Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 17, 2017, we completed the acquisition of Reck cash. The acquisition was funded through our issuance of of senior unsecured notes and pre-payable

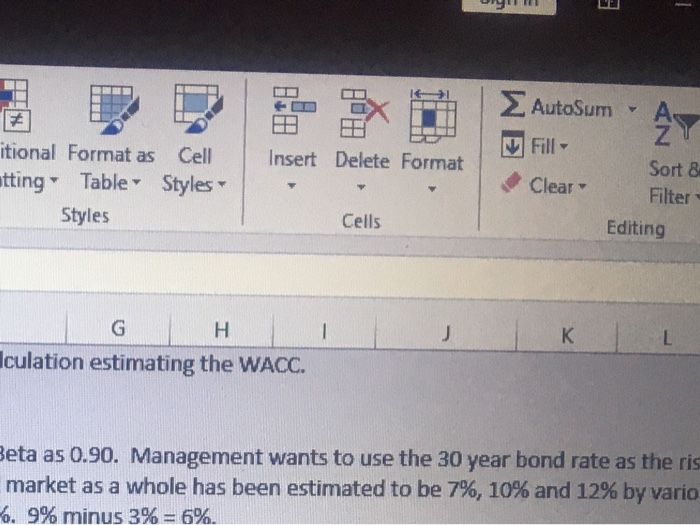

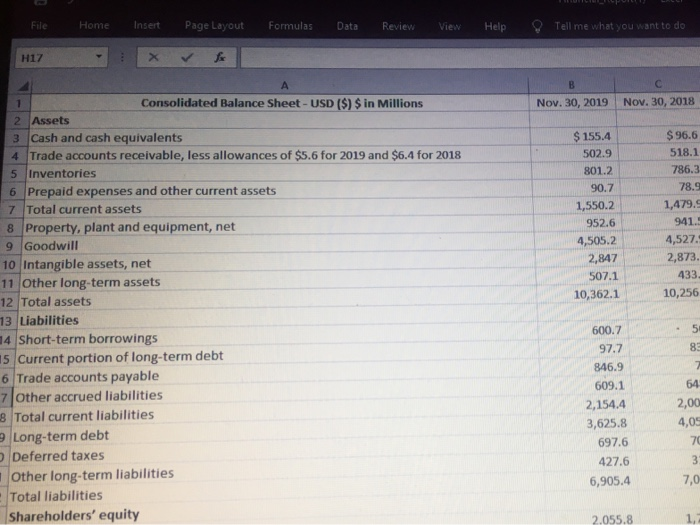

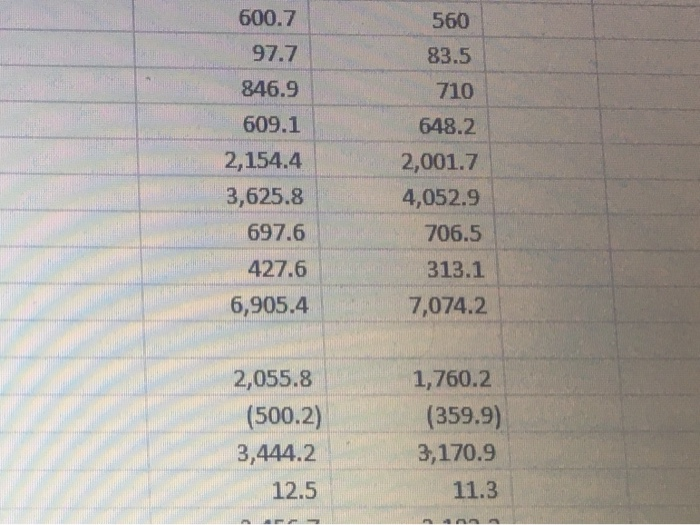

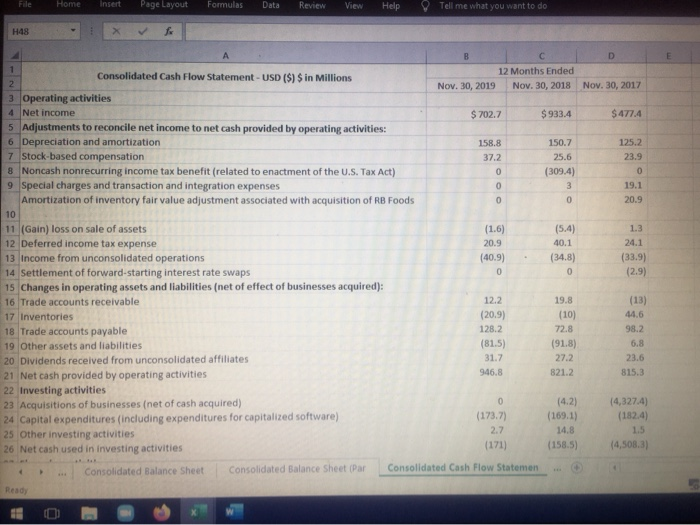

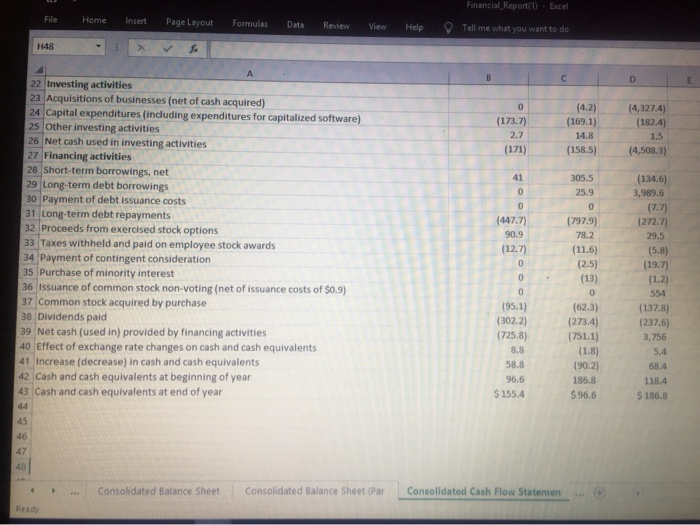

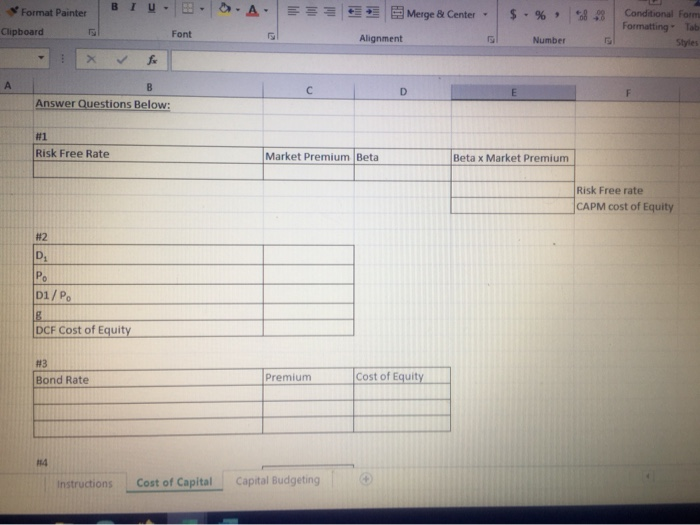

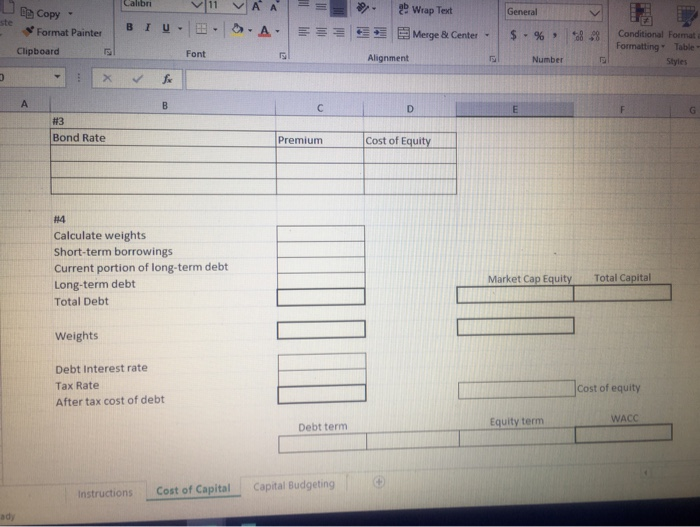

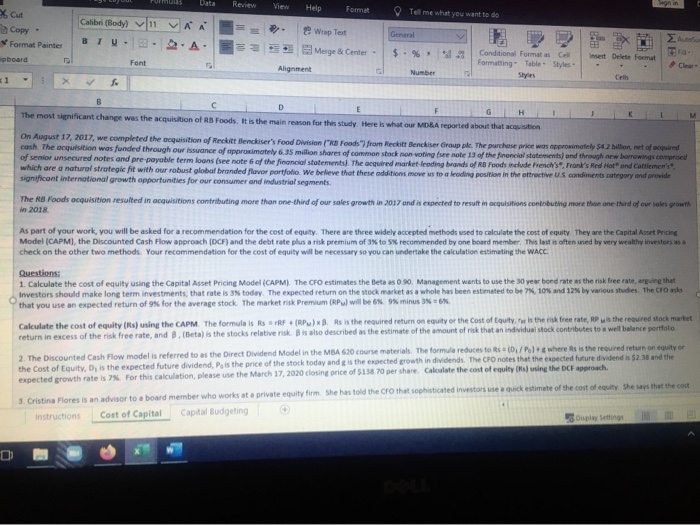

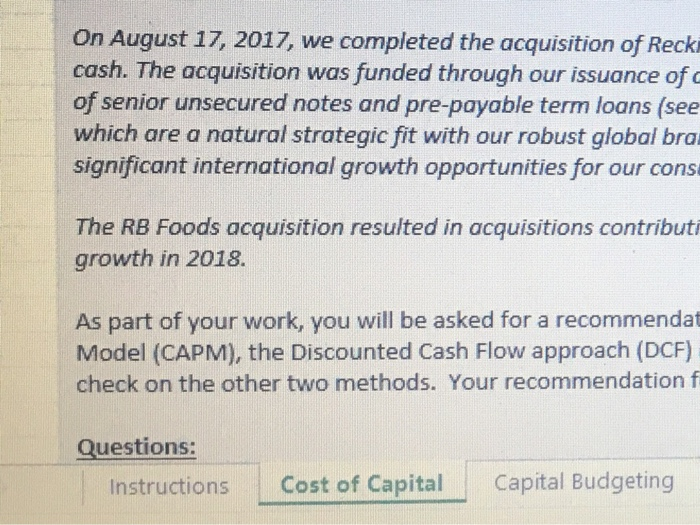

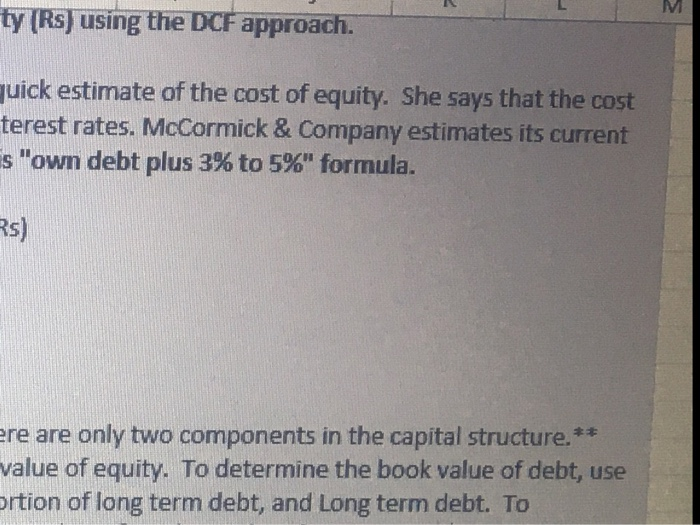

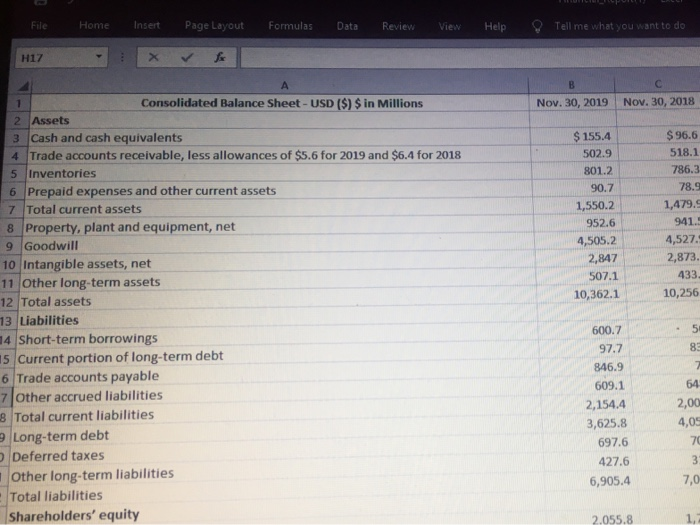

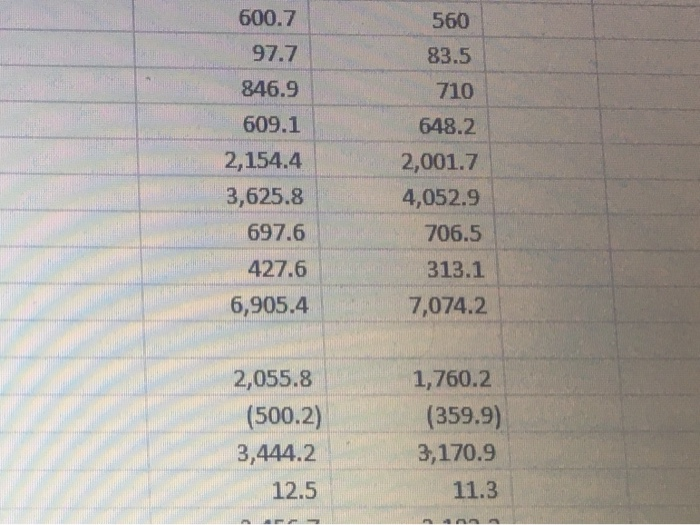

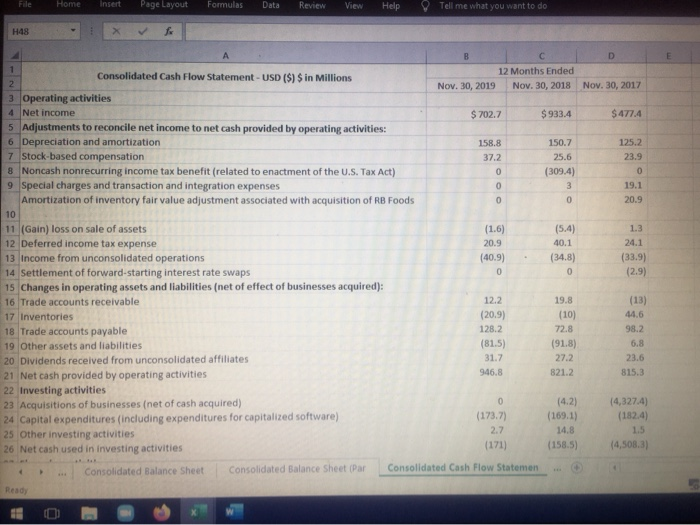

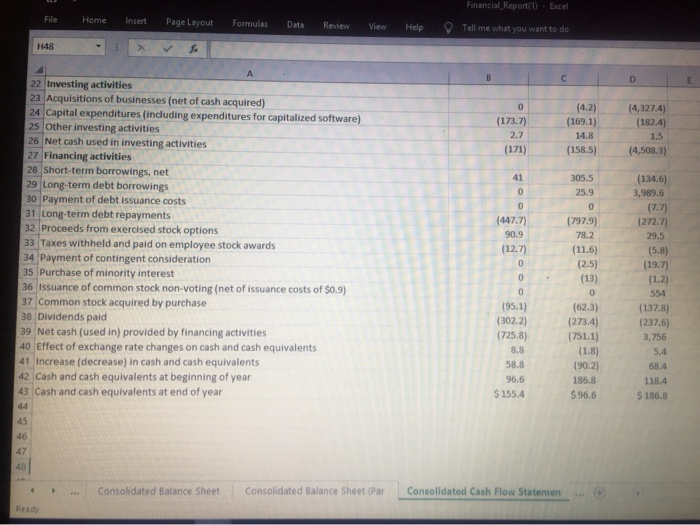

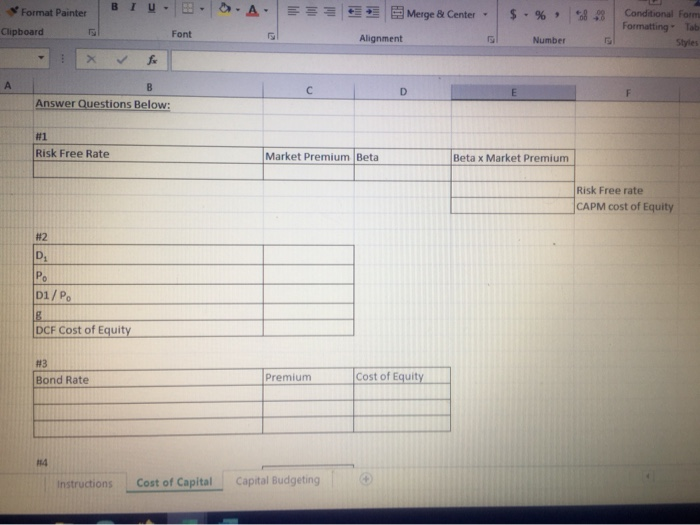

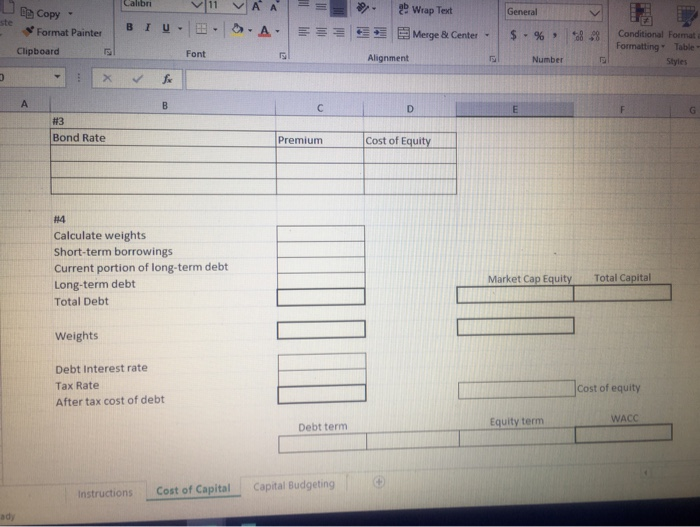

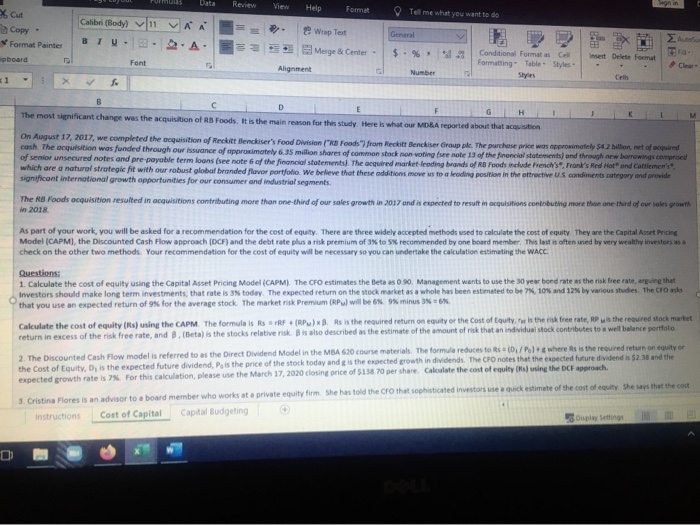

On August 17, 2017, we completed the acquisition of Reck cash. The acquisition was funded through our issuance of of senior unsecured notes and pre-payable term loans (see which are a natural strategic fit with our robust global bra significant international growth opportunities for our cons The RB Foods acquisition resulted in acquisitions contributi growth in 2018. As part of your work, you will be asked for a recommendat Model (CAPM), the Discounted Cash Flow approach (DCF) check on the other two methods. Your recommendation f Questions: Instructions Cost of Capital Capital Budgeting --- AutoSum. Fill - AY Insert Delete Format itional Format as Cell etting Table Styles Styles . Z Sort & Filter Clear Cells Editing - J K G H lculation estimating the WACC. L Beta as 0.90. Management wants to use the 30 year bond rate as the ris market as a whole has been estimated to be 7%, 10% and 12% by vario 6. 9% minus 3% = 6%. M ty (Rs) using the DCF approach. quick estimate of the cost of equity. She says that the cost terest rates. McCormick & Company estimates its current s "own debt plus 3% to 5%" formula. Rs) ere are only two components in the capital structure.** value of equity. To determine the book value of debt, use ortion of long term debt, and long term debt. To File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H17 f Nov. 30, 2019 Nov. 30, 2018 $ 155.4 502.9 801.2 90.7 1,550.2 952.6 4,505.2 2,847 507.1 10,362.1 $ 96.6 518.1 786.3 78.9 1,479. 941.5 4,527 2,873. 433 10,256 A Consolidated Balance Sheet - USD ($) $ in Millions 2 Assets 3 Cash and cash equivalents 4 Trade accounts receivable, less allowances of $5.6 for 2019 and $6.4 for 2018 5 Inventories 6 Prepaid expenses and other current assets 7 Total current assets 8 Property, plant and equipment, net 9 Goodwill 10 Intangible assets, net 11 Other long-term assets 12 Total assets 13 Liabilities 14 Short-term borrowings 15 Current portion of long-term debt 6 Trade accounts payable 7 other accrued liabilities 8 Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Total liabilities Shareholders' equity 600.7 97.7 8 846.9 64 609.1 2,154.4 3,625.8 697.6 427.6 6,905.4 2,00 4,05 70 3 7,0 2.055.8 600.7 S60 977 83.5 710 846.9 6091 648.2 2.154.4 3,625.8 697.5 2,001.7 4,052.9 706.5 3131 4276 6,905.4 7,074.2 2,055.8 (500.2) 3,444.2 12.5 1,760.2 (359.9) 3,170.9 11.3 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 1 0 B D 12 Months Ended Consolidated Cash Flow Statement - USD ($) $ in Millions 2 Nov. 30, 2019 Nov. 30, 2018 Nov. 30, 2017 3 Operating activities 4 Net income $702.7 $933.4 $ 477.4 5 Adjustments to reconcile net income to net cash provided by operating activities: 6 Depreciation and amortization 158.8 150.7 125.2 7 Stock-based compensation 37.2 25.6 23.9 8 Noncash nonrecurring income tax benefit (related to enactment of the U.S. Tax Act) (309.4) 0 9 