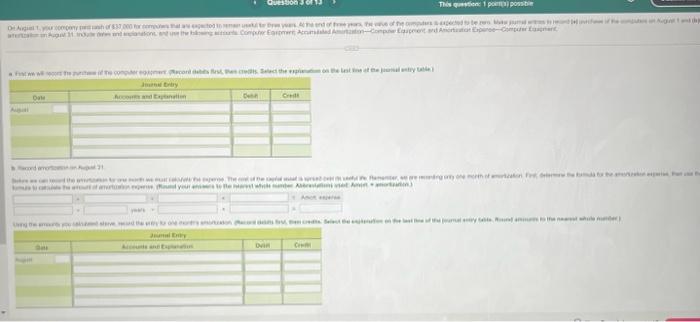

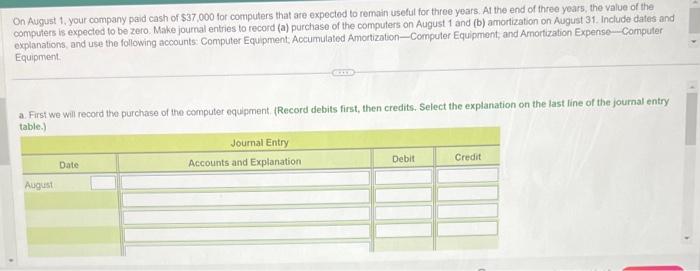

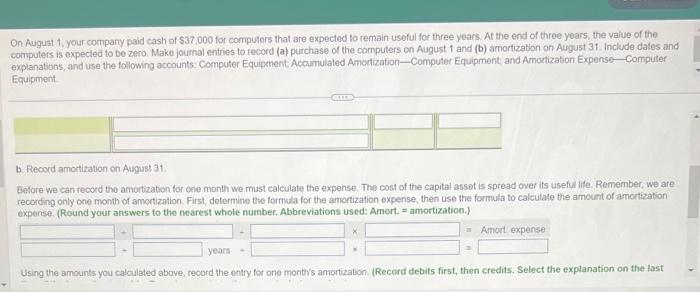

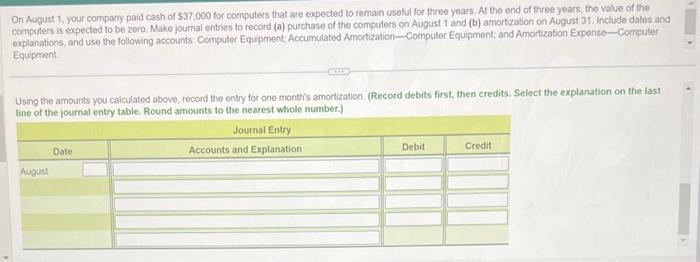

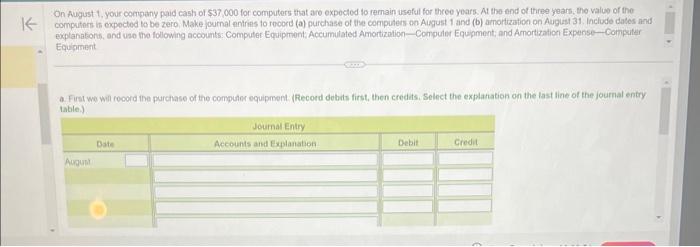

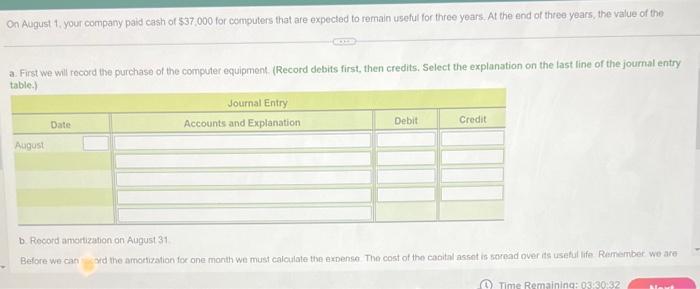

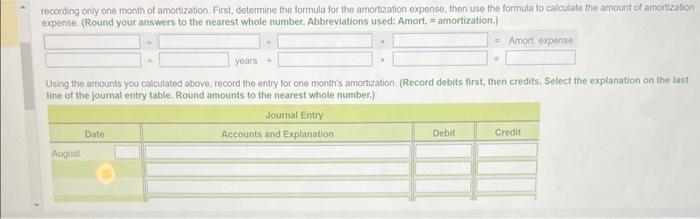

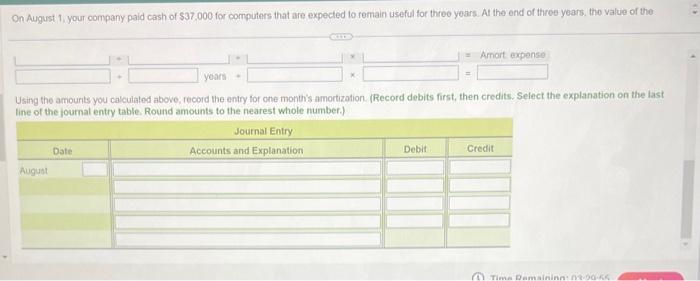

On August 1. your company paid cash of $37,000 tor computers that are expected to remain usetul for three years. Al the end of three years, the value of the computers is expected to be zero. Make journal entries to record (a) purchase of the computers on August 1 and (b) amortization on August 31 . Include dates and explanations, and use the following accounts: Computer Equipment, Accumulated Amotization-Computer Equipment, and Amortization Expense-Computer Equipment. a. First we will record the purchase of the computer equpment, (Record debits first, then credits. Select the explanation on the last line of the journal entry On August 1, your company paid cash of $37,000 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Make joumal entries to record (a) purchase of the computers on August 1 and (b) amortization on August 31 . Include dates and explanations, and use the following accounts. Computer Equipnent: Accumulated Amorization-Computer Equipment; and Amortization Expense-Computer Equipment b Record amortization on August 31 . Before we can record the amortzation for one month we must calculate the expense. The cost of the capital asset is spread over its useful life. Remember. we are recording only one month of amortization. First, determine the formula for the amortization expense, then use the formula to calcutate the amount of amorization expense. (Round your answers to the nearest whole number. Abbreviations used: Amort. = amortization.) On August 1, your company paid cash of $37,000 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Make journal entries to record (a) purchase of the computers on August 1 and (b) amorfization on August 31 . Inctude dales and explanations, and use the following accounts: Computer Equipment Accumulated Amortization-Computer Equipment, and Amortization Expense- Computer Equpment. Using the amounts you calculated above, record the entry for one month's amortization. