Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 9,2021, X Company performed services for $1,700 on account. The entry to record this transaction is: * A debit to Cash $1,700 and

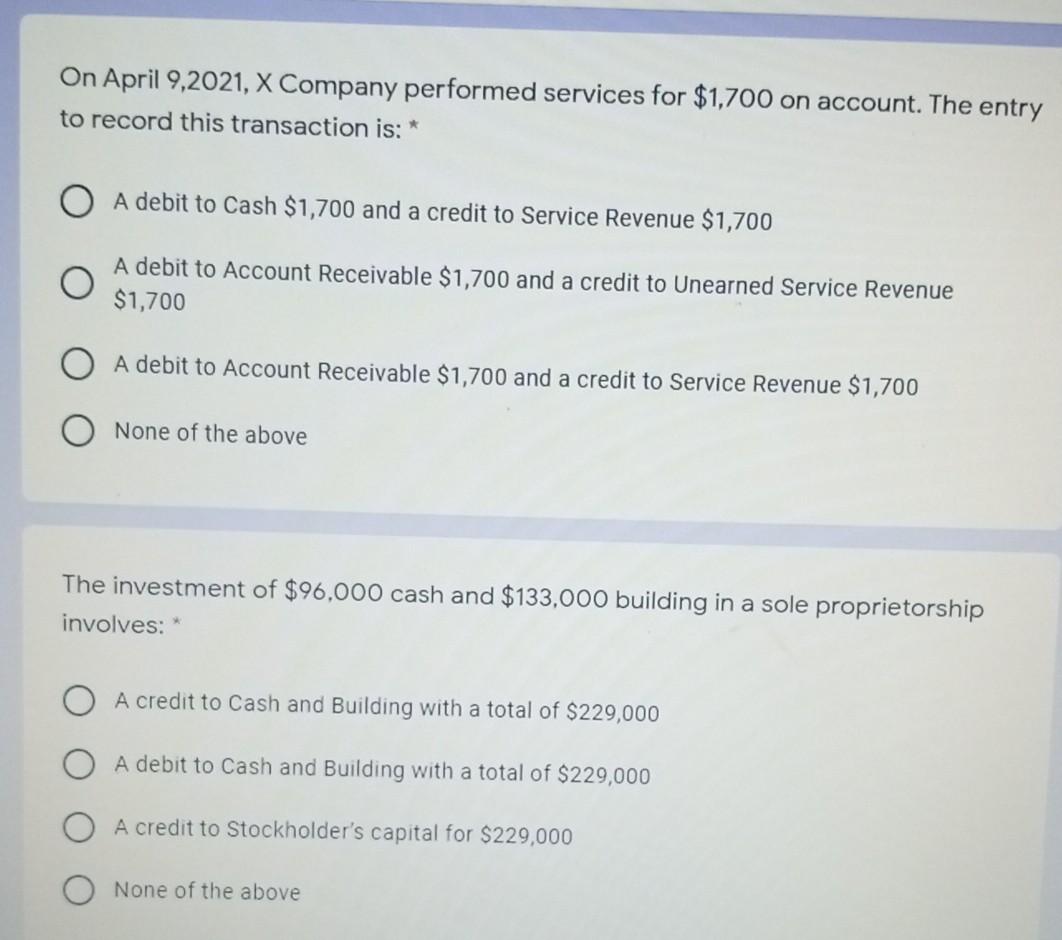

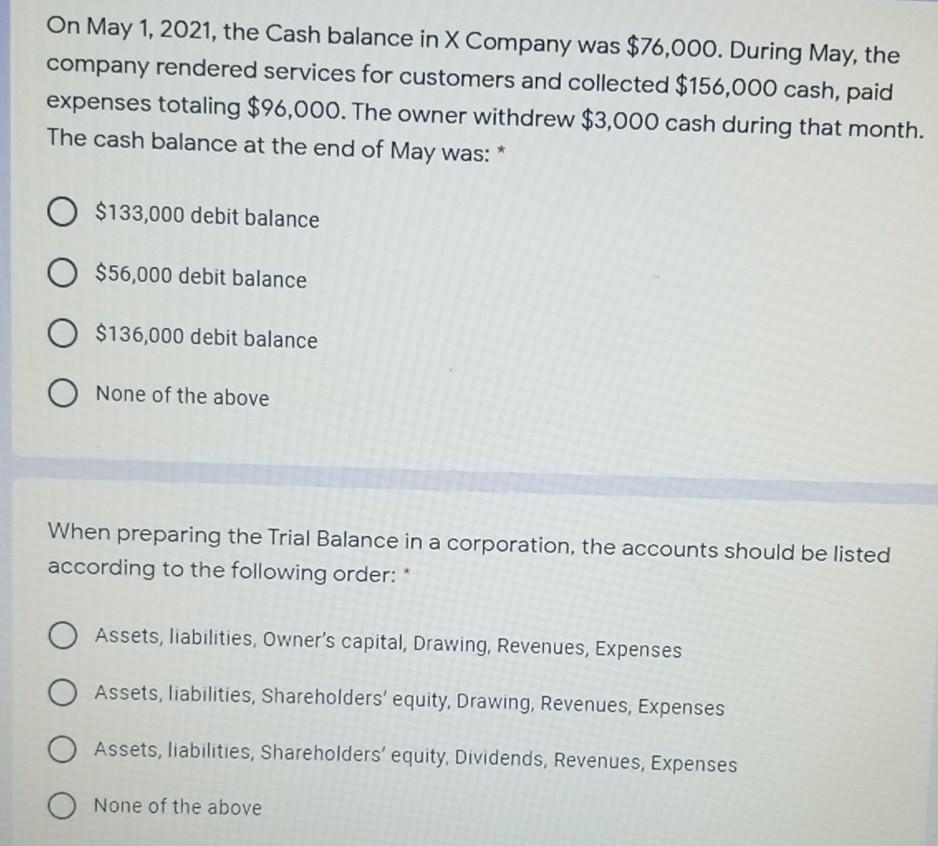

On April 9,2021, X Company performed services for $1,700 on account. The entry to record this transaction is: * A debit to Cash $1,700 and a credit to Service Revenue $1,700 A debit to Account Receivable $1,700 and a credit to Unearned Service Revenue $1,700 A debit to Account Receivable $1,700 and a credit to Service Revenue $1,700 O None of the above The investment of $96,000 cash and $133,000 building in a sole proprietorship involves: A credit to Cash and Building with a total of $229,000 A debit to Cash and Building with a total of $229,000 A credit to Stockholder's capital for $229,000 None of the above On May 1, 2021, the Cash balance in X Company was $76,000. During May, the company rendered services for customers and collected $156,000 cash, paid expenses totaling $96,000. The owner withdrew $3,000 cash during that month. The cash balance at the end of May was: * O $133,000 debit balance $56,000 debit balance O $136,000 debit balance O None of the above When preparing the Trial Balance in a corporation, the accounts should be listed according to the following order: O Assets, liabilities, Owner's capital, Drawing, Revenues, Expenses O Assets, liabilities, Shareholders' equity, Drawing, Revenues, Expenses Assets, liabilities, Shareholders' equity, Dividends, Revenues, Expenses None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started