Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 12, 2020, Espresso Inc. sells merchandise worth $20,000 (gross sales price) to Crescendo Inc., terms 4/10, n/30. Espresso grants cash discounts on

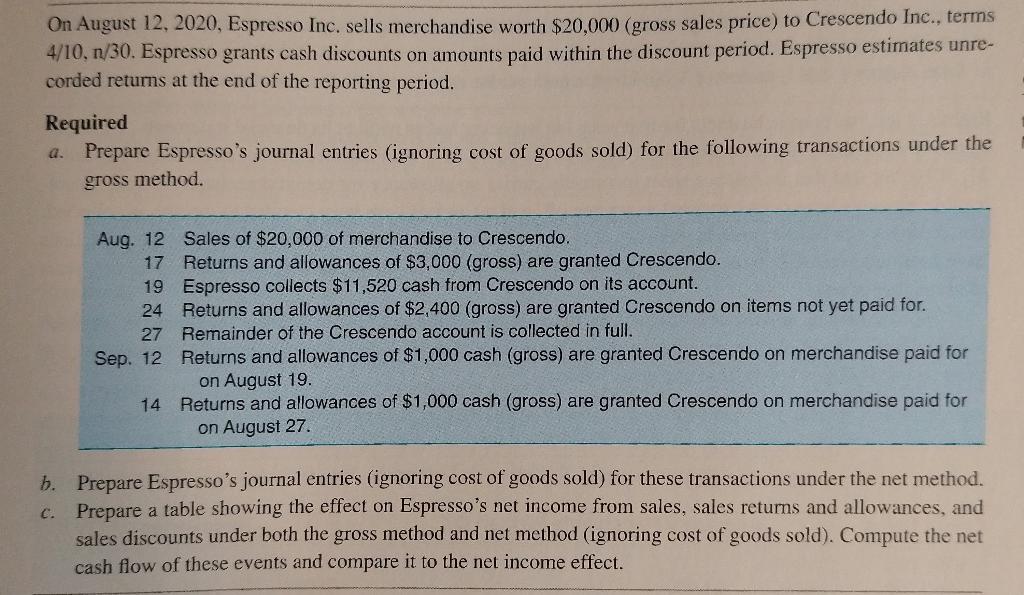

On August 12, 2020, Espresso Inc. sells merchandise worth $20,000 (gross sales price) to Crescendo Inc., terms 4/10, n/30. Espresso grants cash discounts on amounts paid within the discount period. Espresso estimates unre- corded returns at the end of the reporting period. Required a. Prepare Espresso's journal entries (ignoring cost of goods sold) for the following transactions under the gross method. Aug. 12 Sales of $20,000 of merchandise to Crescendo. 17 Returns and allowances of $3,000 (gross) are granted Crescendo. Espresso collects $11,520 cash from Crescendo on its account. 19 24 Returns and allowances of $2,400 (gross) are granted Crescendo on items not yet paid for. Remainder of the Crescendo account is collected in full. 27 Sep. 12 Returns and allowances of $1,000 cash (gross) are granted Crescendo on merchandise paid for on August 19. 14 Returns and allowances of $1,000 cash (gross) are granted Crescendo on merchandise paid for on August 27. b. Prepare Espresso's journal entries (ignoring cost of goods sold) for these transactions under the net method. c. Prepare a table showing the effect on Espresso's net income from sales, sales returns and allowances, and sales discounts under both the gross method and net method (ignoring cost of goods sold). Compute the net cash flow of these events and compare it to the net income effect.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

40 a 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started