Answered step by step

Verified Expert Solution

Question

1 Approved Answer

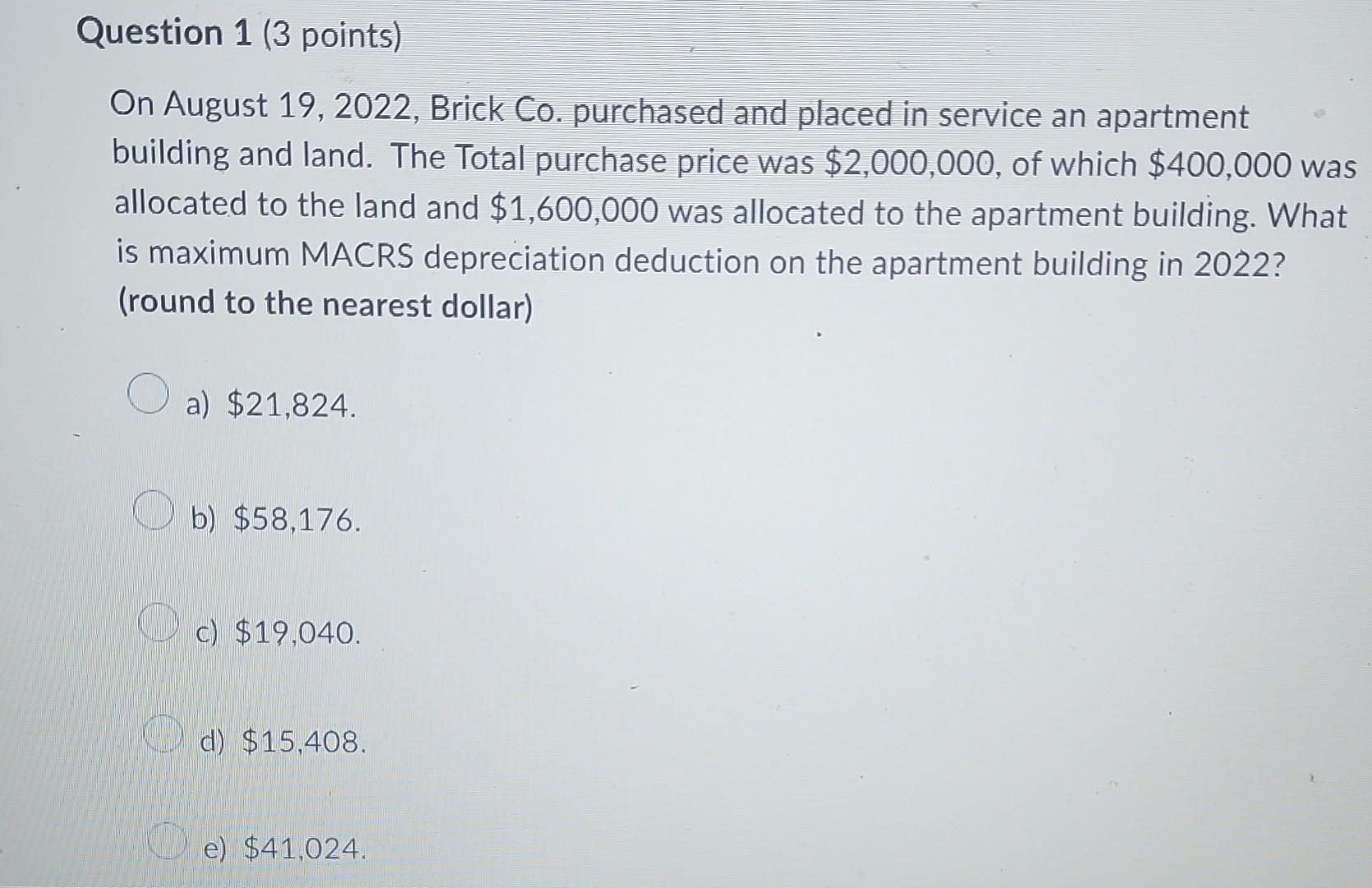

On August 19, 2022, Brick Co. purchased and placed in service an apartment building and land. The Total purchase price was $2,000,000, of which $400,000

