Question

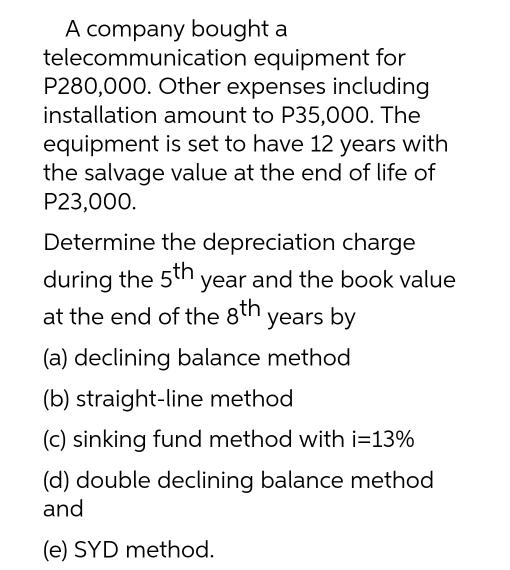

A company bought a telecommunication equipment for P280,000. Other expenses including installation amount to P35,000. The equipment is set to have 12 years with

A company bought a telecommunication equipment for P280,000. Other expenses including installation amount to P35,000. The equipment is set to have 12 years with the salvage value at the end of life of P23,000. Determine the depreciation charge during the 5th year and the book value at the end of the 8th years by (a) declining balance method (b) straight-line method (c) sinking fund method with i=13% (d) double declining balance method and (e) SYD method.

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation charge for each method we need to substitute the given values into the respective formulas Lets calculate the depreciati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

10th edition

1260481956, 1260310175, 978-1260481952

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App