Answered step by step

Verified Expert Solution

Question

1 Approved Answer

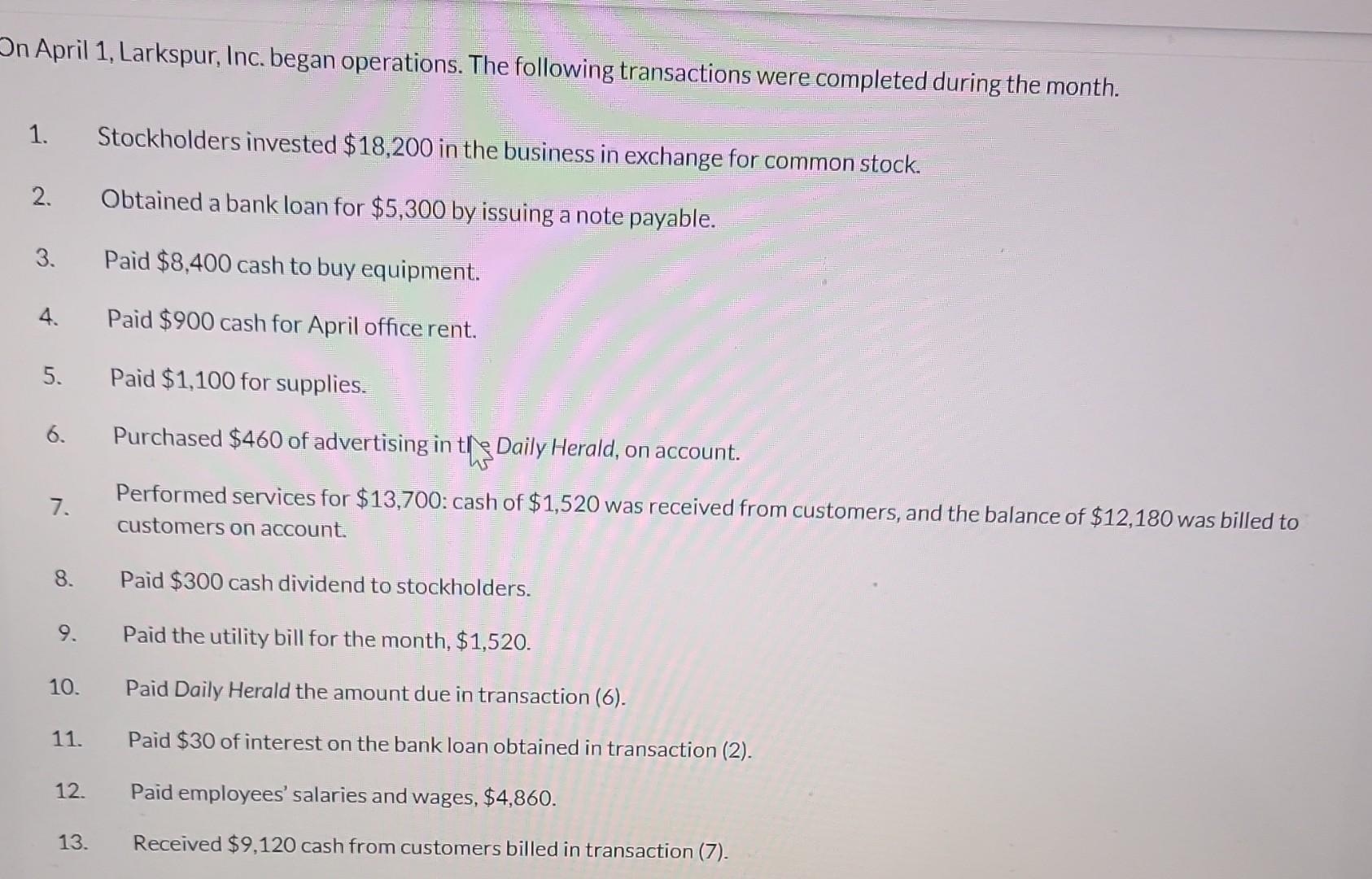

On April 1, Larkspur, Inc. began operations. The following transactions were completed during the month. 1. Stockholders invested $18,200 in the business in exchange for

