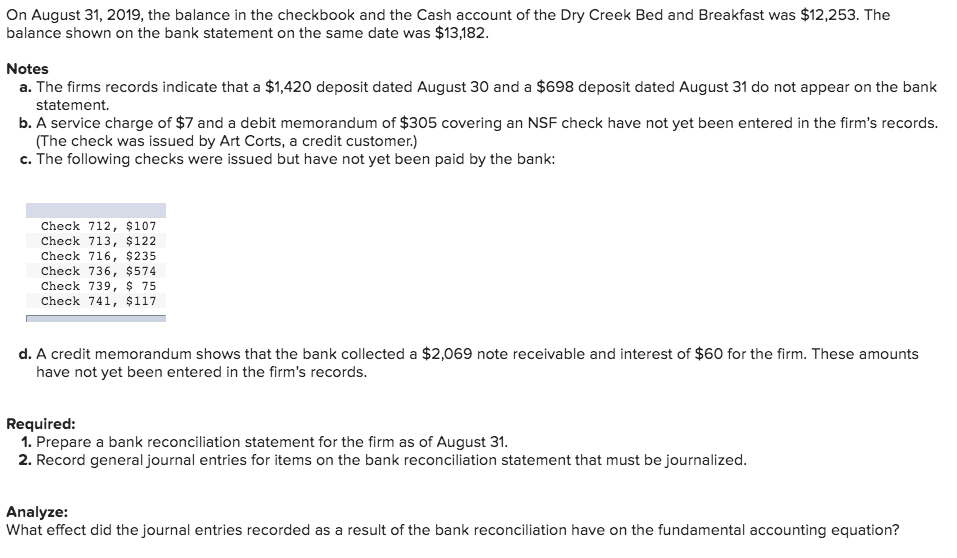

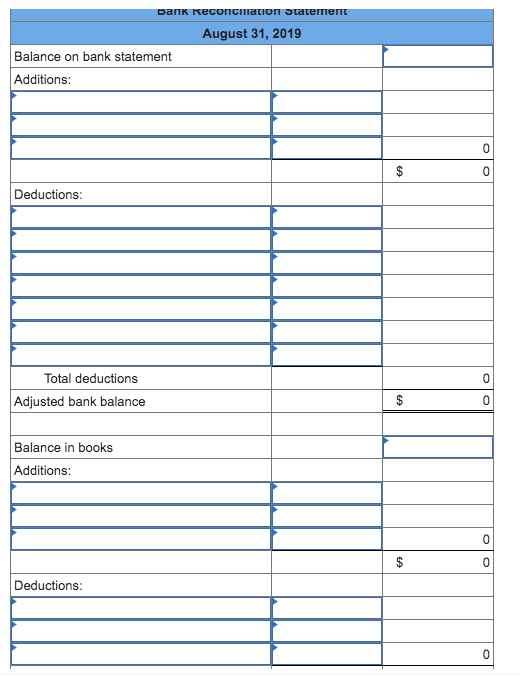

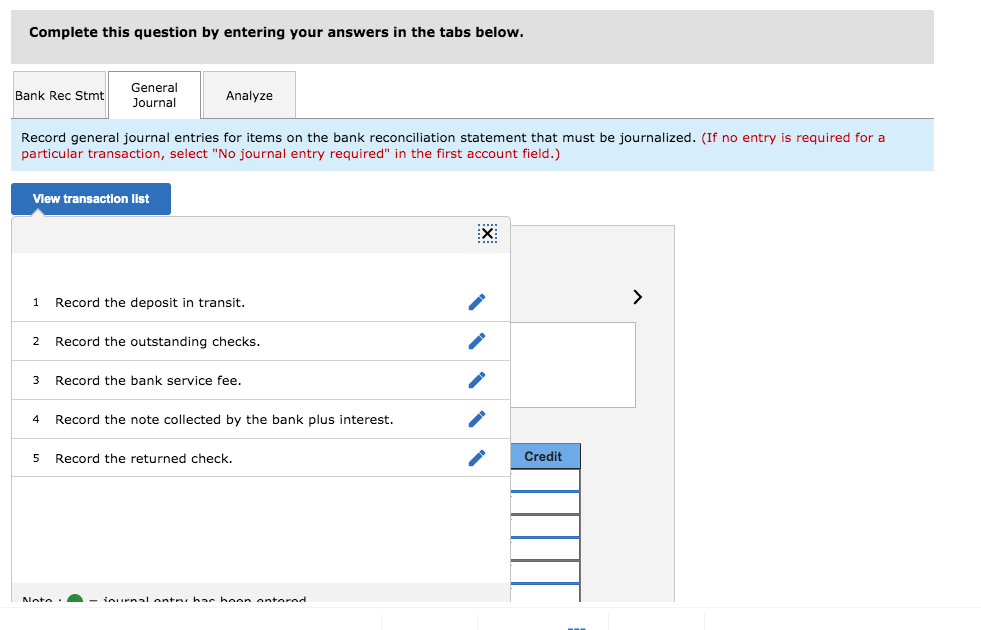

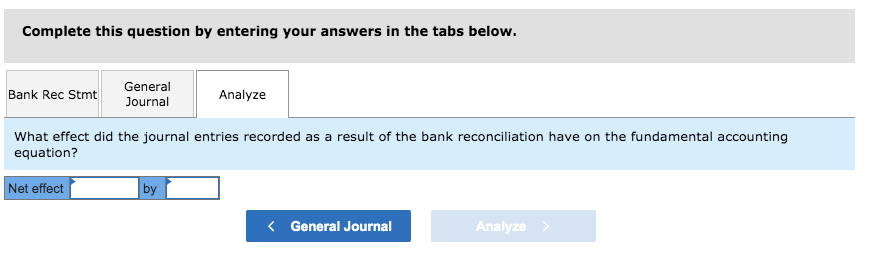

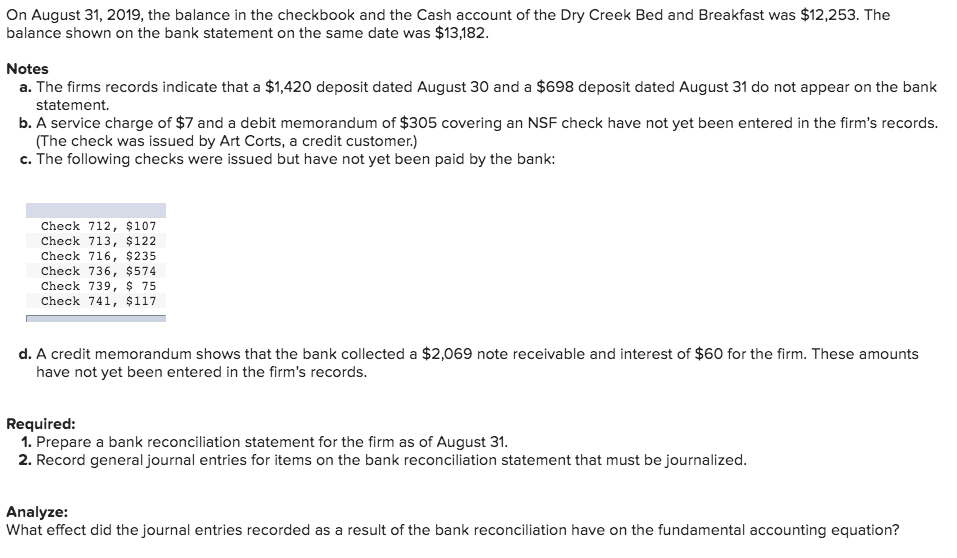

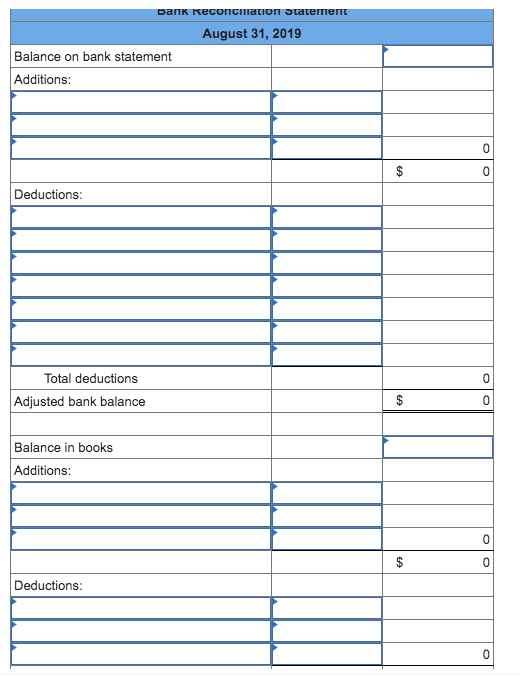

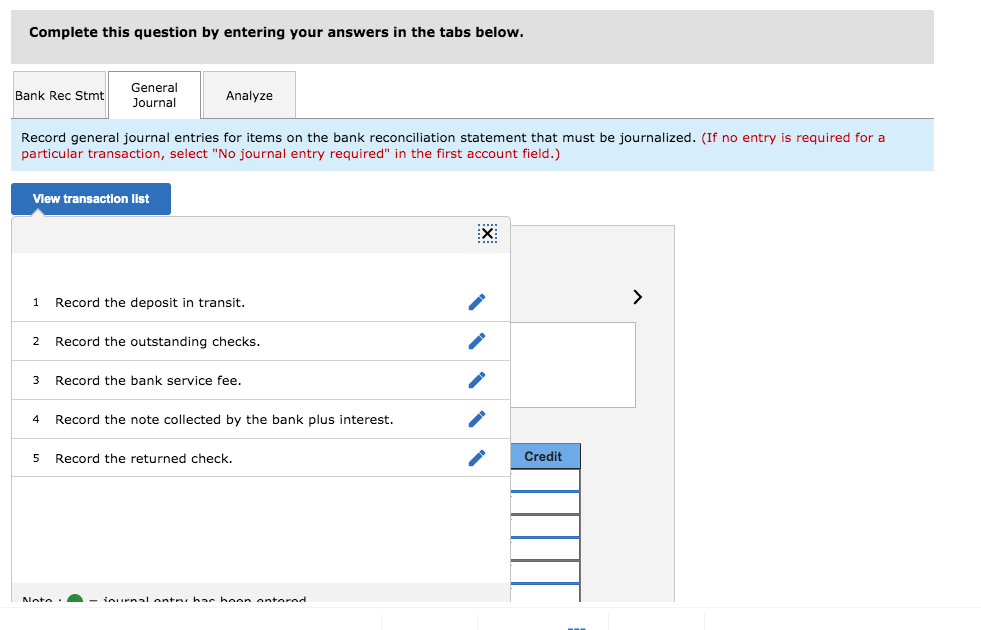

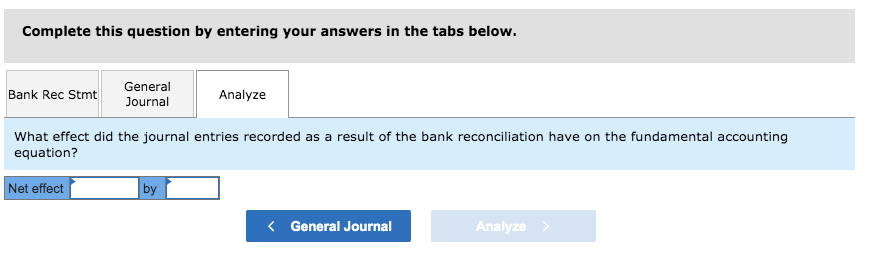

On August 31, 2019, the balance in the checkbook and the Cash account of the Dry Creek Bed and Breakfast was $12,253. The balance shown on the bank statement on the same date was $13,182. Notes a. The firms records indicate that a $1,420 deposit dated August 30 and a $698 deposit dated August 31 do not appear on the bank statement. b. A service charge of $7 and a debit memorandum of $305 covering an NSF check have not yet been entered in the firm's records. (The check was issued