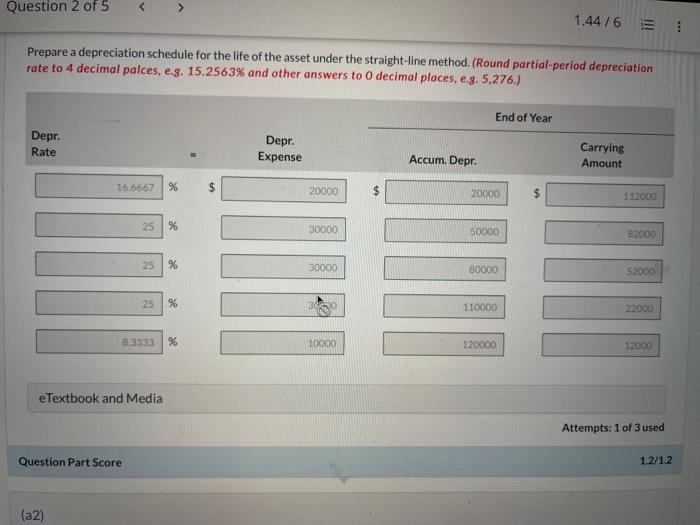

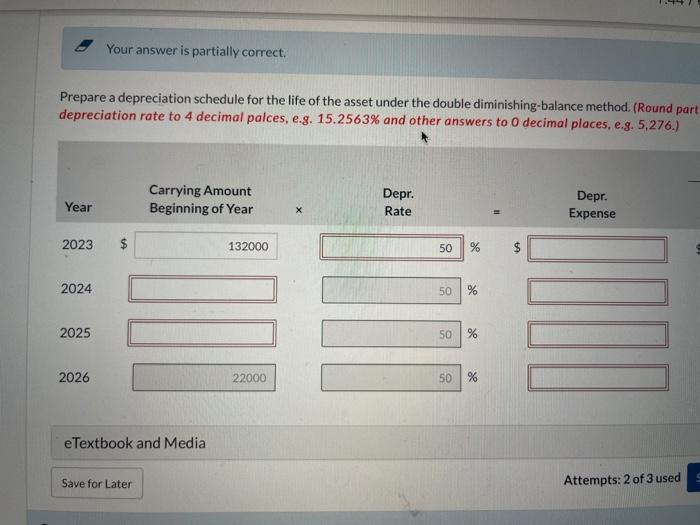

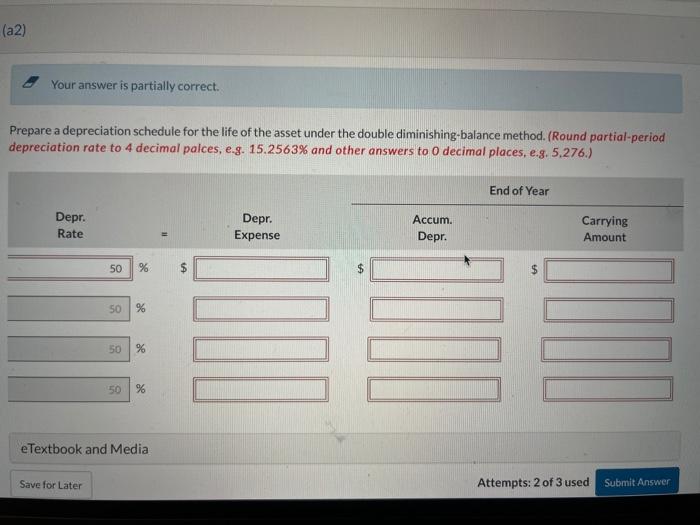

On April 22, 2023, Cullumber Enterprises purchased equipment for $132,000. The company expects to use the equipment for 12,000 working hours during its four-year life and that it will have a residual value of $12,000. Cullumber has a December 31 year end and pro-rates depreciation to the nearest month. The actual machine usage was: 1,300 hours in 2023; 2,900 hours in 2024; 3.800 hours in 2025: 2,800 hours in 2026; and 1,400 hours in 2027. (a) Prepare a depreciation schedule for the life of the asset under the straight-line method. (Round partial-period depreciation rate to 4 decimal paices, e.g. 15.2563% and other answers to 0 decimal places, e.g. 5,276.) Prepare a depreciation schedule for the life of the asset under the straight-line method. (Round partial-period depreciation rate to 4 decimal palces, e.g. 15.2563% and other answers to 0 decimal places, e.3. 5,276.) Your answer is partially correct. Prepare a depreciation schedule for the life of the asset under the double diminishing-balance method. (Round part depreciation rate to 4 decimal palces, e.g. 15.2563\% and other answers to 0 decimal places, e.g. 5,276.) eTextbook and Media Attempts: 2 of 3 used Prepare a depreciation schedule for the life of the asset under the double diminishing-balance method. (Round partial-period depreciation rate to 4 decimal palces, e.g. 15.2563% and other answers to 0 decimal places, e.g. 5,276.) On April 22, 2023, Cullumber Enterprises purchased equipment for $132,000. The company expects to use the equipment for 12,000 working hours during its four-year life and that it will have a residual value of $12,000. Cullumber has a December 31 year end and pro-rates depreciation to the nearest month. The actual machine usage was: 1,300 hours in 2023; 2,900 hours in 2024; 3.800 hours in 2025: 2,800 hours in 2026; and 1,400 hours in 2027. (a) Prepare a depreciation schedule for the life of the asset under the straight-line method. (Round partial-period depreciation rate to 4 decimal paices, e.g. 15.2563% and other answers to 0 decimal places, e.g. 5,276.) Prepare a depreciation schedule for the life of the asset under the straight-line method. (Round partial-period depreciation rate to 4 decimal palces, e.g. 15.2563% and other answers to 0 decimal places, e.3. 5,276.) Your answer is partially correct. Prepare a depreciation schedule for the life of the asset under the double diminishing-balance method. (Round part depreciation rate to 4 decimal palces, e.g. 15.2563\% and other answers to 0 decimal places, e.g. 5,276.) eTextbook and Media Attempts: 2 of 3 used Prepare a depreciation schedule for the life of the asset under the double diminishing-balance method. (Round partial-period depreciation rate to 4 decimal palces, e.g. 15.2563% and other answers to 0 decimal places, e.g. 5,276.)