Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 1 the Treasurer at Dow Chemical knows that sometime in November or December his company will need to purchase 6 0 , 0

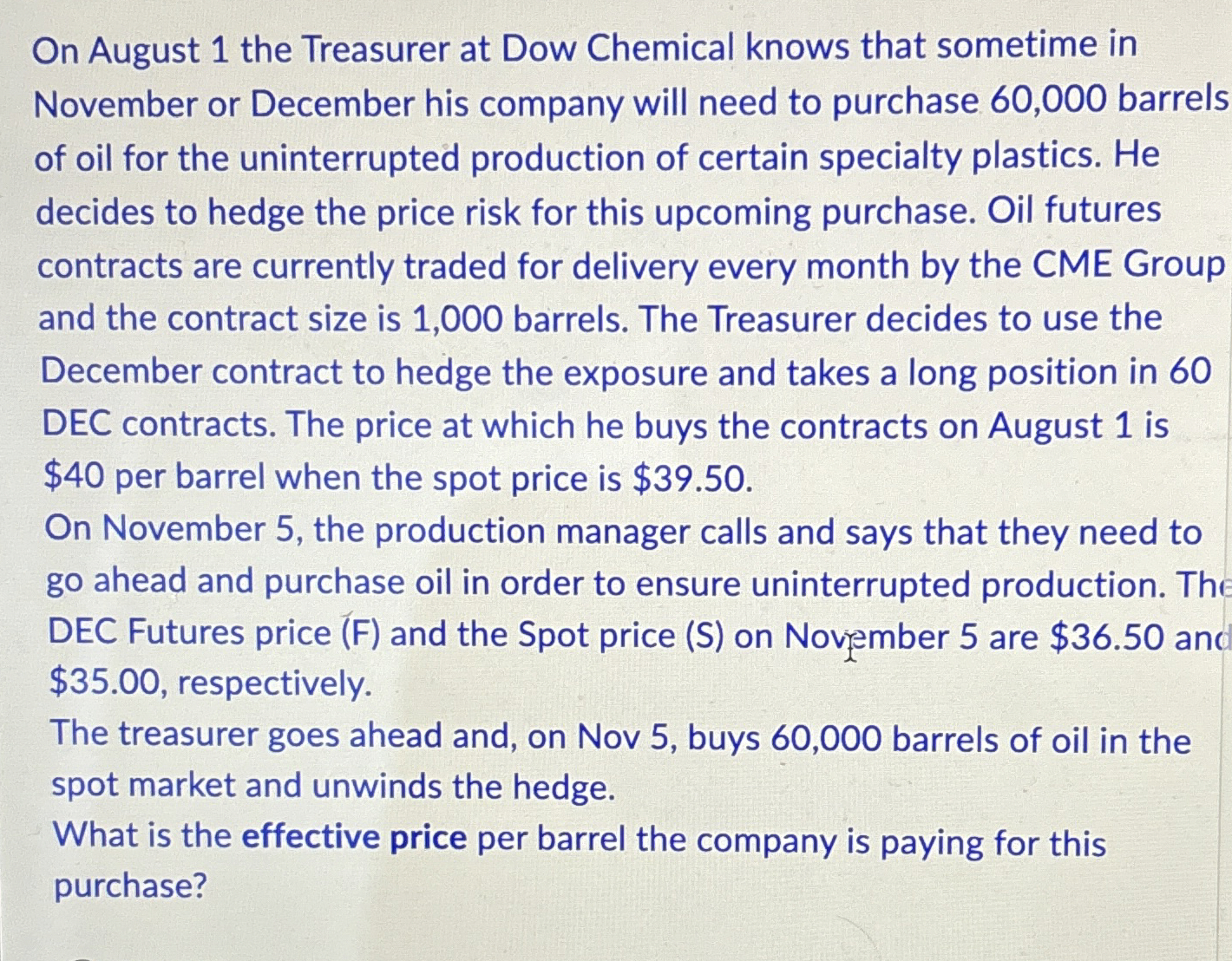

On August the Treasurer at Dow Chemical knows that sometime in November or December his company will need to purchase barrels of oil for the uninterrupted production of certain specialty plastics. He decides to hedge the price risk for this upcoming purchase. Oil futures contracts are currently traded for delivery every month by the CME Group and the contract size is barrels. The Treasurer decides to use the December contract to hedge the exposure and takes a long position in DEC contracts. The price at which he buys the contracts on August is $ per barrel when the spot price is $

On November the production manager calls and says that they need to go ahead and purchase oil in order to ensure uninterrupted production. The DEC Futures price F and the Spot price S on November are $ and $ respectively.

The treasurer goes ahead and, on Nov buys barrels of oil in the spot market and unwinds the hedge.

What is the effective price per barrel the company is paying for this purchase?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started