Special charges and transaction and integration expenses 0 3 19.1 Amortization of inventory fair value adjustment associated with acquisition of RB Foods 0 0 20.9 10 11 (Gain) loss on sale of assets (1.6) (5.4) 1.3 12 Deferred income tax expense 20.9 40.1 24.1 13 Income from unconsolidated operations (40.9) (34.8) (33.9) 14 Settlement of forward-starting interest rate swaps 0 0 (2.9) 15 Changes in operating assets and liabilities (net of effect of businesses acquired): 16 Trade accounts receivable 12.2 19.8 (13) 17 Inventories (20.9) (10) 44.6 18 Trade accounts payable 128.2 72.8 98.2 19 Other assets and liabilities (81.5) (91.8) 6.8 20 Dividends received from unconsolidated affiliates 31.7 27.2 23.6 21 Net cash provided by operating activities 946.8 821.2 815.3 22 Investing activities 0 23 Acquisitions of businesses (net of cash acquired) (4.2) (4,327.4) 24 Capital expenditures (including expenditures for capitalized software) (1737) (169.1) (182.4) 25 Other investing activities 14.8 1.5 26 Net cash used in investing activities (171) (158.5) (4,508.31 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statemen 2.7 Ready Financial Report(1) - Excel File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 D 0 (1737) 2.7 (171) (4.2) (169.1) 14.8 (158.5) (4,327.4) (182.4) 1.5 (4,508.3) 41 22 Investing activities 23 Acquisitions of businesses (net of cash acquired) 24 Capital expenditures (including expenditures for capitalized software) 25 Other investing activities 26 Net cash used in investing activities 27 Financing activities 28 Short-term borrowings, net 29 Long-term debt borrowings 30 Payment of debt issuance costs 31 Long-term debt repayments 32 Proceeds from exercised stock options 33 Taxes withheld and paid on employee stock awards 34 Payment of contingent consideration 35 Purchase of minority interest 36 Issuance of common stock non-voting (net of issuance costs of $0.9) 37 common stock acquired by purchase 38 Dividends paid 39 Net cash (used in) provided by financing activities 40 Effect of exchange rate changes on cash and cash equivalents 41 Increase (decrease) in cash and cash equivalents 42 Cash and cash equivalents at beginning of year 43 Cash and cash equivalents at end of year 0 0 (447.7) 90.9 (12.7) 0 0 0 (95.1) (302.2) (725.8) 8.8 58.8 96.6 $ 155.4 305.5 25.9 0 (797.9) 78.2 (11.6) (2.5) (13) 0 (62.3) (273.4) (751.1) (1.8) (90.2) 186.8 $ 96.6 (134.6) 3,989.6 (7.7) (272.7) 29.5 (5.8) (19.7) (1.2) 554 (137.8) (237.6) 3,756 5.4 68.4 118.4 $ 186.8 45 46 47 48 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statenien Read Format Painter BI DA- E Merge & Center - $ . % *828 Clipboard Conditional Form Formatting Tab Styles Font Alignment Number f A D B Answer Questions Below: #1 Risk Free Rate Market Premium Beta Beta x Market Premium Risk Free rate CAPM cost of Equity #2 D Po 101/Po B DCF Cost of Equity #3 Bond Rate Premium Cost of Equity 114 Instructions Cost of Capital Capital Budgeting Calibri General ste EL Copy - Format Painter BIU- D A IND ab Wrap Text Merge & Center - $ % Clipboard Conditional Format Formatting Table Styles Font Alignment Number X fx A B D E G #3 Bond Rate Premium Cost of Equity #4 Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt Market Cap Equity Total Capital Weights Debt Interest rate Tax Rate After tax cost of debt Cost of equity WACC Debt term Equity term Instructions Cost of Capital Capital Budgeting ad Formulas Review View Sign in Help Format Tell me what you want to do Calibri (Body) v11 Xcut Copy Format Painter R General BA- Wrap Test Merge & Center Autos Cell pboard Conditional Formats Formatting Table Insert Delete format Font Clear Alignment Number 1 > Cells f F M B D G The most significant change was the acquisition of Rs Foods. It is the main reason