Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, 2021, Western Communications, Inc., Issued 12% bonds, dated March 1, 2021, with face amount of $31 million. The bonds sold for

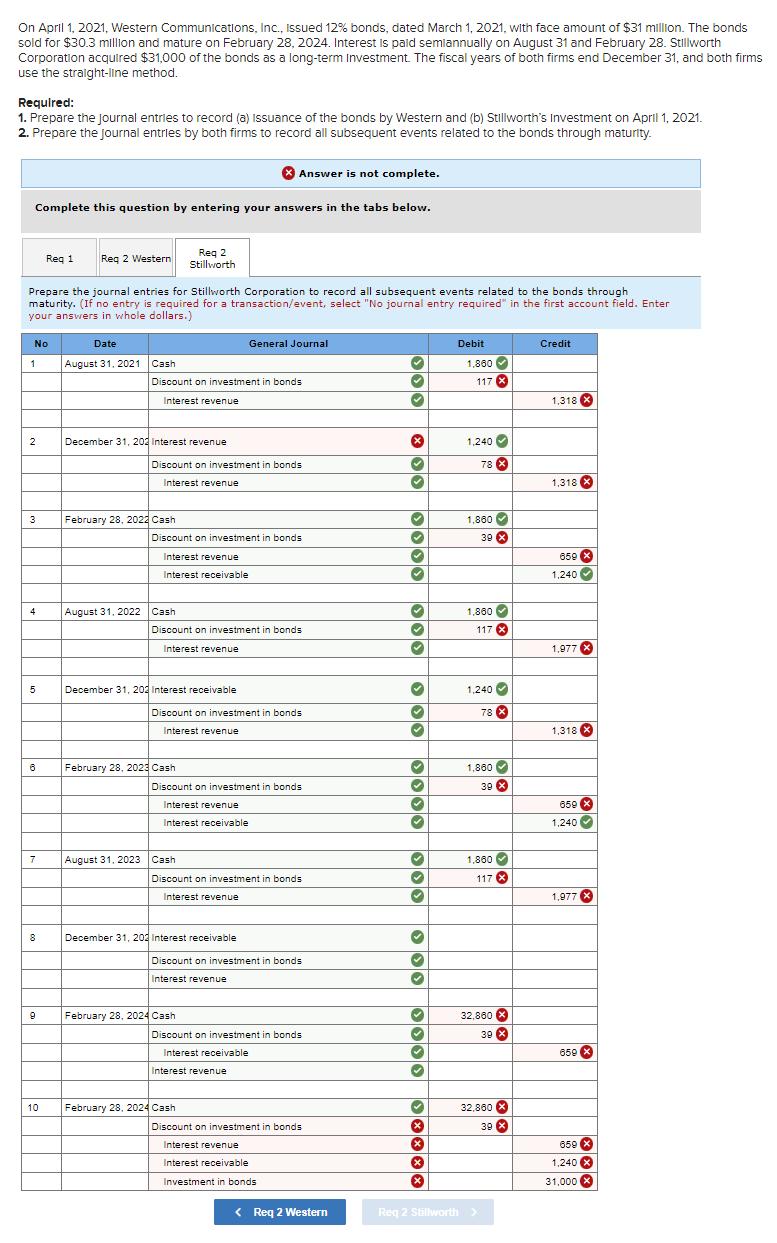

On April 1, 2021, Western Communications, Inc., Issued 12% bonds, dated March 1, 2021, with face amount of $31 million. The bonds sold for $30.3 million and mature on February 28, 2024. Interest is paid semiannually on August 31 and February 28. Stillworth Corporation acquired $31,000 of the bonds as a long-term Investment. The fiscal years of both firms end December 31, and both firms use the straight-line method. Required: 1. Prepare the journal entries to record (a) Issuance of the bonds by Western and (b) Stillworth's Investment on April 1, 2021. 2. Prepare the journal entries by both firms to record all subsequent events related to the bonds through maturity. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Western Req 2 Stillworth Prepare the journal entries for Stillworth Corporation to record all subsequent events related to the bonds through maturity. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) No Date General Journal 1. August 31, 2021 Cash Discount on investment in bonds Interest revenue Debit Credit 1,860 117 1,318 2 December 31, 202 Interest revenue 1,240 Discount on investment in bonds 78 Interest revenue 1,318x 3 February 28, 2022 Cash 1,860 Discount on investment in bonds 39 >> Interest revenue 650 Interest receivable 1,240 4 August 31, 2022 Cash 1,860 Discount on investment in bonds 117 Interest revenue 1,977 X 5 December 31, 202 Interest receivable 1,240 Discount on investment in bonds 78 Interest revenue 1,318 February 28, 2023 Cash 1,800 Discount on investment in bonds 39 Interest revenue 659 Interest receivable 1,240 August 31, 2023 Cash 1,860 Discount on investment in bonds. Interest revenue 117 1,977 x 8 December 31, 202 Interest receivable Discount on investment in bonds Interest revenue 9 February 28, 2024 Cash 32,860 x Discount on investment in bonds 39 Interest receivable 659 Interest revenue 10 February 28, 2024 Cash 32,860 X Discount on investment in bonds. 39 Interest revenue 659 x Interest receivable Investment in bonds 1,240 x 31,000 < Req 2 Western Req 2 Stillworth >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Req 1 Prepare the journal entries to record a Issuance of the bonds by Western and b Stillworths Investment on April 1 2021 a Journal entry for the is...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started