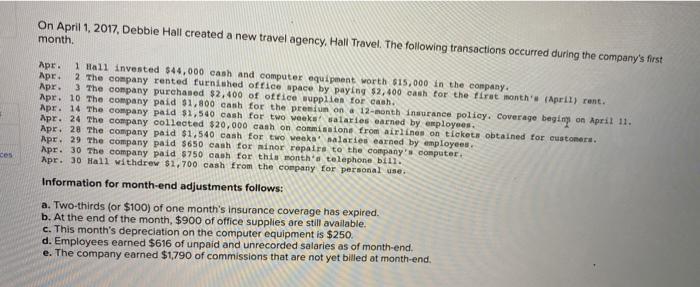

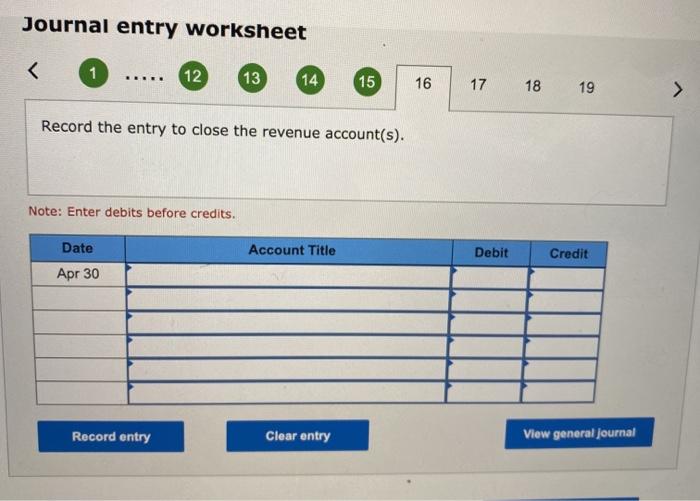

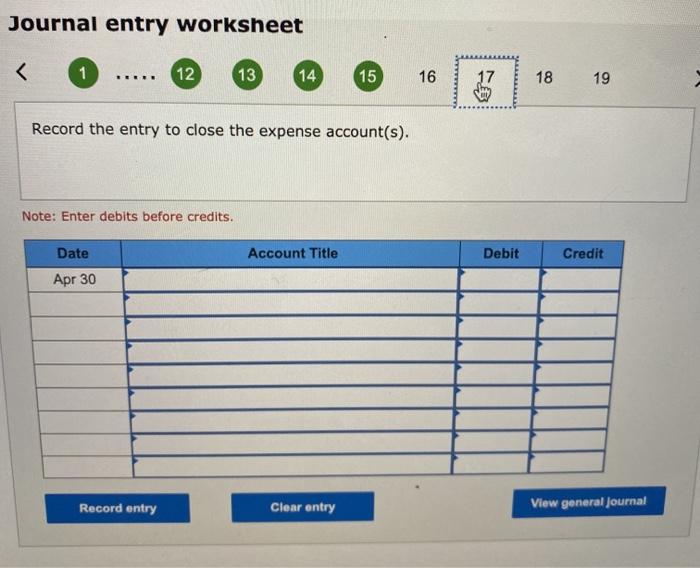

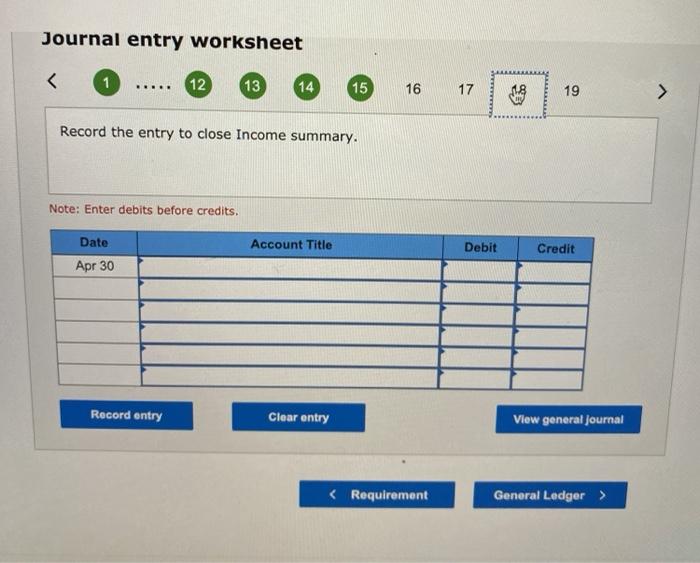

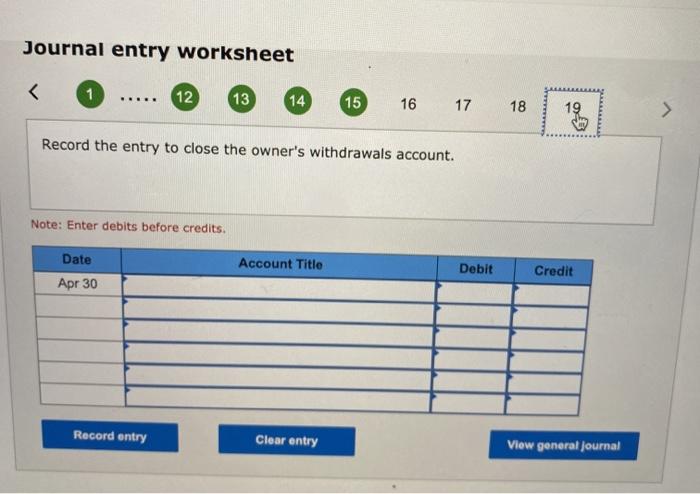

On April 1, 2017, Debbie Hall created a new travel agency, Hall Travel. The following transactions occurred during the company's first month Apr. 1 Hall invested $44,000 cash and computer equipment worth $15,000 in the company. Apr. 2 The company rented furnished office space by paying $2,400 cash for the first month'. (April) rent. Apr. Apr. 10 The company paid $1,800 cash for the premium on 12-month Insurance policy. Coverage begins on April 11. Apr. 14 The company paid $1,540 cash for two weeks' salaries earned by employees Apr. 24 The company collected $20,000 cash on commissions from airlines on tickets obtained for customers. Apr. 28 The company paid $1.540 cash for two weeks' salaries earned by employees. Apr. 29 The company paid $650 cash for minor repairs to the company's computer. Apr. 30 The company paid 5750 cash for this month's telephone bill. Apr. 10 all withdrew $1,700 cash from the company for personal use. Information for month-end adjustments follows: a. Two-thirds (or $100) of one month's insurance coverage has expired. b. At the end of the month, $900 of office supplies are still available c. This month's depreciation on the computer equipment is $250 d. Employees earned $616 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,790 