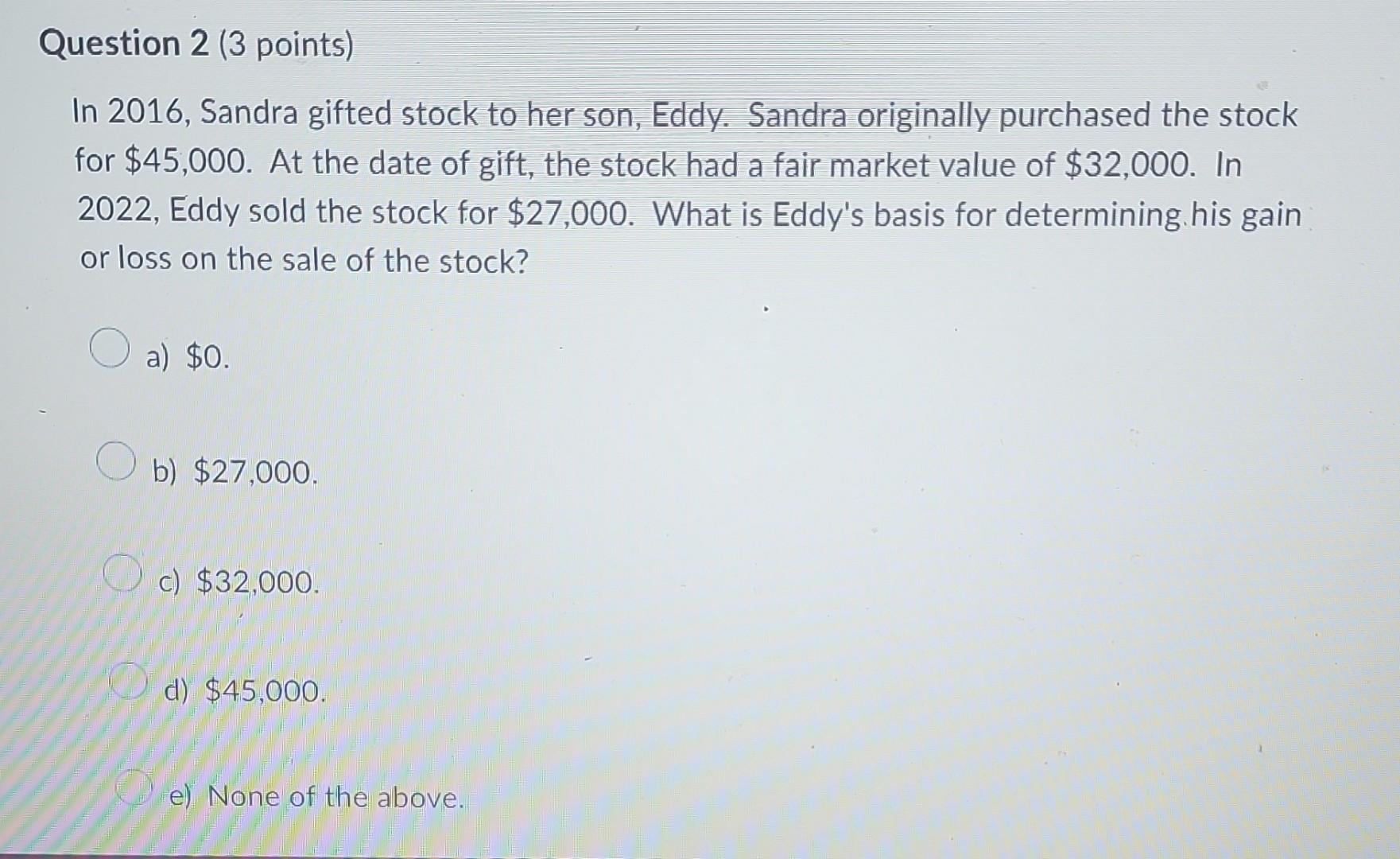

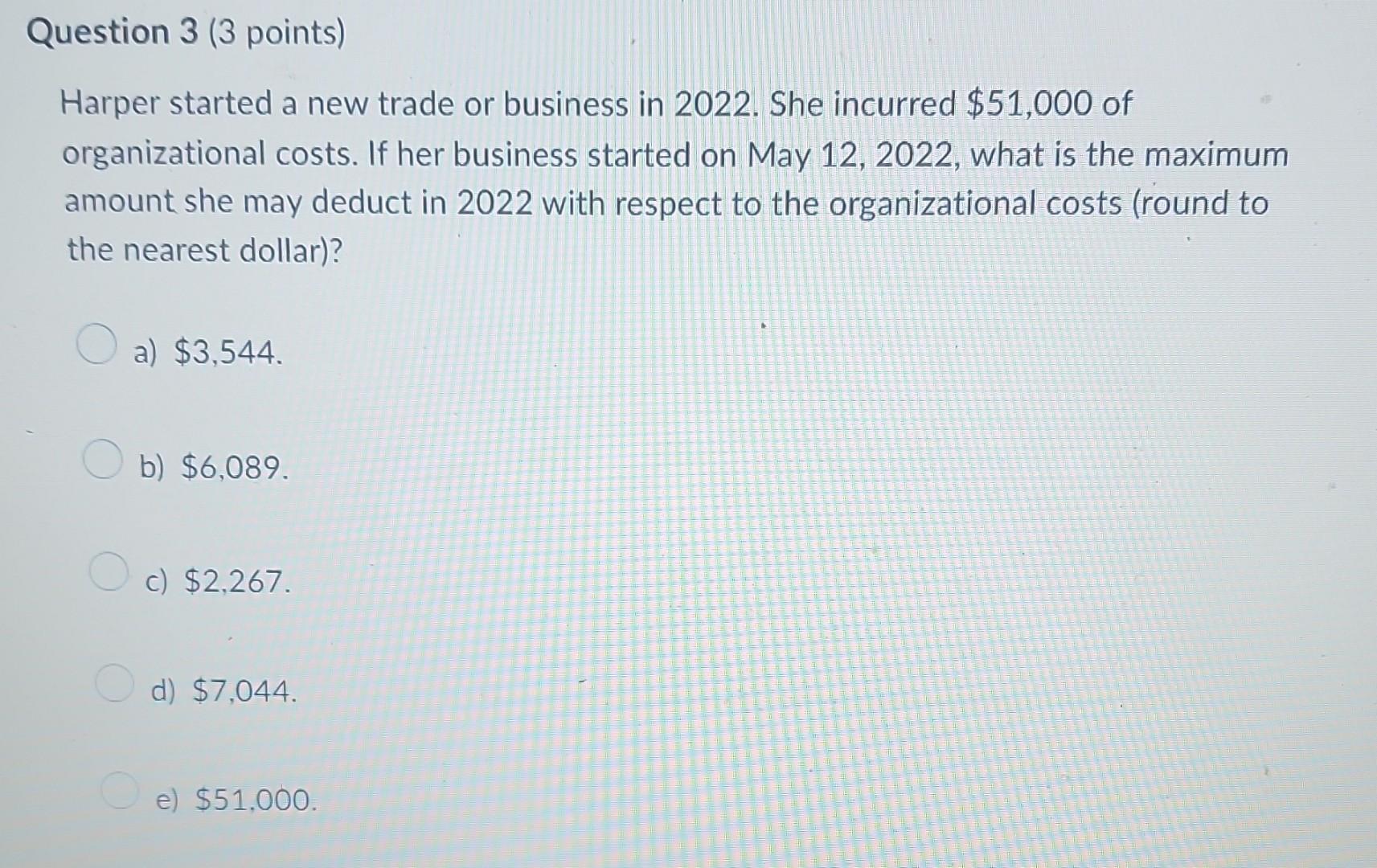

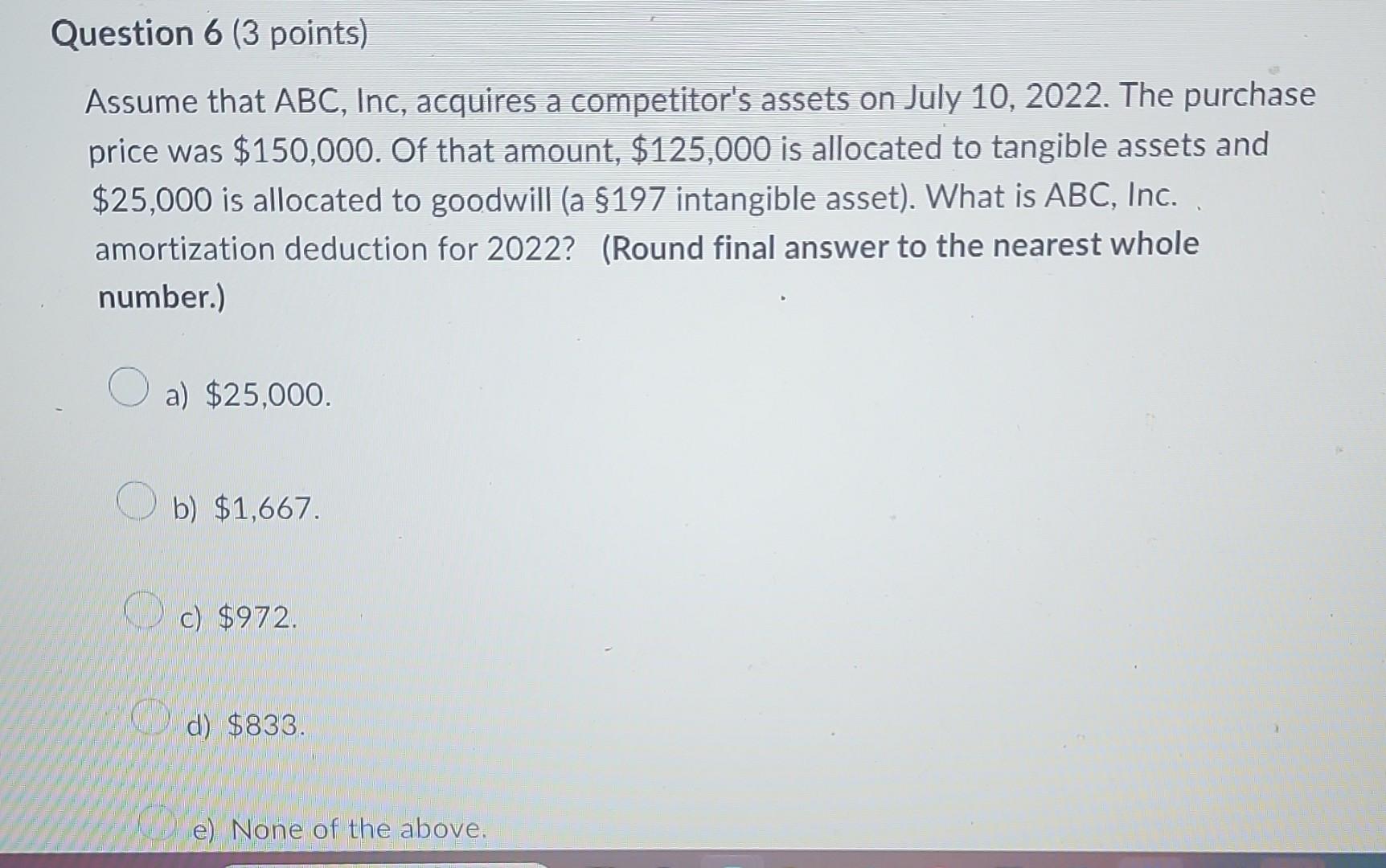

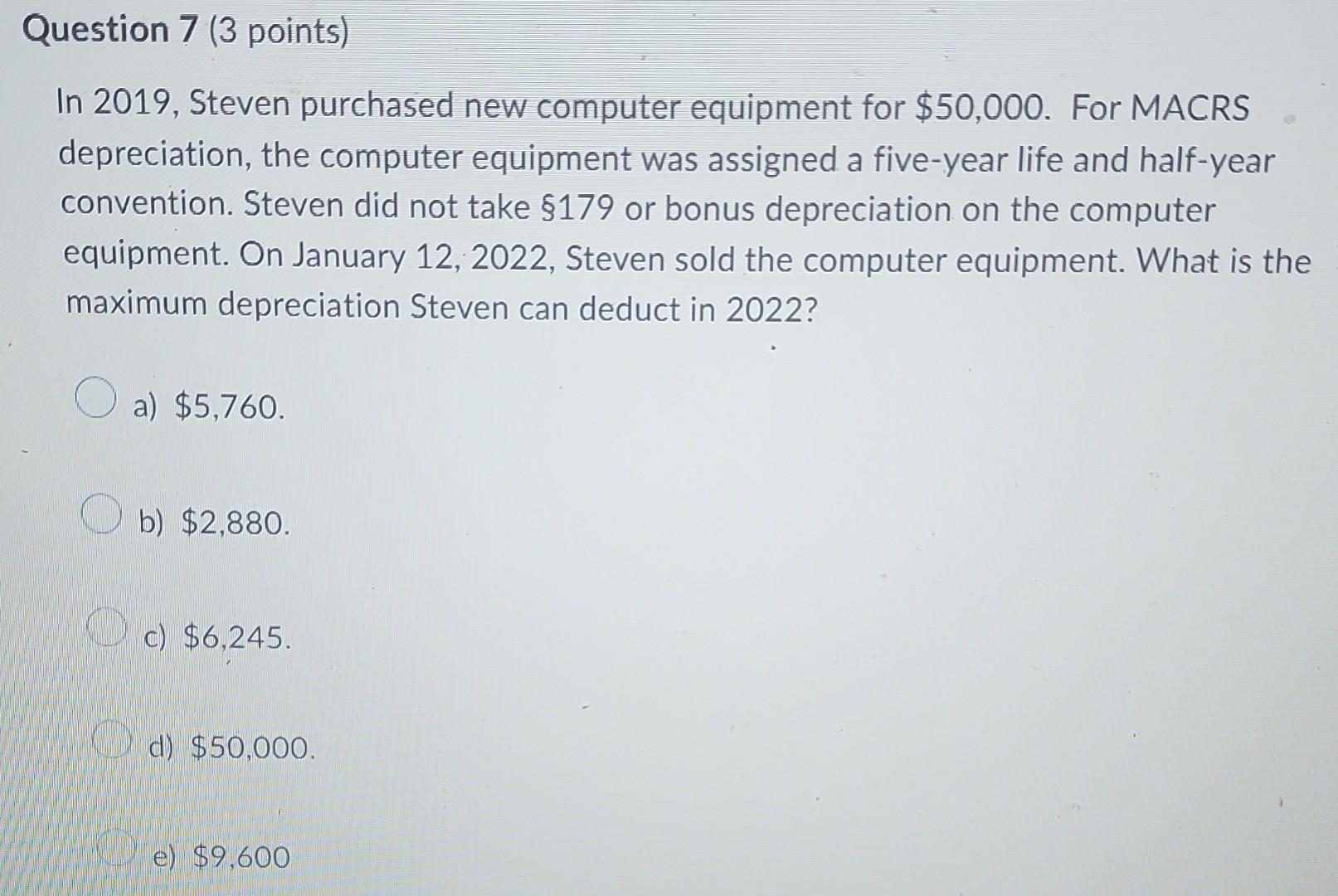

On August 19, 2022, Brick Co. purchased and placed in service an apartment building and land. The Total purchase price was $2,000,000, of which $400,000 was allocated to the land and $1,600,000 was allocated to the apartment building. What is maximum MACRS depreciation deduction on the apartment building in 2022? (round to the nearest dollar) a) $21,824. b) $58,176 