for this study. Here is what our MORA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("8 Foods") from Reckitt Benckiser Group pls. The purchase price was approximately 1.2 billion, net of cred cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting (se note 13 of the financial statements) and through new borrowings comprised of senior unsecured notes and pre payable term loans (see note 6 of the financial statements. The acquired market leading brands of Food indude French's, Frank's Red Hot and Cattlemen's which are a natural strategic fit with our robust global branded flower portfolio. We believe that these additions mowe us to a leading position in the attractive US condiments category and provide significant international growth opportunities for our consumer and industrial segments The RS Food acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of 3% to 5% recommended by one board member This last is often used by very wealthy investeessa check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC Questions: 1. Calculate the cost of equity using the Capital Asset Pricing Model (CAPM). The CrO estimates the Beta as 0 90. Management wants to use the 30 year bond rate as the risk free rate orging that Investors should make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be PM, 10% and 12 by various studies. The Cass that you use an expected return of 9% for the average stock. The market risk Premium (RP) will be 69% minus Calculate the cost of equity (Rs) using the CAPM. The formula is Rs TRF (RPM). As is the required return on equity or the cost of Equity, or is the risk free rate, is the required stock market return in excess of the risk free rate, and B. (Beta) is the stocks relative risk. Bis also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs0/Pol where Is is the recured return on equity or the cost of Equity, D, is the expected future dividend, Po is the price of the stock today and the expected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please use the March 17, 2020 closing price of 5138 70 per share. Calculate the cost of equity (a) using the DCF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the Cro that sophisticated investors use a quick estimate of the cost of equity. She says that the cost Instructions Cost of Capital Capital Budgeting Display Settings On August 17, 2017, we completed the acquisition of Reck cash. The acquisition was funded through our issuance of of senior unsecured notes and pre-payable term loans (see which are a natural strategic fit with our robust global bra significant international growth opportunities for our cons The RB Foods acquisition resulted in acquisitions contributi growth in 2018. As part of your work, you will be asked for a recommendat Model (CAPM), the Discounted Cash Flow approach (DCF) check on the other two methods. Your recommendation f Questions: Instructions Cost of Capital Capital Budgeting --- AutoSum. Fill - AY Insert Delete Format itional Format as Cell etting Table Styles Styles . Z Sort & Filter Clear Cells Editing - J K G H lculation estimating the WACC. L Beta as 0.90. Management wants to use the 30 year bond rate as the ris market as a whole has been estimated to be 7%, 10% and 12% by vario 6. 9% minus 3% = 6%. M ty (Rs) using the DCF approach. quick estimate of the cost of equity. She says that the cost terest rates. McCormick & Company estimates its current s "own debt plus 3% to 5%" formula. Rs) ere are only two components in the capital structure.** value of equity. To determine the book value of debt, use ortion of long term debt, and long term debt. To File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H17 f Nov. 30, 2019 Nov. 30, 2018 $ 155.4 502.9 801.2 90.7 1,550.2 952.6 4,505.2 2,847 507.1 10,362.1 $ 96.6 518.1 786.3 78.9 1,479. 