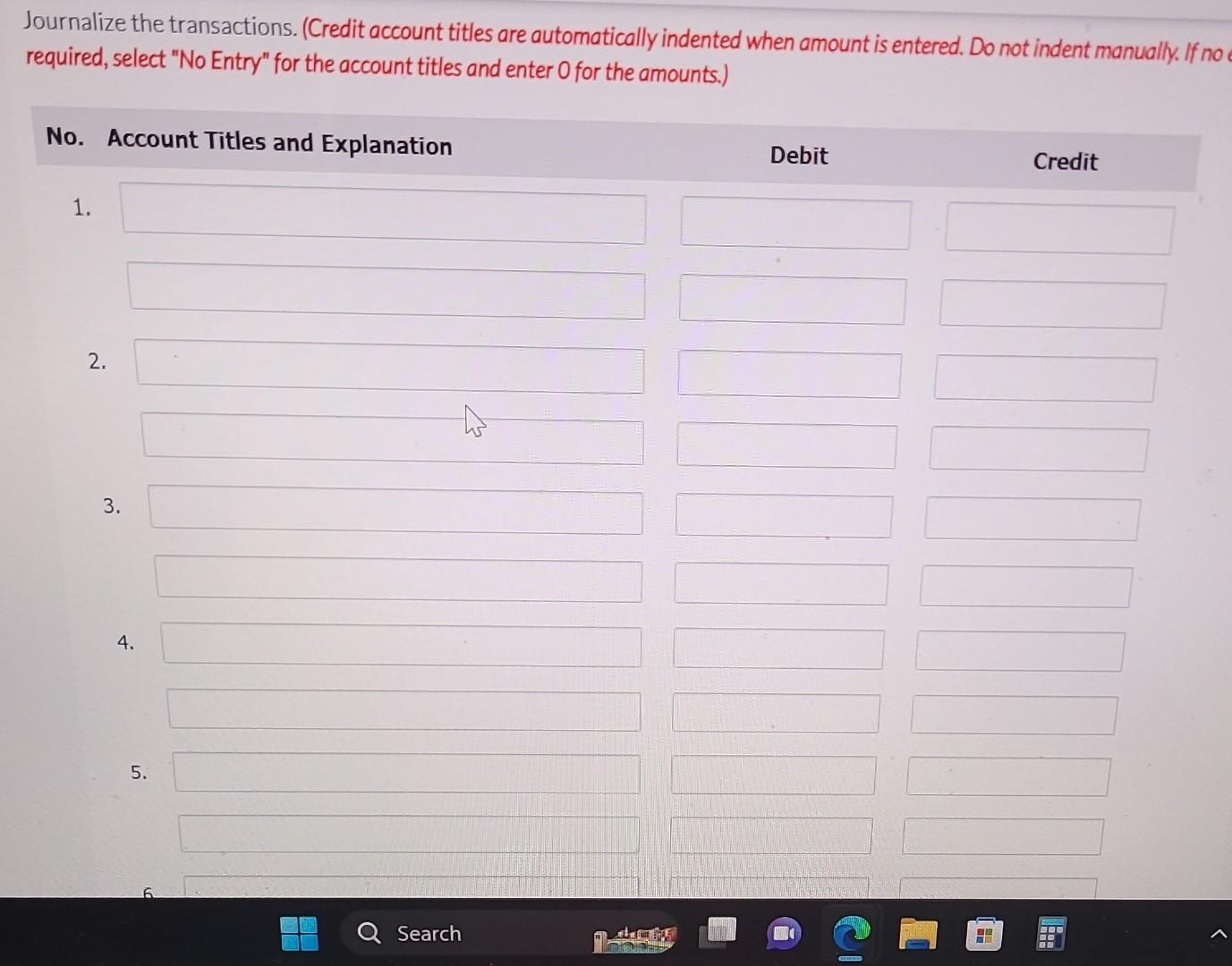

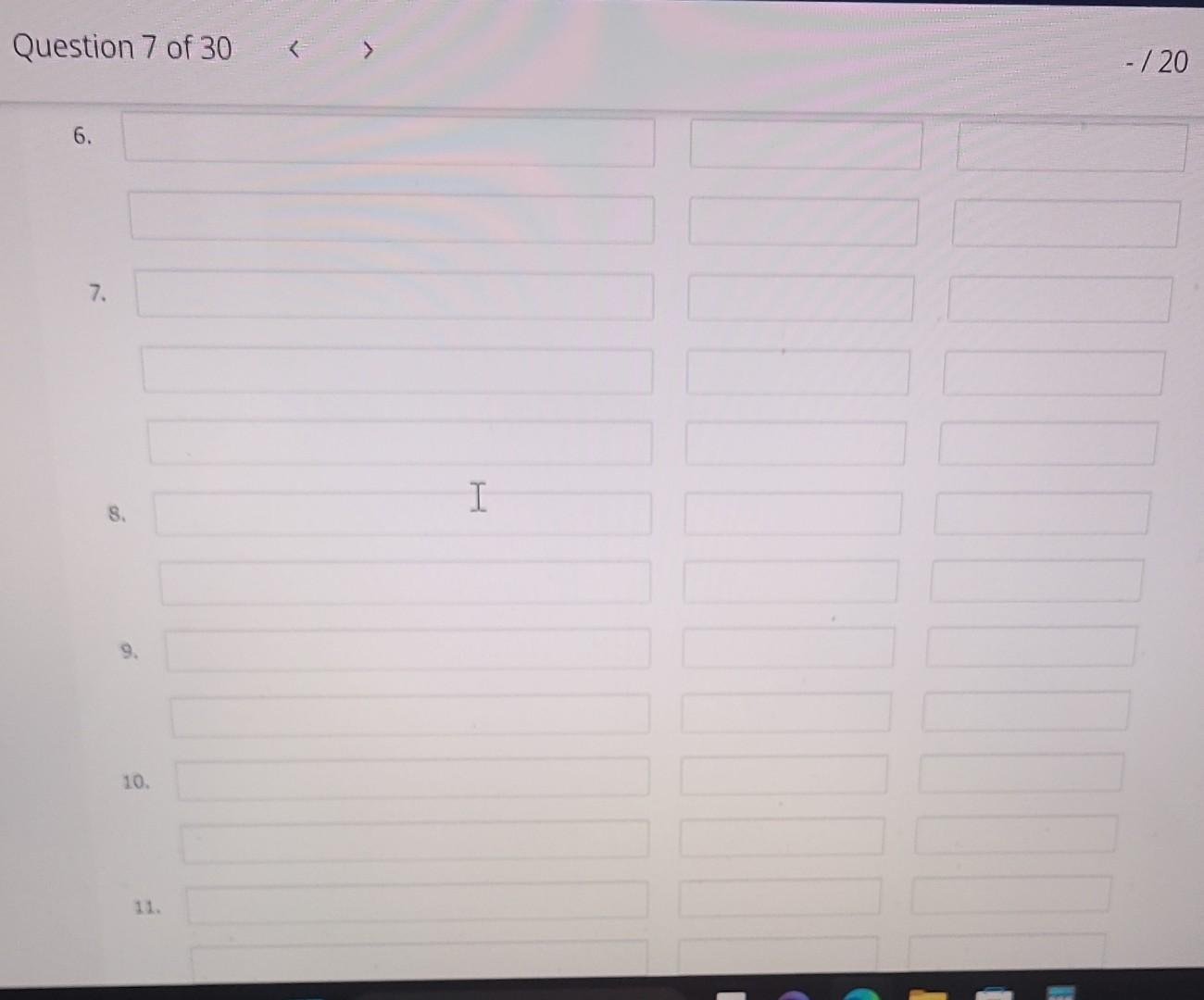

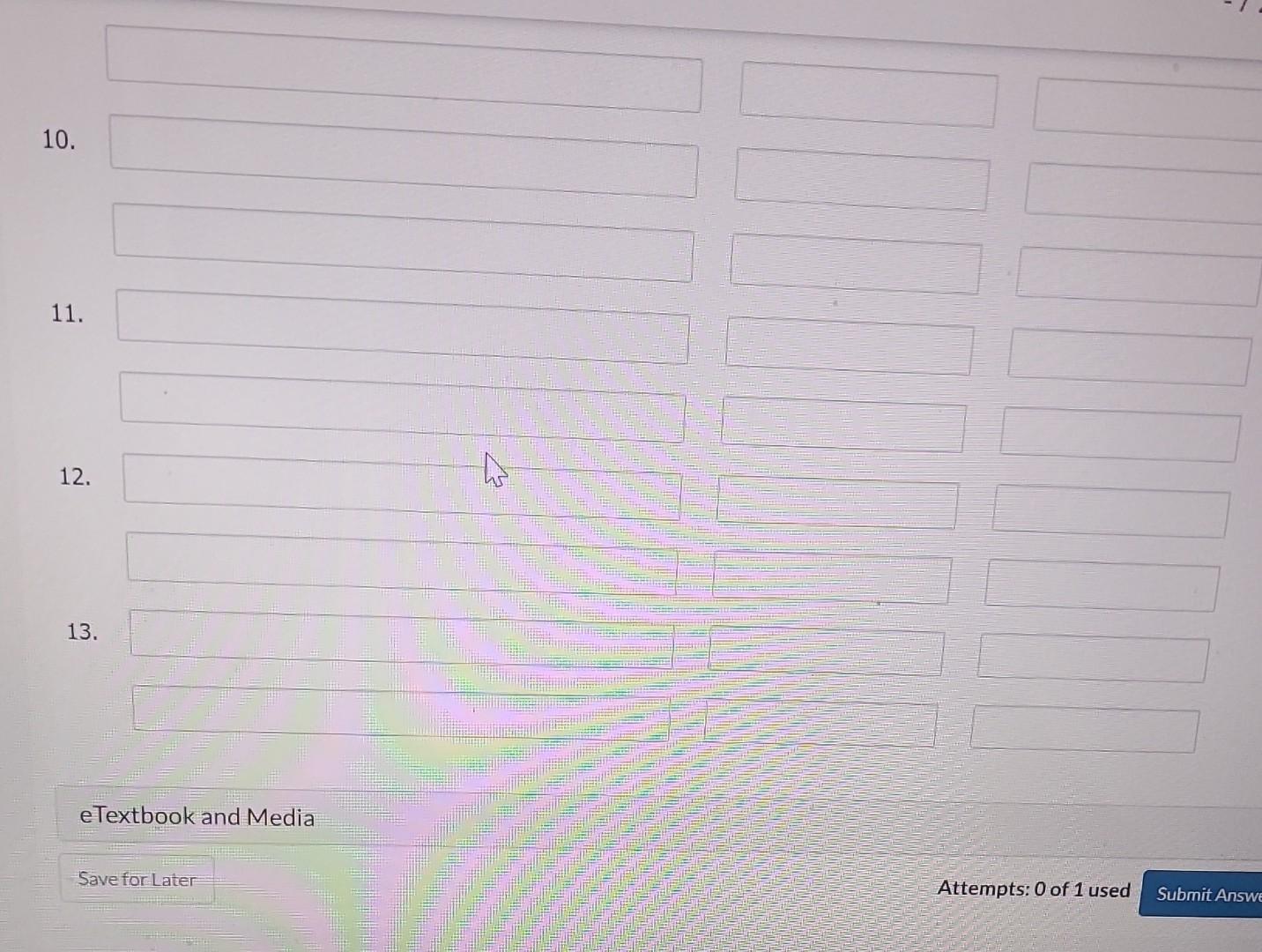

On April 1, Larkspur, Inc. began operations. The following transactions were completed during the month. 1. Stockholders invested $18,200 in the business in exchange for common stock. 2. Obtained a bank loan for $5,300 by issuing a note payable. 3. Paid $8,400 cash to buy equipment. 4. Paid $900 cash for April office rent. 5. Paid $1,100 for supplies. 6. Purchased $460 of advertising in the Daily Herald, on account. 7. Performed services for $13,700 : cash of $1,520 was received from customers, and the balance of $12,180 was billed to customers on account. 8. Paid $300 cash dividend to stockholders. 9. Paid the utility bill for the month, $1,520. 10. Paid Daily Herald the amount due in transaction (6). 11. Paid $30 of interest on the bank loan obtained in transaction (2). 12. Paid employees' salaries and wages, $4,860. 13. Received $9,120 cash from customers billed in transaction (7). Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no required, select "No Entry" for the account titles and enter 0 for the amounts.) Question 7 of 30 120 6. 7. 8. 9. 10. 11. 10. 11. 12. 13. eTextbook and Media Save for Later Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started