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Round amounts to the nearest whole number.) On August 1. your company paid cash of $37,000 for computers that are expected to remain useful for three years. At the end of three years. the valuo of the computors is expocted to be zero, Make journal entrins to rooord (a) purchase of the computers on Auggust 1 and (b) amortization on August 31 . incliode dates and explanalons, and uso the following accounts: Computer Equipinont: Accumulated Amortization-Compuler Equpmenti and Amortization Expense-Computer Equiment a. Fins we wil rocord the purchase of the computor equipment. (fecord debits first, then credits. Select the explanation on the last line of the journal entry table.) On August 1. your company paid cash of $37,000 for computers that are expected to remain useful for three years. At the end of three years, the value of the a. First we wil record the purchase of the computer equipment. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) b. Record amortization on August 31 Before we can wad the amotization foc one month we must calculate the expense. The cost of the cacital assat is soread over its usatul life Remember we are sing the amounts you calcuiated above, record the entry for ono month's amortization. (Record debits first, then credits. ine of the journal entry table. Round amounts to the nearest whole number.) On August 1. your company paid cash of $37.000 for computers that are expected to remain useful for threo years. At the end of three years. the value of the yoarti * =Amortexpense= Using the amounts you calculated above, record the entry for one month's amortization. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table. Round amounts to the nearest whole number.)