Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, 20X1, Abingdon Company paid $200,000 for 8,000 shares of Galax Company when Galax's total stockholders' equity (including beginning retained earnings) was

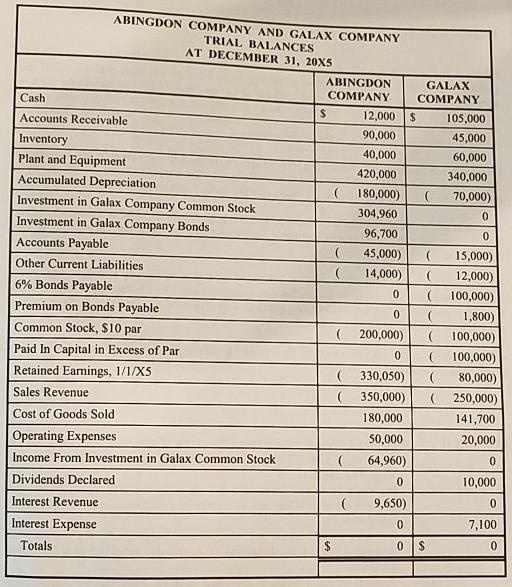

On April 1, 20X1, Abingdon Company paid $200,000 for 8,000 shares of Galax Company when Galax's total stockholders' equity (including beginning retained earnings) was $210,000 (no additional common stock has been issued by Galax since that date). Galax had income for the first quarter of 20X1 of $10,000. No dividends were paid during the first quarter of 20X1. Any excess of cost over book value acquired is considered to be goodwill. Abingdon uses the incomplete (partial) equity method to account for this investment. Galax sells merchandise to Abingdon at a markup of 50%. Intercompany sales were $60,000 during 20X5. At year end, $20,000 of these sales remained unpaid. There were $12,000 of these goods in the beginning inventory of Abingdon Company and $15,000 of such goods in the ending inventory. Abingdon sold a machine with a book value of $10,000 to Galax for $15,000 on January 1, 20X4. The machine had a five year life as of January 1, 20X4, and is being depreciated using straight line depreciation. Galax Company issued $100,000 par value, 8%, five year bonds on January 1, 20X3. The bonds sold at a premium of $4,500 since the market rate of interest was 6%. On January 1, 20X4, when the market rate was 7%, Abingdon Company purchased all of these bonds for $93,400. Straight line amortization is being used for the bonds. Galax Company paid a cash dividend on December 31, 20X5. The attached trial balances were prepared as of December 31, 20X5. REQUIRED: (1) (2) Prepare a schedule to determine the excess of cost over book value for the purchase of Galax Company stock by Abingdon Company. Show all supporting calculations. Prepare a schedule, in good form, showing the distribution of income between the controlling and noncontrolling interest. Show all supporting calculations. (3) Prepare a consolidation worksheet to use for preparing the consolidated financial statements of Abingdon Company and its subsidiary as of December 31, 20X5. Prepare, in good form, a classified balance sheet for the consolidated companies as of December 31, 20X5. ABINGDON COMPANY AND GALAX COMPANY TRIAL BALANCES AT DECEMBER 31, 20X5 Cash. Accounts Receivable Inventory Plant and Equipment Accumulated Depreciation Investment in Galax Company Common Stock Investment in Galax Company Bonds Accounts Payable Other Current Liabilities 6% Bonds Payable Premium on Bonds Payable Common Stock, $10 par Paid In Capital in Excess of Par Retained Earnings, 1/1/X5 Sales Revenue Cost of Goods Sold Operating Expenses Income From Investment in Galax Common Stock Dividends Declared Interest Revenue Interest Expense Totals ABINGDON COMPANY S $ 12,000 $ 90,000 40,000 420,000 (180,000) 304,960 96,700 45,000) ( 15,000) 14,000) ( 12,000) ( 100,000) ( 1,800) ( 100,000) ( 100,000) ( 80,000) ( 250,000) 141,700 20,000 0 10,000 0 7,100 0 ( ( ( 0 ( 0 200,000) 0 (330,050) (350,000) GALAX COMPANY 180,000 50,000 64,960) 0 9,650) 0 0 ( $ 105,000 45,000 60,000 340,000 70,000) 0 0

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Excess of cost over book value for the purchase of Galax Company stock by Abingdon Company Shares purchased 8000 Total stockholders equity including beginning retained earnings 210000 Income for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started