Question

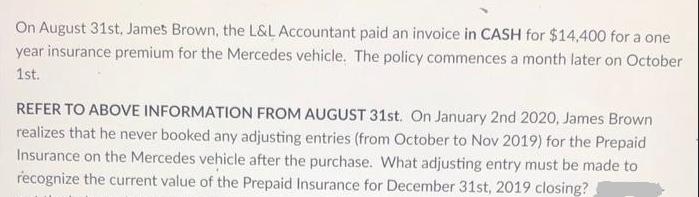

On August 31st, James Brown, the L&L Accountant paid an invoice in CASH for $14,400 for a one year insurance premium for the Mercedes

On August 31st, James Brown, the L&L Accountant paid an invoice in CASH for $14,400 for a one year insurance premium for the Mercedes vehicle. The policy commences a month later on October 1st. REFER TO ABOVE INFORMATION FROM AUGUST 31st. On January 2nd 2020, James Brown realizes that he never booked any adjusting entries (from October to Nov 2019) for the Prepaid Insurance on the Mercedes vehicle after the purchase. What adjusting entry must be made to recognize the current value of the Prepaid Insurance for December 31st, 2019 closing?

Step by Step Solution

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To recognize the current value of the Prepaid Insurance for December 31st 2019 an adjusting entry mu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Contemporary Approach

Authors: David Haddock, John Price, Michael Farina

3rd edition

77639731, 978-0077639730

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App