Question

On August 3, Cinco Construction purchased special-purpose equipment at a cost of $2,664,800. The useful life of the equipment was estimated to be eight years,

On August 3, Cinco Construction purchased special-purpose equipment at a cost of $2,664,800. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $60,940.

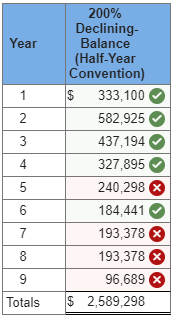

b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.

Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.(Adjust year 9 depreciation, if necessary, so that the total depreciation expense equals depreciable value of the asset. Do not round intermediate calculations and round your final answers to the nearest whole number.)

******Please Help with the ones in RED, Thank You************

200% Declining Balance (Half-Year Year Convention) $ 333,100 582,925 437,194 327,895 240,298 184,441 193,378 193,378 96,689 Totals $ 2,589,298Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started