Question

On April 1, 2021, Harrison Limited issued $18,000,000 of 8%, 15-year bonds, with interest paid annually on April 1 of each year. The bonds were

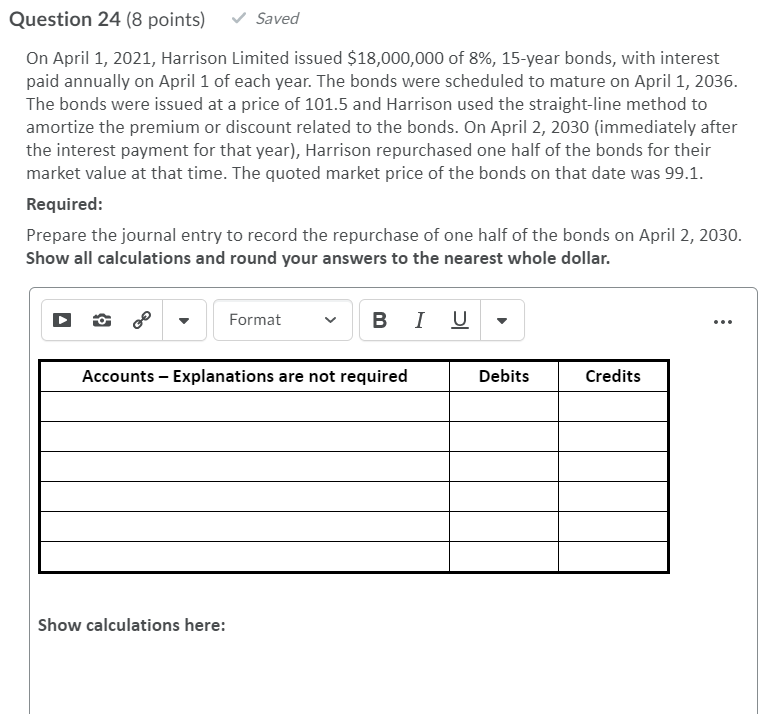

On April 1, 2021, Harrison Limited issued $18,000,000 of 8%, 15-year bonds, with interest paid annually on April 1 of each year. The bonds were scheduled to mature on April 1, 2036. The bonds were issued at a price of 101.5 and Harrison used the straight-line method to amortize the premium or discount related to the bonds. On April 2, 2030 (immediately after the interest payment for that year), Harrison repurchased one half of the bonds for their market value at that time. The quoted market price of the bonds on that date was 99.1.

Required:

Prepare the journal entry to record the repurchase of one half of the bonds on April 2, 2030. Show all calculations and round your answers to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started