Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$500,000. The machinery was delivered on October 1, Year

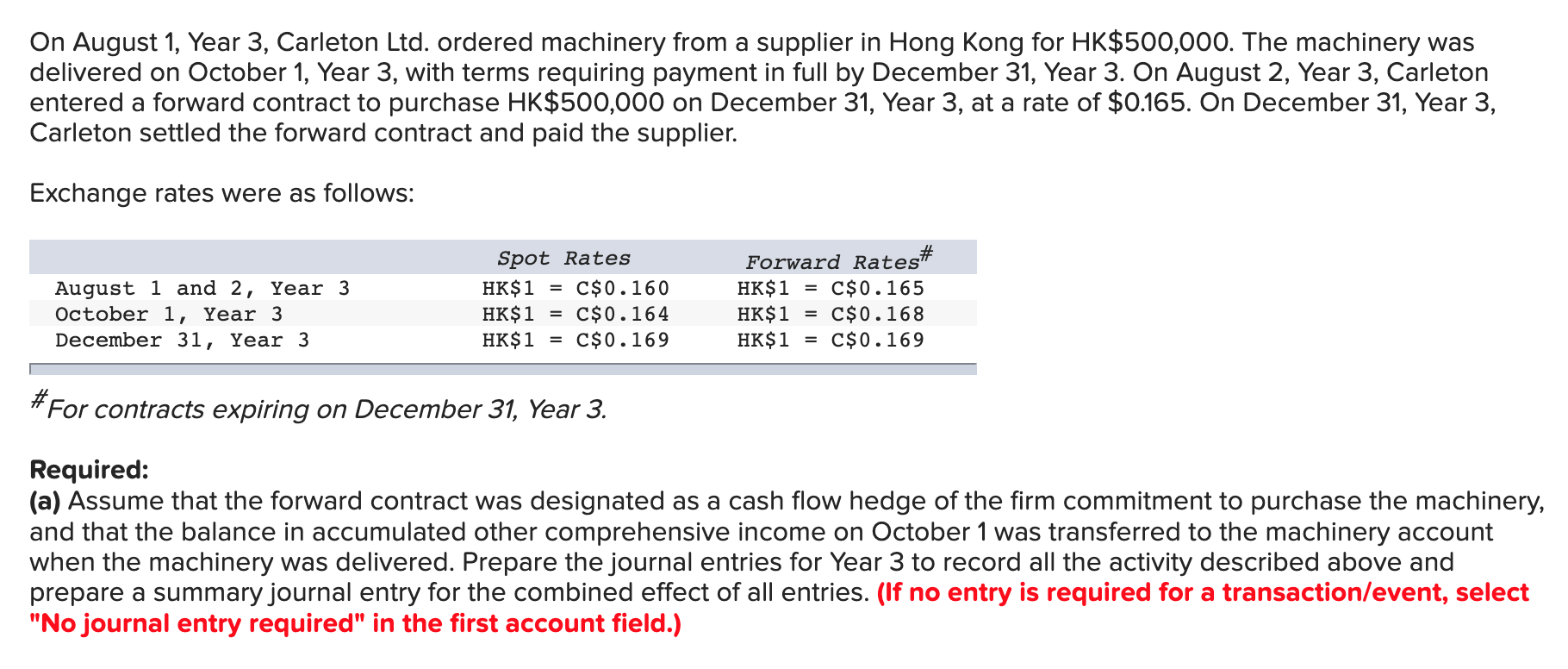

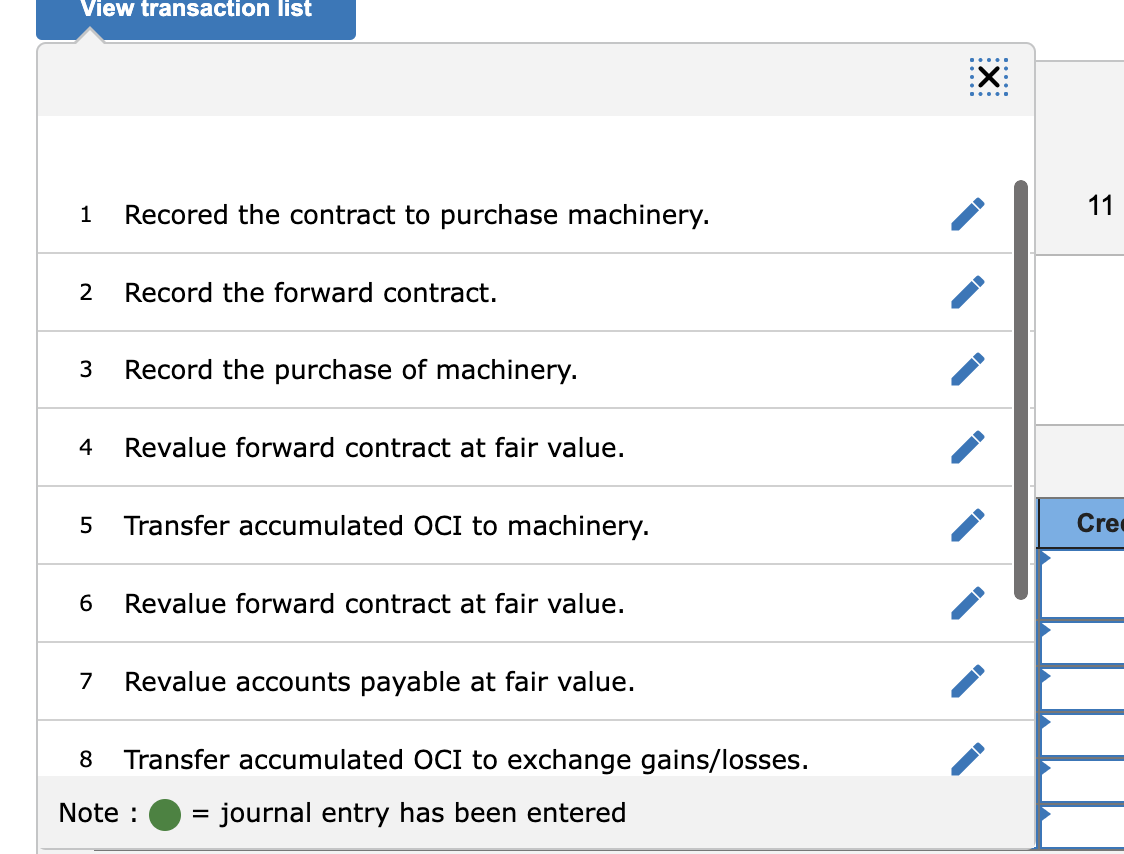

On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK\$500,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forward contract to purchase HK\$500,000 on December 31, Year 3, at a rate of \$0.165. On December 31, Year 3, Carleton settled the forward contract and paid the supplier. Exchange rates were as follows: \#For contracts expiring on December 31, Year 3. Required: (a) Assume that the forward contract was designated as a cash flow hedge of the firm commitment to purchase the machinery, and that the balance in accumulated other comprehensive income on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Recored the contract to purchase machinery. 2 Record the forward contract. 3 Record the purchase of machinery. 4 Revalue forward contract at fair value. 5 Transfer accumulated OCI to machinery. 6 Revalue forward contract at fair value. 7 Revalue accounts payable at fair value. 8 Transfer accumulated OCI to exchange gains/losses. Note: = journal entry has been entered (b) Assume that the forward contract was designated as a fair value hedge of the firm commitment to purchase the machinery and that the balance in the commitment asset/liability account on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (In cases where no entry is required, please select the option "No journal entry required" for your answer to grade correctly. Leave no cells blank - be certain to enter "0" wherever required.) (c) Assume that hedge accounting was not applied. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Recored the contract to purchase machinery. 2 Record the forward contract. 3 Record the purchase of machinery. 4 Revalue forward contract at fair value. 5 Revalue forward contract at fair value. 6 Revalue accounts payable at fair value. 7 Record the cash received frombank. 8 Record payment of accounts payable. Note : = journal entry has been entered