of commissions that are not yet billed at month-end. On April 1, 2017, Debbie Hall created a new travel agency, Hall Travel. The following transactions occurred during the company's first month, Apr. 1 Hall invested $44,000 cash and computer equipment worth $15,000 in the company. Apr. 2 The company rented furnished office space by paying $2,400 cash for the first month'. (April) rent. Apr. 3 The company purchased $2,400 of office supplies for cash. Apr. 19 The company paid $1,800 cash for the premium 12-onth nurance policy. Coverage begin on April 11. Apr. 14 The company paid $1,540 cash for two weeks salaries earned by employees. Apr. 24 The company collected $20,000 cash on commissione from airlines on tickets obtained for customers. Apr. 28 The company paid $1.540 cash for two weeks' salaries earned by employees. Apr. 29 The company paid $650 cash for minor repairs to the company's computer. Apr. 30 The company paid $750 cash for this month'd telephone bill. Apr. 30 Hall withdrew $1,700 cash from the company for personal use. Information for month-end adjustments follows: a. Two-thirds (or $100) of one month's Insurance coverage has expired. b. At the end of the month, $900 of office supplies are still available. c. This month's depreciation on the computer equipment is $250. d. Employees earned $616 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,790 of commissions that are not yet billed at month-end. Journal entry worksheet Journal entry worksheet