941.5 4,527 2,873. 433 10,256 A Consolidated Balance Sheet - USD ($) $ in Millions 2 Assets 3 Cash and cash equivalents 4 Trade accounts receivable, less allowances of $5.6 for 2019 and $6.4 for 2018 5 Inventories 6 Prepaid expenses and other current assets 7 Total current assets 8 Property, plant and equipment, net 9 Goodwill 10 Intangible assets, net 11 Other long-term assets 12 Total assets 13 Liabilities 14 Short-term borrowings 15 Current portion of long-term debt 6 Trade accounts payable 7 other accrued liabilities 8 Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Total liabilities Shareholders' equity 600.7 97.7 8 846.9 64 609.1 2,154.4 3,625.8 697.6 427.6 6,905.4 2,00 4,05 70 3 7,0 2.055.8 600.7 S60 977 83.5 710 846.9 6091 648.2 2.154.4 3,625.8 697.5 2,001.7 4,052.9 706.5 3131 4276 6,905.4 7,074.2 2,055.8 (500.2) 3,444.2 12.5 1,760.2 (359.9) 3,170.9 11.3 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 1 0 B D 12 Months Ended Consolidated Cash Flow Statement - USD ($) $ in Millions 2 Nov. 30, 2019 Nov. 30, 2018 Nov. 30, 2017 3 Operating activities 4 Net income $702.7 $933.4 $ 477.4 5 Adjustments to reconcile net income to net cash provided by operating activities: 6 Depreciation and amortization 158.8 150.7 125.2 7 Stock-based compensation 37.2 25.6 23.9 8 Noncash nonrecurring income tax benefit (related to enactment of the U.S. Tax Act) (309.4) 0 9 Special charges and transaction and integration expenses 0 3 19.1 Amortization of inventory fair value adjustment associated with acquisition of RB Foods 0 0 20.9 10 11 (Gain) loss on sale of assets (1.6) (5.4) 1.3 12 Deferred income tax expense 20.9 40.1 24.1 13 Income from unconsolidated operations (40.9) (34.8) (33.9) 14 Settlement of forward-starting interest rate swaps 0 0 (2.9) 15 Changes in operating assets and liabilities (net of effect of businesses acquired): 16 Trade accounts receivable 12.2 19.8 (13) 17 Inventories (20.9) (10) 44.6 18 Trade accounts payable 128.2 72.8 98.2 19 Other assets and liabilities (81.5) (91.8) 6.8 20 Dividends received from unconsolidated affiliates 31.7 27.2 23.6 21 Net cash provided by operating activities 946.8 821.2 815.3 22 Investing activities 0 23 Acquisitions of businesses (net of cash acquired) (4.2) (4,327.4) 24 Capital expenditures (including expenditures for capitalized software) (1737) (169.1) (182.4) 25 Other investing activities 14.8 1.5 26 Net cash used in investing activities (171) (158.5) (4,508.31 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statemen 2.7 Ready Financial Report(1) - Excel File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 D 0 (1737) 2.7 (171) (4.2) (169.1) 14.8 (158.5) (4,327.4) (182.4) 1.5 (4,508.3) 41 22 Investing activities 23 Acquisitions of businesses (net of cash acquired) 24 Capital expenditures (including expenditures for capitalized software) 25 Other investing activities 26 Net cash used in investing activities 27 Financing activities 28 Short-term borrowings, net 29 Long-term debt borrowings 30 Payment of debt issuance costs 31 Long-term debt repayments 32 Proceeds from exercised stock options 33 Taxes withheld and paid on employee stock awards 34 Payment of contingent consideration 35 Purchase of minority interest 36 Issuance of common stock non-voting (net of issuance costs of $0.9) 37 common stock acquired by purchase 38 Dividends paid 39 Net cash (used in) provided by financing activities 40 Effect of exchange rate changes on cash and cash equivalents 41 Increase (decrease) in cash and cash equivalents 42 Cash and cash equivalents at beginning of year 43 Cash and cash equivalents at end of year 0 0 (447.7) 90.9 (12.7) 0 0 0 (95.1) (302.2) (725.8) 8.8 58.8 96.6 $ 155.4 305.5 25.9 0 (797.9) 78.2 (11.6) (2.5) (13) 