On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK\$500,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forward contract to purchase HK\$500,000 on December 31, Year 3, at a rate of \$0.165. On December 31, Year 3, Carleton settled the forward contract and paid the supplier. Exchange rates were as follows: \#For contracts expiring on December 31, Year 3. Required: (a) Assume that the forward contract was designated as a cash flow hedge of the firm commitment to purchase the machinery, and that the balance in accumulated other comprehensive income on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Recored the contract to purchase machinery. 2 Record the forward contract. 3 Record the purchase of machinery. 4 Revalue forward contract at fair value. 5 Transfer accumulated OCI to machinery. 6 Revalue forward contract at fair value. 7 Revalue accounts payable at fair value. 8 Transfer accumulated OCI to exchange gains/losses. Note: = journal entry has been entered (b) Assume that the forward contract was designated as a fair value hedge of the firm commitment to purchase the machinery and that the balance in the commitment asset/liability account on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (In cases where no entry is required, please select the option "No journal entry required" for your answer to grade correctly. Leave no cells blank - be certain to enter "0" wherever required.) (c) Assume that hedge accounting was not applied. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Recored the contract to purchase machinery. 2 Record the forward contract. 3 Record the purchase of machinery. 4 Revalue forward contract at fair value. 5 Revalue forward contract at fair value. 6 Revalue accounts payable at fair value. 7 Record the cash received frombank. 8 Record payment of accounts payable. Note : = journal entry has been entered Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started