c) $19,040 d) $15,408. e) $41,024 In 2016, Sandra gifted stock to her son, Eddy. Sandra originally purchased the stock for $45,000. At the date of gift, the stock had a fair market value of $32,000. In 2022 , Eddy sold the stock for $27,000. What is Eddy's basis for determining. his gain or loss on the sale of the stock? a) $0. b) $27,000. c) $32,000. d) $45,000. e) None of the above. Harper started a new trade or business in 2022. She incurred $51,000 of organizational costs. If her business started on May 12,2022 , what is the maximum amount she may deduct in 2022 with respect to the organizational costs (round to the nearest dollar)? a) $3,544. b) $6,089. c) $2,267. d) $7,044. e) $51,000. Assume that ABC, Inc, acquires a competitor's assets on July 10, 2022. The purchase price was $150,000. Of that amount, $125,000 is allocated to tangible assets and $25,000 is allocated to goodwill (a $197 intangible asset). What is ABC, Inc. amortization deduction for 2022? (Round final answer to the nearest whole number.) a) $25,000. b) $1,667. c) $972. d) $833. e) None of the above. In 2019 , Steven purchased new computer equipment for $50,000. For MACRS depreciation, the computer equipment was assigned a five-year life and half-year convention. Steven did not take 179 or bonus depreciation on the computer equipment. On January 12, 2022, Steven sold the computer equipment. What is the maximum depreciation Steven can deduct in 2022? a) $5,760. b) $2,880. c) $6,245. d) $50,000. e) $9,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started