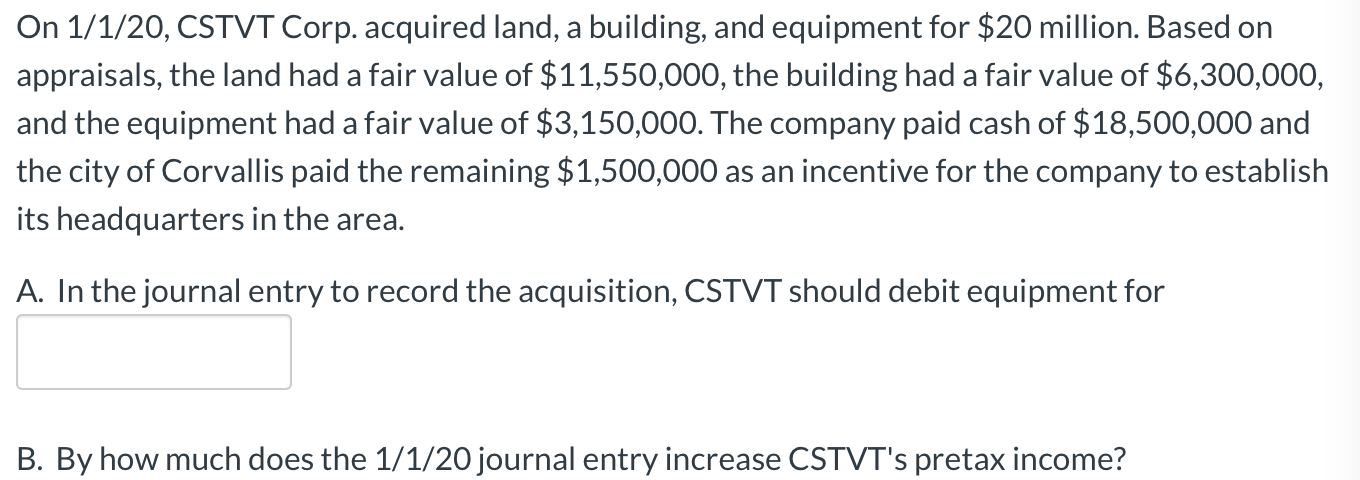

On April 1, 2018, Stars Co. purchased manufacturing equipment for $4,200,000. The company uses the straight-line method of depreciation, with an estimated useful life of the equipment of 10 years, and an estimated salvage value of $600,000. At the end of 2020, Stars believes that the asset may be impaired and only has a remaining usefu life of four years and a salvage value of $100,000. In addition, the company estimates that the undiscounted sum of the future net cash flows from the equipment is $3,400,000, and the estimated fair value of the equipment is $3,000,000. A. What is the book value of the equipment that the company should use to conduct the 12/31/20 impairment test? B. What is the amount of impairment loss that should be reported on the 2020 income statement? Do not put a negative sign or parentheses as part of your answer. C. What is the amount of depreciation expense that should be recorded on the equipment in 2021? D. What is the ending balance in the Accumulated Depreciation account on 12/31/21? On 1/1/20, CSTVT Corp. acquired land, a building, and equipment for $20 million. Based on appraisals, the land had a fair value of $11,550,000, the building had a fair value of $6,300,000, and the equipment had a fair value of $3,150,000. The company paid cash of $18,500,000 and the city of Corvallis paid the remaining $1,500,000 as an incentive for the company to establish its headquarters in the area. A. In the journal entry to record the acquisition, CSTVT should debit equipment for B. By how much does the 1/1/20 journal entry increase CSTVT's pretax income? On April 1, 2018, Stars Co. purchased manufacturing equipment for $4,200,000. The company uses the straight-line method of depreciation, with an estimated useful life of the equipment of 10 years, and an estimated salvage value of $600,000. At the end of 2020, Stars believes that the asset may be impaired and only has a remaining usefu life of four years and a salvage value of $100,000. In addition, the company estimates that the undiscounted sum of the future net cash flows from the equipment is $3,400,000, and the estimated fair value of the equipment is $3,000,000. A. What is the book value of the equipment that the company should use to conduct the 12/31/20 impairment test? B. What is the amount of impairment loss that should be reported on the 2020 income statement? Do not put a negative sign or parentheses as part of your answer. C. What is the amount of depreciation expense that should be recorded on the equipment in 2021? D. What is the ending balance in the Accumulated Depreciation account on 12/31/21? On 1/1/20, CSTVT Corp. acquired land, a building, and equipment for $20 million. Based on appraisals, the land had a fair value of $11,550,000, the building had a fair value of $6,300,000, and the equipment had a fair value of $3,150,000. The company paid cash of $18,500,000 and the city of Corvallis paid the remaining $1,500,000 as an incentive for the company to establish its headquarters in the area. A. In the journal entry to record the acquisition, CSTVT should debit equipment for B. By how much does the 1/1/20 journal entry increase CSTVT's pretax income