0 (62.3) (273.4) (751.1) (1.8) (90.2) 186.8 $ 96.6 (134.6) 3,989.6 (7.7) (272.7) 29.5 (5.8) (19.7) (1.2) 554 (137.8) (237.6) 3,756 5.4 68.4 118.4 $ 186.8 45 46 47 48 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statenien Read Format Painter BI DA- E Merge & Center - $ . % *828 Clipboard Conditional Form Formatting Tab Styles Font Alignment Number f A D B Answer Questions Below: #1 Risk Free Rate Market Premium Beta Beta x Market Premium Risk Free rate CAPM cost of Equity #2 D Po 101/Po B DCF Cost of Equity #3 Bond Rate Premium Cost of Equity 114 Instructions Cost of Capital Capital Budgeting Calibri General ste EL Copy - Format Painter BIU- D A IND ab Wrap Text Merge & Center - $ % Clipboard Conditional Format Formatting Table Styles Font Alignment Number X fx A B D E G #3 Bond Rate Premium Cost of Equity #4 Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt Market Cap Equity Total Capital Weights Debt Interest rate Tax Rate After tax cost of debt Cost of equity WACC Debt term Equity term Instructions Cost of Capital Capital Budgeting ad Formulas Review View Sign in Help Format Tell me what you want to do Calibri (Body) v11 Xcut Copy Format Painter R General BA- Wrap Test Merge & Center Autos Cell pboard Conditional Formats Formatting Table Insert Delete format Font Clear Alignment Number 1 > Cells f F M B D G The most significant change was the acquisition of Rs Foods. It is the main reason for this study. Here is what our MORA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("8 Foods") from Reckitt Benckiser Group pls. The purchase price was approximately 1.2 billion, net of cred cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting (se note 13 of the financial statements) and through new borrowings comprised of senior unsecured notes and pre payable term loans (see note 6 of the financial statements. The acquired market leading brands of Food indude French's, Frank's Red Hot and Cattlemen's which are a natural strategic fit with our robust global branded flower portfolio. We believe that these additions mowe us to a leading position in the attractive US condiments category and provide significant international growth opportunities for our consumer and industrial segments The RS Food acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of 3% to 5% recommended by one board member This last is often used by very wealthy investeessa check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC Questions: 1. Calculate the cost of equity using the Capital Asset Pricing Model (CAPM). The CrO estimates the Beta as 0 90. Management wants to use the 30 year bond rate as the risk free rate orging that Investors should make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be PM, 10% and 12 by various studies. The Cass that you use an expected return of 9% for the average stock. The market risk Premium (RP) will be 69% minus Calculate the cost of equity (Rs) using the CAPM. The formula is Rs TRF (RPM). As is the required return on equity or the cost of Equity, or is the risk free rate, is the required stock market return in excess of the risk free rate, and B. (Beta) is the stocks relative risk. Bis also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs0/Pol where Is is the recured return on equity or the cost of Equity, D, is the expected future dividend, Po is the price of the stock today and the expected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please use the March 17, 2020 closing price of 5138 70 per share. Calculate the cost of equity (a) using the DCF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the Cro that sophisticated investors use a quick estimate of the cost of equity. She says that the cost Instructions Cost of Capital Capital Budgeting Display Settings

