Answered step by step

Verified Expert Solution

Question

1 Approved Answer

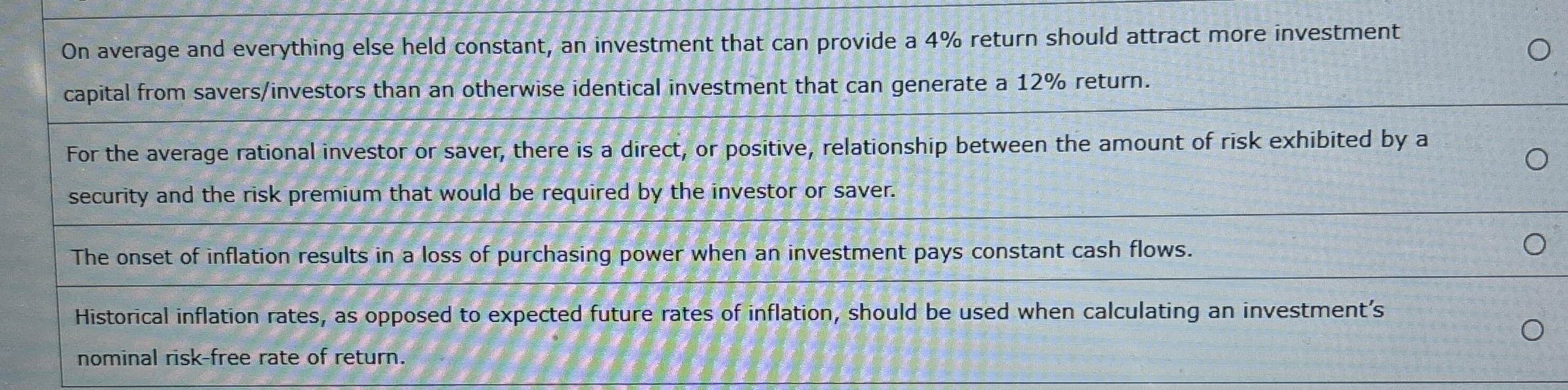

On average and everything else held constant, an investment that can provide a 4 % return should attract more investment capital from savers / investors

On average and everything else held constant, an investment that can provide a return should attract more investment

capital from saversinvestors than an otherwise identical investment that can generate a return.

For the average rational investor or saver, there is a direct, or positive, relationship between the amount of risk exhibited by a

security and the risk premium that would be required by the investor or saver.

The onset of inflation results in a loss of purchasing power when an investment pays constant cash flows.

Historical inflation rates, as opposed to expected future rates of inflation, should be used when calculating an investment's

nominal riskfree rate of return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started