by Art Corts, a credit customer.) c. The following checks were issued but have not yet been paid by the bank: Check 712, $107 Check 713, $122 Check 716, $235 Check 736, $ 574 Check 739, $ 75 Check 741, $117 d. A credit memorandum shows that the bank collected a $2,069 note receivable and interest of $60 for the firm. These amounts have not yet been entered in the firm's records. Required: 1. Prepare a bank reconciliation statement for the firm as of August 31. 2. Record general journal entries for items on the bank reconciliation statement that must be journalized. Analyze: What effect did the journal entries recorded as a result of the bank reconciliation have on the fundamental accounting equation? bank reconciliation Statement August 31, 2019 Balance on bank statement Additions: 0 $ 0 Deductions: Total deductions Adjusted bank balance $ 0 Balance in books Additions: 0 $ 0 Deductions: 0 Complete this question by entering your answers in the tabs below. Bank Rec Stmt General Journal Analyze Record general journal entries for items on the bank reconciliation statement that must be journalized. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list :X: > 1 Record the deposit in transit. 2 Record the outstanding checks. 3 Record the bank service fee. 4 Record the note collected by the bank plus interest. 5 Record the returned check. Credit Mata. - inurnal antharhaan antarar Complete this question by entering your answers in the tabs below. Bank Rec Stmt General Journal Analyze What effect did the journal entries recorded as a result of the bank reconciliation have on the fundamental accounting equation? Net effect by