On August 17, 2017, we completed the acquisition of Reck cash. The acquisition was funded through our issuance of of senior unsecured notes and pre-payable term loans (see which are a natural strategic fit with our robust global bra significant international growth opportunities for our cons The RB Foods acquisition resulted in acquisitions contributi growth in 2018. As part of your work, you will be asked for a recommendat Model (CAPM), the Discounted Cash Flow approach (DCF) check on the other two methods. Your recommendation f Questions: Instructions Cost of Capital Capital Budgeting --- AutoSum. Fill - AY Insert Delete Format itional Format as Cell etting Table Styles Styles . Z Sort & Filter Clear Cells Editing - J K G H lculation estimating the WACC. L Beta as 0.90. Management wants to use the 30 year bond rate as the ris market as a whole has been estimated to be 7%, 10% and 12% by vario 6. 9% minus 3% = 6%. M ty (Rs) using the DCF approach. quick estimate of the cost of equity. She says that the cost terest rates. McCormick & Company estimates its current s "own debt plus 3% to 5%" formula. Rs) ere are only two components in the capital structure.** value of equity. To determine the book value of debt, use ortion of long term debt, and long term debt. To File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H17 f Nov. 30, 2019 Nov. 30, 2018 $ 155.4 502.9 801.2 90.7 1,550.2 952.6 4,505.2 2,847 507.1 10,362.1 $ 96.6 518.1 786.3 78.9 1,479. 941.5 4,527 2,873. 433 10,256 A Consolidated Balance Sheet - USD ($) $ in Millions 2 Assets 3 Cash and cash equivalents 4 Trade accounts receivable, less allowances of $5.6 for 2019 and $6.4 for 2018 5 Inventories 6 Prepaid expenses and other current assets 7 Total current assets 8 Property, plant and equipment, net 9 Goodwill 10 Intangible assets, net 11 Other long-term assets 12 Total assets 13 Liabilities 14 Short-term borrowings 15 Current portion of long-term debt 6 Trade accounts payable 7 other accrued liabilities 8 Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Total liabilities Shareholders' equity 600.7 97.7 8 846.9 64 609.1 2,154.4 3,625.8 697.6 427.6 6,905.4 2,00 4,05 70 3 7,0 2.055.8 600.7 S60 977 83.5 710 846.9 6091 648.2 2.154.4 3,625.8 697.5 2,001.7 4,052.9 706.5 3131 4276 6,905.4 7,074.2 2,055.8 (500.2) 3,444.2 12.5 1,760.2 (359.9) 3,170.9 11.3 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 1 0 B D 12 Months Ended Consolidated Cash Flow Statement - USD ($) $ in Millions 2 Nov. 30, 2019 Nov. 30, 2018 Nov. 30, 2017 3 Operating activities 4 Net income $702.7 $933.4 $ 477.4 5 Adjustments to reconcile net income to net cash provided by operating activities: 6 Depreciation and amortization 158.8 150.7 125.2 7 Stock-based compensation 37.2 25.6 23.9 8 Noncash nonrecurring income tax benefit (related to enactment of the U.S. Tax Act) (309.4) 0 9 Special charges and transaction and integration expenses 0 3 19.1 Amortization of inventory fair value adjustment associated with acquisition of RB Foods 0 0 20.9 10 11 (Gain) loss on sale of assets (1.6) (5.4) 1.3 12 Deferred income tax expense 20.9 40.1 24.1 13 Income from unconsolidated operations (40.9) (34.8) (33.9) 14 Settlement of forward-starting interest rate swaps 0 0 (2.9) 15 Changes in operating assets and liabilities (net of effect of businesses acquired): 16 Trade accounts receivable 12.2 19.8 (13) 17 Inventories (20.9) (10) 44.6 18 Trade accounts payable 128.2 72.8 98.2 19 Other assets and liabilities (81.5) (91.8) 6.8 20 Dividends received from unconsolidated affiliates 31.7 27.2 23.6 21 Net cash provided by operating activities 946.8 821.2 815.3 22 Investing activities 0 23 Acquisitions of businesses (net of cash acquired) (4.2) (4,327.4) 24 Capital expenditures (including expenditures for capitalized software) (1737) (169.1) (182.4) 25 Other investing activities 14.8 1.5 26 Net cash used in investing activities (171) (158.5) (4,508.31 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statemen 2.7 Ready Financial Report(1) - Excel File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 D 0 (1737) 2.7 (171) (4.2) (169.1) 14.8 (158.5) (4,327.4) (182.4) 1.5 (4,508.3) 41 22 Investing activities 23 Acquisitions of businesses (net of cash acquired) 24 Capital expenditures (including expenditures for capitalized software) 25 Other investing activities 26 Net cash used in investing activities 27 Financing activities 28 Short-term borrowings, net 29 Long-term debt borrowings 30 Payment of debt issuance costs 31 Long-term debt repayments 32 Proceeds from exercised stock options 33 Taxes withheld and paid on employee stock awards 34 Payment of contingent consideration 35 Purchase of minority interest 36 Issuance of common stock non-voting (net of issuance costs of $0.9) 37 common stock acquired by purchase 38 Dividends paid 39 Net cash (used in) provided by financing activities 40 Effect of exchange rate changes on cash and cash equivalents 41 Increase (decrease) in cash and cash equivalents 42 Cash and cash equivalents at beginning of year 43 Cash and cash equivalents at end of year 0 0 (447.7) 90.9 (12.7) 0 0 0 (95.1) (302.2) (725.8) 8.8 58.8 96.6 $ 155.4 305.5 25.9 0 (797.9) 78.2 (11.6) (2.5) (13) 0 (62.3) (273.4) (751.1) (1.8) (90.2) 186.8 $ 96.6 (134.6) 3,989.6 (7.7) (272.7) 29.5 (5.8) (19.7) (1.2) 554 (137.8) (237.6) 3,756 5.4 68.4 118.4 $ 186.8 45 46 47 48 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statenien Read Format Painter BI DA- E Merge & Center - $ . % *828 Clipboard Conditional Form Formatting Tab Styles Font Alignment Number f A D B Answer Questions Below: #1 Risk Free Rate Market Premium Beta Beta x Market Premium Risk Free rate CAPM cost of Equity #2 D Po 101/Po B DCF Cost of Equity #3 Bond Rate Premium Cost of Equity 114 Instructions Cost of Capital Capital Budgeting Calibri General ste EL Copy - Format Painter BIU- D A IND ab Wrap Text Merge & Center - $ % Clipboard Conditional Format Formatting Table Styles Font Alignment Number X fx A B D E G #3 Bond Rate Premium