Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1 3 of 2 0 2 3 , the couple paid their $ 1 , 5 0 0 in state taxes due with

On April of the couple paid their $ in state taxes due with their state tax return. They paid state income tax for of $ The couples estimated state and local sales taxes for will be a total of $ The property taxes paid on their principal residence for is $ excluding any amounts allotted to the artist studio.

On October st they donated a parcel with a separate small building to the Girl Scouts of America for use as an art studio. They had purchased the acres in and recently divided a portion for sale see e above This portion has a basis of $ A professional appraiser determined the fair market value of the property was $ on September th of

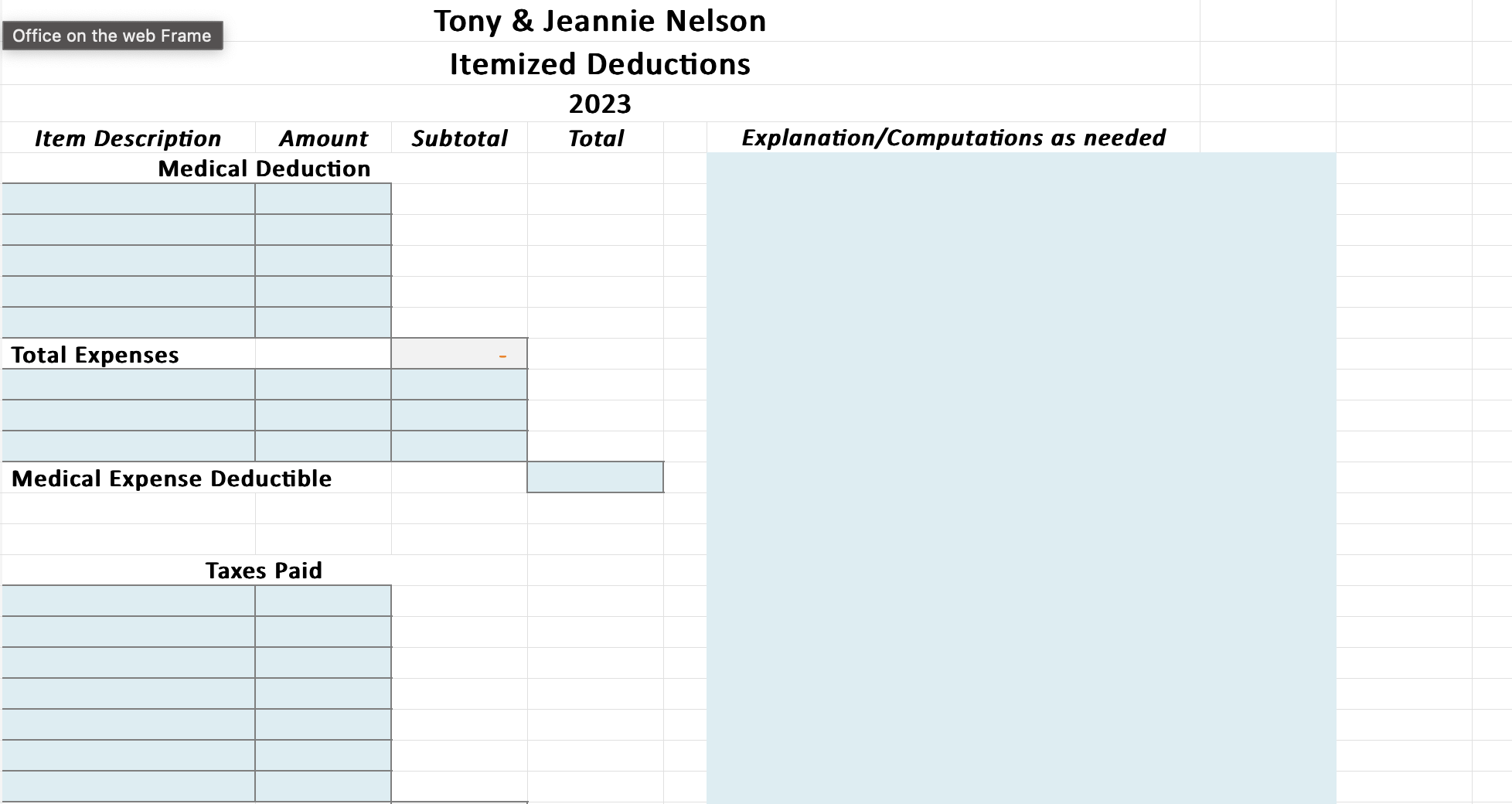

Please put each number in the corresponding spot based on the photo. Tony & Jeannie Nelson

Itemized Deductions Charitable Contribution Deductible

Other Itemized Deductions

Other Deductible

Total Itemized Deductions

Standard Deduction

Amount Deductible Total Expenses

Tax Expense Deductible

Total Expenses

Interest Expense Deductible

Charitable Contribution Deductible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started