Answered step by step

Verified Expert Solution

Question

1 Approved Answer

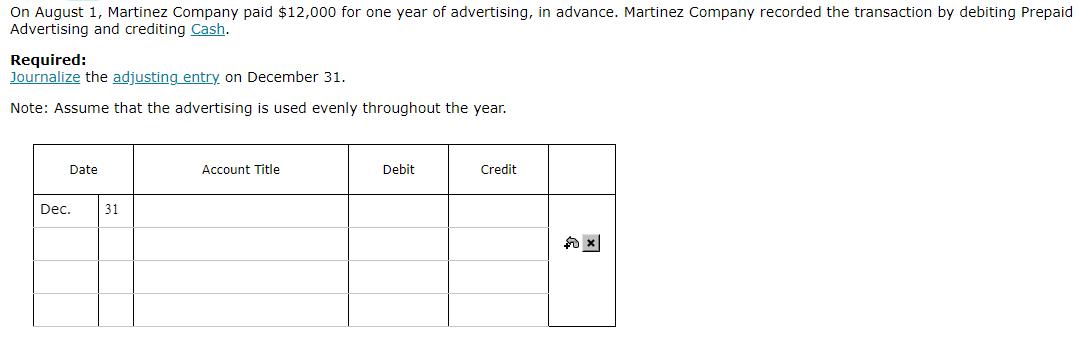

On August 1, Martinez Company paid $12,000 for one year of advertising, in advance. Martinez Company recorded the transaction by debiting Prepaid Advertising and

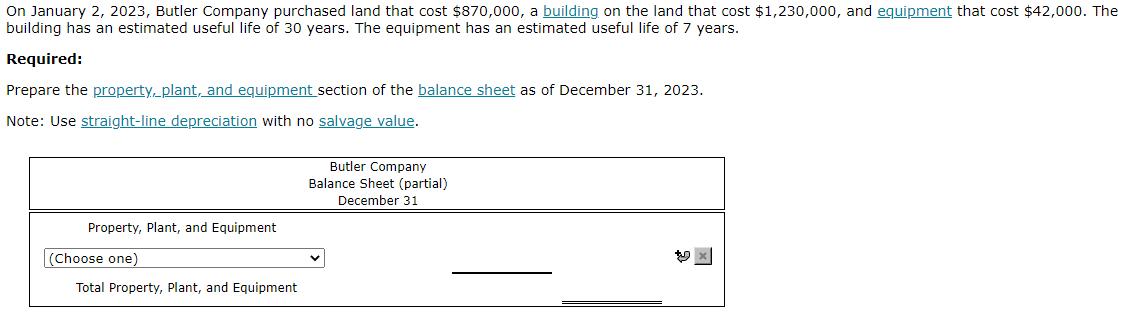

On August 1, Martinez Company paid $12,000 for one year of advertising, in advance. Martinez Company recorded the transaction by debiting Prepaid Advertising and crediting Cash. Required: Journalize the adjusting entry on December 31. Note: Assume that the advertising is used evenly throughout the year. Account Title Debit HITTE Date Dec. 31 Credit On January 2, 2023, Butler Company purchased land that cost $870,000, a building on the land that cost $1,230,000, and equipment that cost $42,000. The building has an estimated useful life of 30 years. The equipment has an estimated useful life of 7 years. Required: Prepare the property, plant, and equipment section of the balance sheet as of December 31, 2023. Note: Use straight-line depreciation with no salvage value. Property, Plant, and Equipment (Choose one) Total Property, Plant, and Equipment Butler Company Balance Sheet (partial) December 31

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started