Cost of Equity #4 Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt Market Cap Equity Total Capital Weights Debt Interest rate Tax Rate After tax cost of debt Cost of equity WACC Debt term Equity term Instructions Cost of Capital Capital Budgeting ad Formulas Review View Sign in Help Format Tell me what you want to do Calibri (Body) v11 Xcut Copy Format Painter R General BA- Wrap Test Merge & Center Autos Cell pboard Conditional Formats Formatting Table Insert Delete format Font Clear Alignment Number 1 > Cells f F M B D G The most significant change was the acquisition of Rs Foods. It is the main reason for this study. Here is what our MORA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("8 Foods") from Reckitt Benckiser Group pls. The purchase price was approximately 1.2 billion, net of cred cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting (se note 13 of the financial statements) and through new borrowings comprised of senior unsecured notes and pre payable term loans (see note 6 of the financial statements. The acquired market leading brands of Food indude French's, Frank's Red Hot and Cattlemen's which are a natural strategic fit with our robust global branded flower portfolio. We believe that these additions mowe us to a leading position in the attractive US condiments category and provide significant international growth opportunities for our consumer and industrial segments The RS Food acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of 3% to 5% recommended by one board member This last is often used by very wealthy investeessa check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC Questions: 1. Calculate the cost of equity using the Capital Asset Pricing Model (CAPM). The CrO estimates the Beta as 0 90. Management wants to use the 30 year bond rate as the risk free rate orging that Investors should make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be PM, 10% and 12 by various studies. The Cass that you use an expected return of 9% for the average stock. The market risk Premium (RP) will be 69% minus Calculate the cost of equity (Rs) using the CAPM. The formula is Rs TRF (RPM). As is the required return on equity or the cost of Equity, or is the risk free rate, is the required stock market return in excess of the risk free rate, and B. (Beta) is the stocks relative risk. Bis also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs0/Pol where Is is the recured return on equity or the cost of Equity, D, is the expected future dividend, Po is the price of the stock today and the expected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please use the March 17, 2020 closing price of 5138 70 per share. Calculate the cost of equity (a) using the DCF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the Cro that sophisticated investors use a quick estimate of the cost of equity. She says that the cost Instructions Cost of Capital Capital Budgeting Display Settings On August 17, 2017, we completed the acquisition of Reck cash. The acquisition was funded through our issuance of of senior unsecured notes and pre-payable term loans (see which are a natural strategic fit with our robust global bra significant international growth opportunities for our cons The RB Foods acquisition resulted in acquisitions contributi growth in 2018. As part of your work, you will be asked for a recommendat Model (CAPM), the Discounted Cash Flow approach (DCF) check on the other two methods. Your recommendation f Questions: Instructions Cost of Capital Capital Budgeting --- AutoSum. Fill - AY Insert Delete Format itional Format as Cell etting Table Styles Styles . Z Sort & Filter Clear Cells Editing - J K G H lculation estimating the WACC. L Beta as 0.90. Management wants to use the 30 year bond rate as the ris market as a whole has been estimated to be 7%, 10% and 12% by vario 6. 9% minus 3% = 6%. M ty (Rs) using the DCF approach. quick estimate of the cost of equity. She says that the cost terest rates. McCormick & Company estimates its current s "own debt plus 3% to 5%" formula. Rs) ere are only two components in the capital structure.** value of equity. To determine the book value of debt, use ortion of long term debt, and long term debt. To File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H17 f Nov. 30, 2019 Nov. 30, 2018 $ 155.4 502.9 801.2 90.7 1,550.2 952.6 4,505.2 2,847 507.1 10,362.1 $ 96.6 518.1 786.3 78.9 1,479. 941.5 4,527 2,873. 433 10,256 A Consolidated Balance Sheet - USD ($) $ in Millions 2 Assets 3 Cash and cash equivalents 4 Trade accounts receivable, less allowances of $5.6 for 2019 and $6.4 for 2018 5 Inventories 6 Prepaid expenses and other current assets 7 Total current assets 8 Property, plant and equipment, net 9 Goodwill 10 Intangible assets, net 11 Other long-term assets 12 Total assets 13 Liabilities 14 Short-term borrowings 15 Current portion of long-term debt 6 Trade accounts payable 7 other accrued liabilities 8 Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Total liabilities Shareholders' equity 600.7 97.7 8 846.9 64 609.1 2,154.4 3,625.8 697.6 427.6 6,905.4 2,00 4,05 70 3 7,0 2.055.8 600.7 S60 977 83.5 710 846.9 6091 648.2 2.154.4 3,625.8 697.5 2,001.7 4,052.9 706.5 3131 4276 6,905.4 7,074.2 2,055.8 (500.2) 3,444.2 12.5 1,760.2 (359.9) 3,170.9 11.3 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 1 0 B D 12 Months Ended Consolidated Cash Flow Statement - USD ($) $ in Millions 2 Nov. 30, 2019 Nov. 30, 2018 Nov. 30, 2017 3 Operating activities 4 Net income $702.7 $933.4 $ 477.4 5 Adjustments to reconcile net income to net cash provided by operating activities: 6 Depreciation and amortization 158.8 150.7 125.2 7 Stock-based compensation 37.2 25.6 23.9 8 Noncash nonrecurring income tax benefit (related to enactment of the U.S. Tax Act) (309.4) 0 9 Special charges and transaction and integration expenses 0 3 19.1 Amortization of inventory fair value adjustment associated with acquisition of RB Foods 0 0 20.9 10 11 (Gain) loss on sale of assets (1.6) (5.4) 1.3 12 Deferred income tax expense 20.9 40.1 24.1 13 Income from unconsolidated operations (40.9) (34.8) (33.9) 14 Settlement of forward-starting interest rate swaps 0 0 (2.9) 15 Changes in operating assets and liabilities (net of effect of businesses acquired): 16 Trade accounts receivable 12.2 19.8 (13) 17 Inventories (20.9) (10) 44.6 18 Trade accounts payable 128.2 72.8 98.2 19 Other assets and liabilities (81.5) (91.8) 6.8 20 Dividends received from unconsolidated affiliates 31.7 27.2 23.6 21 Net cash provided by operating activities 946.8 821.2 815.3 22 Investing activities 0 23 Acquisitions of businesses (net of cash acquired) (4.2) (4,327.4) 24 Capital expenditures (including expenditures for capitalized software) (1737) (169.1) (182.4) 25 Other investing activities 14.8 1.5 26 Net cash used in investing activities (171) (158.5) (4,508.31 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statemen 2.7 Ready Financial Report(1) - Excel File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do H48 D 0 (1737) 2.7 (171) (4.2) (169.1) 14.8 (158.5) (4,327.4) (182.4) 1.5 (4,508.3) 41 22 Investing activities 23 Acquisitions of businesses (net of cash acquired) 24 Capital expenditures (including expenditures for capitalized software) 25 Other investing activities 26 Net cash used in investing activities 27 Financing activities 28 Short-term borrowings, net 29 Long-term debt borrowings 30 Payment of debt issuance costs 31 Long-term debt repayments 32 Proceeds from exercised stock options 33 Taxes withheld and paid on employee stock awards 34 Payment of contingent consideration 35 Purchase of minority interest 36 Issuance of common stock non-voting (net of issuance costs of $0.9) 37 common stock acquired by purchase 38 Dividends paid 39 Net cash (used in) provided by financing activities 40 Effect of exchange rate changes on cash and cash equivalents 41 Increase (decrease) in cash and cash equivalents 42 Cash and cash equivalents at beginning of year 43 Cash and cash equivalents at end of year 0 0 (447.7) 90.9 (12.7) 0 0 0 (95.1) (302.2) (725.8) 8.8 58.8 96.6 $ 155.4 305.5 25.9 0 (797.9) 78.2 (11.6) (2.5) (13) 0 (62.3) (273.4) (751.1) (1.8) (90.2) 186.8 $ 96.6 (134.6) 3,989.6 (7.7) (272.7) 29.5 (5.8) (19.7) (1.2) 554 (137.8) (237.6) 3,756 5.4 68.4 118.4 $ 186.8 45 46 47 48 Consolidated Balance Sheet Consolidated Balance Sheet (Par Consolidated Cash Flow Statenien Read Format Painter BI DA- E Merge & Center - $ . % *828 Clipboard Conditional Form Formatting Tab Styles Font Alignment Number f A D B Answer Questions Below: #1 Risk Free Rate Market Premium Beta Beta x Market Premium Risk Free rate CAPM cost of Equity #2 D Po 101/Po B DCF Cost of Equity #3 Bond Rate Premium Cost of Equity 114 Instructions Cost of Capital Capital Budgeting Calibri General ste EL Copy - Format Painter BIU- D A IND ab Wrap Text Merge & Center - $ % Clipboard Conditional Format Formatting Table Styles Font Alignment Number X fx A B D E G #3 Bond Rate Premium Cost of Equity #4 Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt Market Cap Equity Total Capital Weights Debt Interest rate Tax Rate After tax cost of debt Cost of equity WACC Debt term Equity term Instructions Cost of Capital Capital Budgeting ad Formulas Review View Sign in Help Format Tell me what you want to do Calibri (Body) v11 Xcut Copy Format Painter R General BA- Wrap Test Merge & Center Autos Cell pboard Conditional Formats Formatting Table Insert Delete format Font Clear Alignment Number 1 > Cells f F M B D G The most significant change was the acquisition of Rs Foods. It is the main reason for this study. Here is what our MORA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("8 Foods") from Reckitt Benckiser Group pls. The purchase price was approximately 1.2 billion, net of cred cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting (se note 13 of the financial statements) and through new borrowings comprised of senior unsecured notes and pre payable term loans (see note 6 of the financial statements. The acquired market leading brands of Food indude French's, Frank's Red Hot and Cattlemen's which are a natural strategic fit with our robust global branded flower portfolio. We believe that these additions mowe us to a leading position in the attractive US condiments category and provide significant international growth opportunities for our consumer and industrial segments The RS Food acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of 3% to 5% recommended by one board member This last is often used by very wealthy investeessa check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC Questions: 1. Calculate the cost of equity using the Capital Asset Pricing Model (CAPM). The CrO estimates the Beta as 0 90. Management wants to use the 30 year bond rate as the risk free rate orging that Investors should make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be PM, 10% and 12 by various studies. The Cass that you use an expected return of 9% for the average stock. The market risk Premium (RP) will be 69% minus Calculate the cost of equity (Rs) using the CAPM. The formula is Rs TRF (RPM). As is the required return on equity or the cost of Equity, or is the risk free rate, is the required stock market return in excess of the risk free rate, and B. (Beta) is the stocks relative risk. Bis also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs0/Pol where Is is the recured return on equity or the cost of Equity, D, is the expected future dividend, Po is the price of the stock today and the expected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please use the March 17, 2020 closing price of 5138 70 per share. Calculate the cost of equity (a) using the DCF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the Cro that sophisticated investors use a quick estimate of the cost of equity. She says that the cost Instructions Cost of Capital Capital Budgeting Display Settings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started