Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 15, 2018, Ira filed her Form 1040, U.S. Individual Income Tax Return, for the 2017 taxable year. On her 2017 Form 1040,

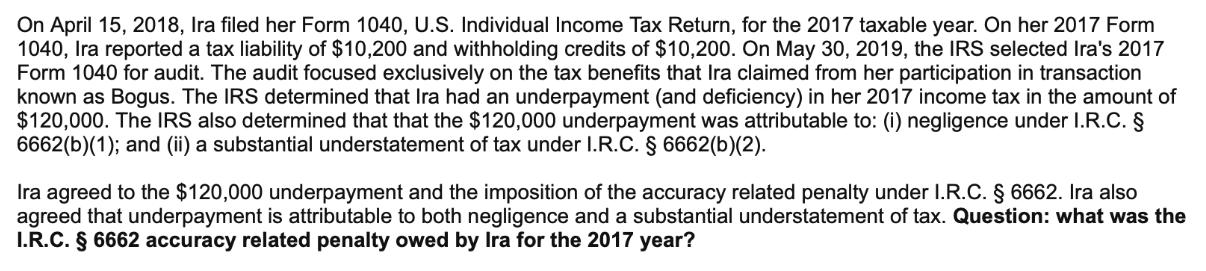

On April 15, 2018, Ira filed her Form 1040, U.S. Individual Income Tax Return, for the 2017 taxable year. On her 2017 Form 1040, Ira reported a tax liability of $10,200 and withholding credits of $10,200. On May 30, 2019, the IRS selected Ira's 2017 Form 1040 for audit. The audit focused exclusively on the tax benefits that Ira claimed from her participation in transaction known as Bogus. The IRS determined that Ira had an underpayment (and deficiency) in her 2017 income tax in the amount of $120,000. The IRS also determined that that the $120,000 underpayment was attributable to: (i) negligence under I.R.C. 6662(b)(1); and (ii) a substantial understatement of tax under I.R.C. 6662(b)(2). Ira agreed to the $120,000 underpayment and the imposition of the accuracy related penalty under I.R.C. 6662. Ira also agreed that underpayment is attributable to both negligence and a substantial understatement of tax. Question: what was the I.R.C. 6662 accuracy related penalty owed by Ira for the 2017 year?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the accuracyrelated penalty owed by Ira for the 2017 tax year under IRC 6662 we n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started