On April 12, 2011, BAM Technologies floated a $100 million bond issue. Each $1,000 bond entitled the bondholder to receive $50 every six months

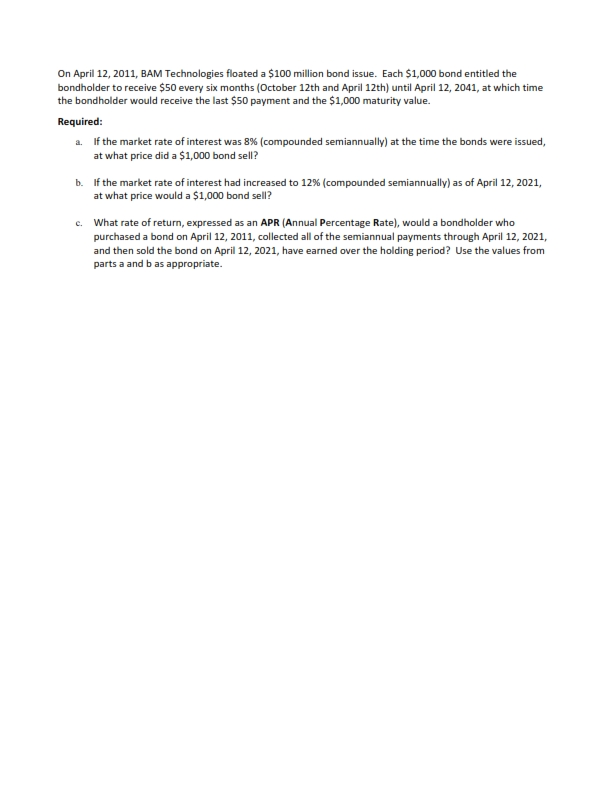

On April 12, 2011, BAM Technologies floated a $100 million bond issue. Each $1,000 bond entitled the bondholder to receive $50 every six months (October 12th and April 12th) until April 12, 2041, at which time the bondholder would receive the last $50 payment and the $1,000 maturity value. Required: a. If the market rate of interest was 8% (compounded semiannually) at the time the bonds were issued, at what price did a $1,000 bond sell? b. If the market rate of interest had increased to 12% (compounded semiannually) as of April 12, 2021, at what price would a $1,000 bond sell? c. What rate of return, expressed as an APR (Annual Percentage Rate), would a bondholder who purchased a bond on April 12, 2011, collected all of the semiannual payments through April 12, 2021, and then sold the bond on April 12, 2021, have earned over the holding period? Use the values from parts a and b as appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutions a Price of the bond at issuance This is a present value of an annuity due problem with a f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started