Answered step by step

Verified Expert Solution

Question

1 Approved Answer

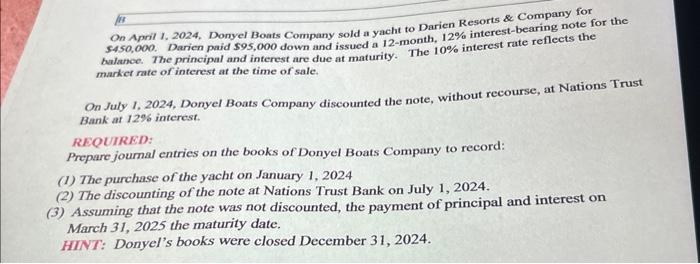

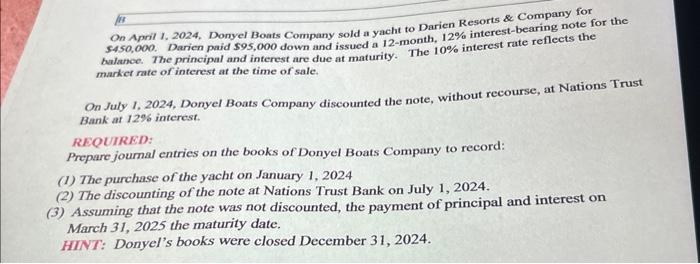

On April 1, 2024, Donyel Boats Company sold a yacht to Darien Resorts & Company for $450,000. Darien paid $95,000 down and issued a 12-month,

On April 1, 2024, Donyel Boats Company sold a yacht to Darien Resorts & Company for $450,000. Darien paid $95,000 down and issued a 12-month, 12% interest -bearing not for the balance. The principal and interest are due at maturity. The 10% interest rate reflects the market rate of interest at the time of scale. On July 1,2024 Donyel Bones Company doscounted the note, without recourse, at Nations Trust Bank wt 12% interest. Prepare journal entries on the books of Donyel Boats Company to record: the purchase of the yacht on Janurary 1, 2024, the discounting of the note at Nations Trust Bank on July 1,2024, and assuming that the note was not discounted, the payment of principal and interest on March 31,2025 the maturity date.

HI On April 1, 2024, Donyel Boats Company sold a yacht to Darien Resorts \& Company for 5450,000 . Darien paid $95,000 down and issued a 12 -month, 12% interest-bearing note for the bulance. The principal and interest are due at maturity. The 10% interest rate reflects the market rate of interest at the time of sale. On July 1, 2024, Donyel Boats Company discounted the note, without recourse, at Nations Trust Bank at 12% interest. REQUIRED: Prepare journal entries on the books of Donyel Boats Company to record: (1) The purchase of the yacht on January 1, 2024 (2) The discounting of the note at Nations Trust Bank on July 1,2024. Assuming that the note was not discounted, the payment of principal and interest on March 31, 2025 the maturity date. HINT: Donyel's books were closed December 31, 2024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started