Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, 2023, Mendoza Company (a U.S.-based company) borrowed 540,000 euros for one year at an interest rate of 5 percent per annum.

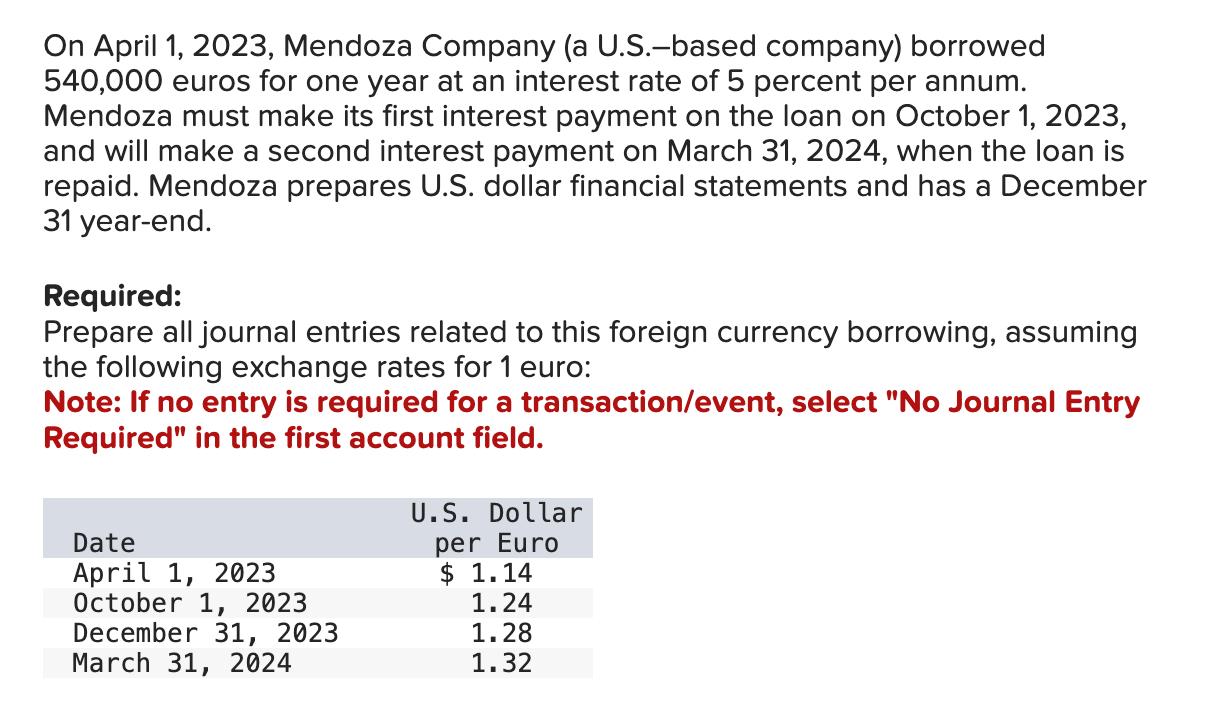

On April 1, 2023, Mendoza Company (a U.S.-based company) borrowed 540,000 euros for one year at an interest rate of 5 percent per annum. Mendoza must make its first interest payment on the loan on October 1, 2023, and will make a second interest payment on March 31, 2024, when the loan is repaid. Mendoza prepares U.S. dollar financial statements and has a December 31 year-end. Required: Prepare all journal entries related to this foreign currency borrowing, assuming the following exchange rates for 1 euro: Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Date April 1, 2023 October 1, 2023 December 31, 2023 March 31, 2024 U.S. Dollar per Euro $ 1.14 1.24 1.28 1.32

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries for Mendoza Companys Foreign Currency Borrowing 1 April 1 2023 Borrowing of Euros Ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started