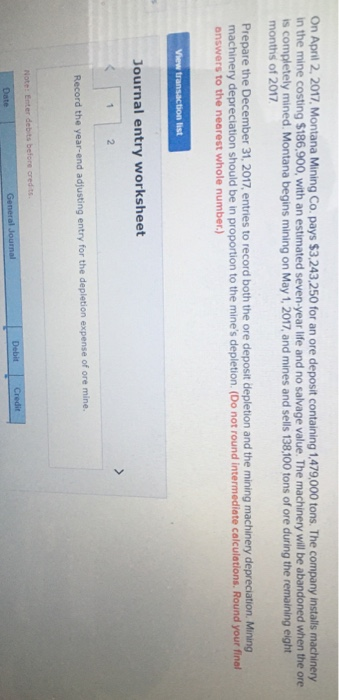

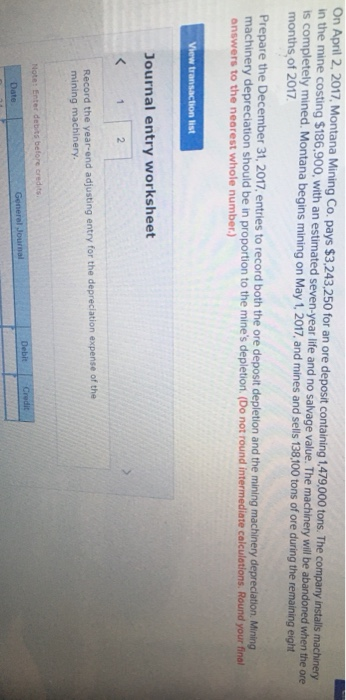

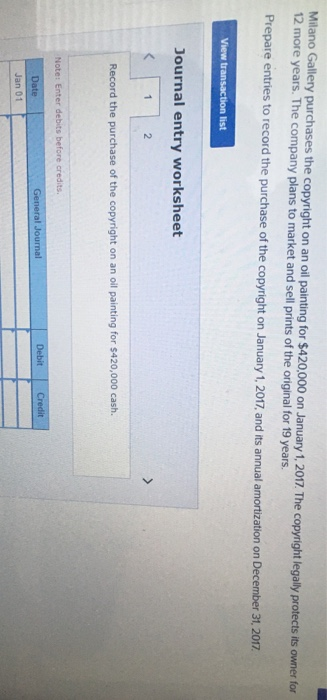

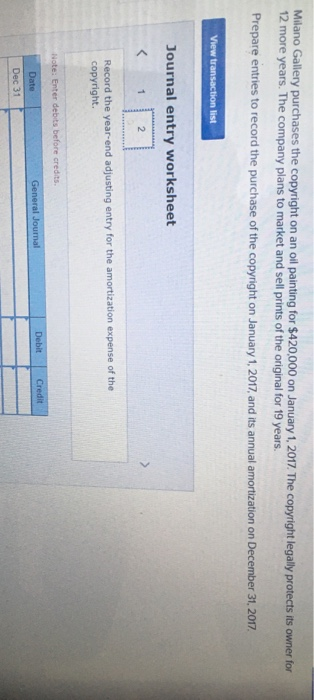

On April 2, 2017, Montana Mining Co. pays $3,243,250 for an ore deposit containing 1.479,000 tons. The company installs machinery in the mine costing $186,900, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 138,100 tons of ore during the remaining eight months of 2017 Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round Intermediate calculations. Round your final answers to the nearest whole number.) View transaction list Journal entry worksheet Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debts before cred to Debit Credit Date General Journal On April 2, 2017, Montana Mining Co. pays $3,243,250 for an ore deposit containing 1,479,000 tons. The company installs machinery in the mine costing $186.900, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 138,100 tons of ore during the remaining eight months of 2017 Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) View transaction list Journal entry worksheet 1 2 Record the year-end adjusting entry for the depreciation expense of the mining machinery. Note: Enter debts before credits General Journal Debit Credit Date Milano Gallery purchases the copyright on an oil painting for $420,000 on January 1, 2017. The copyright legally protects its owner for 12 more years. The company plans to market and sell prints of the original for 19 years. Prepare entries to record the purchase of the copyright on January 1, 2017, and its annual amortization on December 31, 2017 View transaction list Journal entry worksheet Record the purchase of the copyright on an oil painting for $420,000 cash. Note: Enter debits before credits. Debit General Journal Date Credit Jan 01 Milano Gallery purchases the copyright on an oil painting for $420,000 on January 1, 2017. The copyright legally protects its owner for 12 more years. The company plans to market and sell prints of the original for 19 years. Prepare entries to record the purchase of the copyright on January 1, 2017, and its annual amortization on December 31, 2017 View transaction list Journal entry worksheet Record the year-end adjusting entry for the amortization expense of the copyright. Note: Enter debits before credits Debit Credit General Journal Date Dec 31