Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 1, 20X1 KAG Ltd. (a lessor) leased an asset with a fair value of $44,000 to a customer. The asset has a carrying

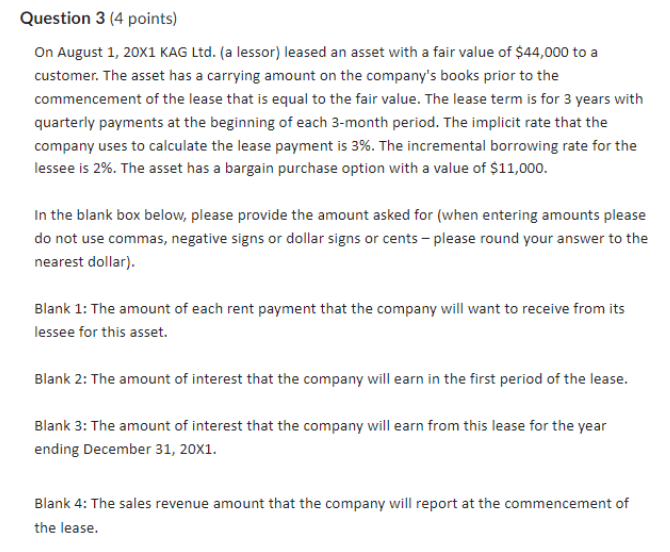

On August 1, 20X1 KAG Ltd. (a lessor) leased an asset with a fair value of $44,000 to a customer. The asset has a carrying amount on the company's books prior to the commencement of the lease that is equal to the fair value. The lease term is for 3 years with quarterly payments at the beginning of each 3 -month period. The implicit rate that the company uses to calculate the lease payment is 3%. The incremental borrowing rate for the lessee is 2%. The asset has a bargain purchase option with a value of $11,000. In the blank box below, please provide the amount asked for (when entering amounts please do not use commas, negative signs or dollar signs or cents - please round your answer to the nearest dollar). Blank 1: The amount of each rent payment that the company will want to receive from its lessee for this asset. Blank 2: The amount of interest that the company will earn in the first period of the lease. Blank 3: The amount of interest that the company will earn from this lease for the year ending December 31, 201. Blank 4: The sales revenue amount that the company will report at the commencement of the lease

On August 1, 20X1 KAG Ltd. (a lessor) leased an asset with a fair value of $44,000 to a customer. The asset has a carrying amount on the company's books prior to the commencement of the lease that is equal to the fair value. The lease term is for 3 years with quarterly payments at the beginning of each 3 -month period. The implicit rate that the company uses to calculate the lease payment is 3%. The incremental borrowing rate for the lessee is 2%. The asset has a bargain purchase option with a value of $11,000. In the blank box below, please provide the amount asked for (when entering amounts please do not use commas, negative signs or dollar signs or cents - please round your answer to the nearest dollar). Blank 1: The amount of each rent payment that the company will want to receive from its lessee for this asset. Blank 2: The amount of interest that the company will earn in the first period of the lease. Blank 3: The amount of interest that the company will earn from this lease for the year ending December 31, 201. Blank 4: The sales revenue amount that the company will report at the commencement of the lease Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started