Question

On April 12, Jackson Company agrees to accept a 60-day, 7%, $6,600 note from Alan Company to extend the due date on an overdue

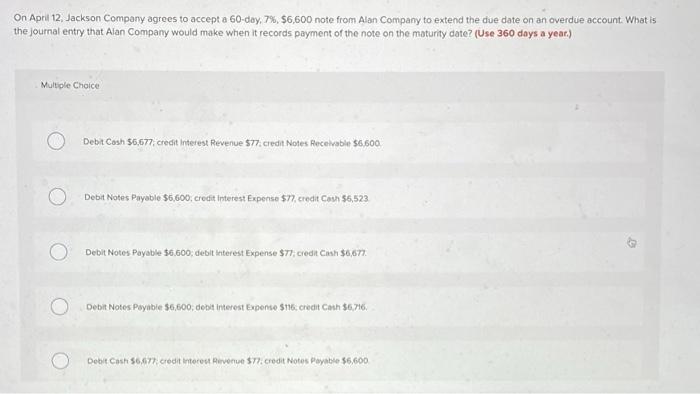

On April 12, Jackson Company agrees to accept a 60-day, 7%, $6,600 note from Alan Company to extend the due date on an overdue account. What is the journal entry that Alan Company would make when it records payment of the note on the maturity date? (Use 360 days a year.) Multiple Choice Debit Cash $6,677, credit Interest Revenue $77. credit Notes Receivable $6.600 Debit Notes Payable $6,600, credit Interest Expense $77, credit Cash $6,523 Debit Notes Payable $6.600; debit interest Expense $77; credit Cash $6,677. Debit Notes Payable $6,600; debit interest Expense $116: credit Cash $6,716 Debit Cash $6,677, credit Interest Revenue $77, credit Notes Payable $6,600

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

General Journal Debit Credit Cash Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

4th Edition

978-0133251241, 9780133427516, 133251241, 013342751X, 978-0133255584

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App