Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, Meriter Corporation declared a cash dividend of $5 per share on its 89,600 outstanding shares of common stock ($1 par). The

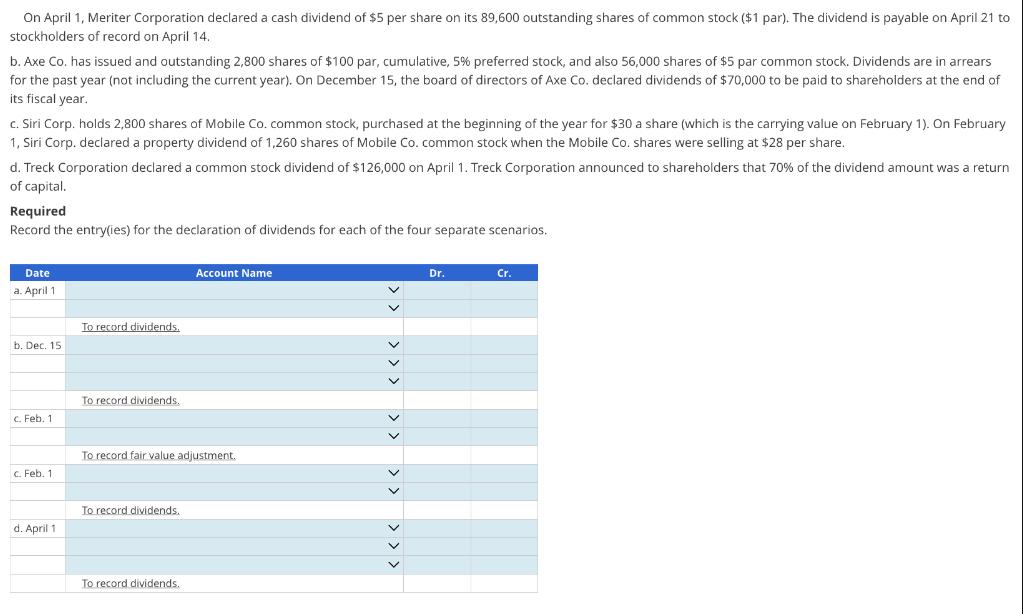

On April 1, Meriter Corporation declared a cash dividend of $5 per share on its 89,600 outstanding shares of common stock ($1 par). The dividend is payable on April 21 to stockholders of record on April 14. b. Axe Co. has issued and outstanding 2,800 shares of $100 par, cumulative, 5% preferred stock, and also 56,000 shares of $5 par common stock. Dividends are in arrears for the past year (not including the current year). On December 15, the board of directors of Axe Co. declared dividends of $70,000 to be paid to shareholders at the end of its fiscal year. c. Siri Corp. holds 2,800 shares of Mobile Co. common stock, purchased at the beginning of the year for $30 a share (which is the carrying value on February 1). On February 1, Siri Corp. declared a property dividend of 1,260 shares of Mobile Co. common stock when the Mobile Co. shares were selling at $28 per share. d. Treck Corporation declared a common stock dividend of $126,000 on April 1. Treck Corporation announced to shareholders that 70% of the dividend amount was a return of capital. Required Record the entry(ies) for the declaration of dividends for each of the four separate scenarios. Date a. April 1 b. Dec. 15 c. Feb. 1 c. Feb. 1. d. April 1 To record dividends. To record dividends, To record fair value adjustment. To record dividends. Account Name To record dividends. Dr. Cr.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the declaration of dividends ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started