Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 7, Gideon Ridge Restaurant purchased a building in exchange for a note with a face amount of $1,660,000. The cost of the land

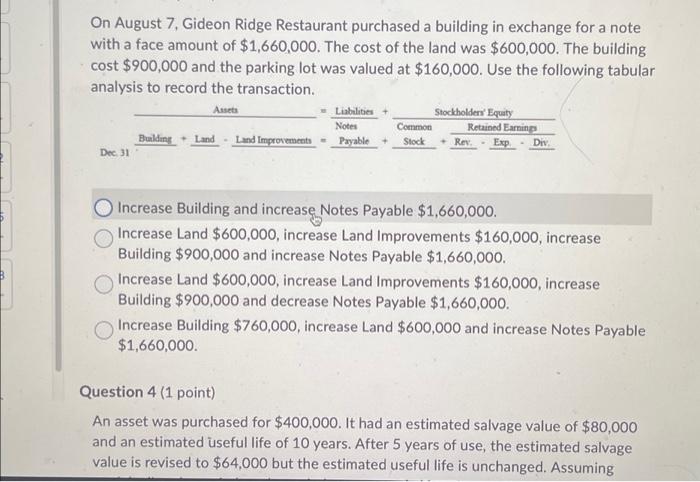

On August 7, Gideon Ridge Restaurant purchased a building in exchange for a note with a face amount of $1,660,000. The cost of the land was $600,000. The building cost $900,000 and the parking lot was valued at $160,000. Use the following tabular analysis to record the transaction. Assets Dec. 31 Building+ Land Land Improvements = Liabilities + Notes Payable Stockholders' Equity Retained Earnings Exp. Common Stock + Rev. - - Div. Increase Building and increase Notes Payable $1,660,000. Increase Land $600,000, increase Land Improvements $160,000, increase Building $900,000 and increase Notes Payable $1,660,000. Increase Land $600,000, increase Land Improvements $160,000, increase Building $900,000 and decrease Notes Payable $1,660,000. Increase Building $760,000, increase Land $600,000 and increase Notes Payable $1,660,000. Question 4 (1 point) An asset was purchased for $400,000. It had an estimated salvage value of $80,000 and an estimated useful life of 10 years. After 5 years of use, the estimated salvage value is revised to $64,000 but the estimated useful life is unchanged. Assuming

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started