Answered step by step

Verified Expert Solution

Question

1 Approved Answer

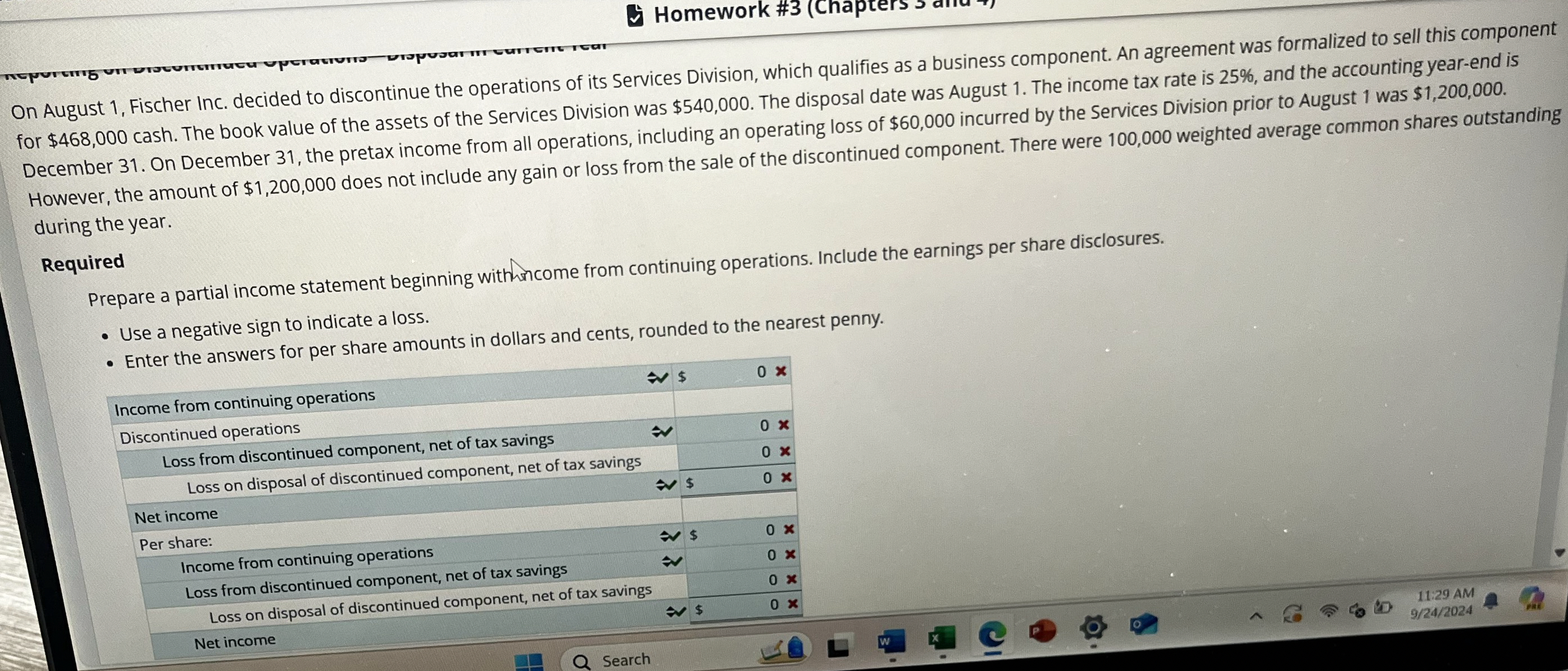

On August 1 , Fischer Inc. decided to discontinue the operations of its Services Division, which qualifies as a business component. An agreement was formalized

On August Fischer Inc. decided to discontinue the operations of its Services Division, which qualifies as a business component. An agreement was formalized to sell this component

for $ cash. The book value of the assets of the Services Division was $ The disposal date was August The income tax rate is and the accounting yearend is

December On December the pretax income from all operations, including an operating loss of $ incurred by the Services Division prior to August was $

However, the amount of $ does not include any gain or loss from the sale of the discontinued component. There were weighted average common shares outstanding

during the year.

Required

Prepare a partial income statement beginning with

Use a negative sign to indicate a loss.

Enter the answers for per share amounts in dollars and cents, rounded to the nearest penny.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started