Answered step by step

Verified Expert Solution

Question

1 Approved Answer

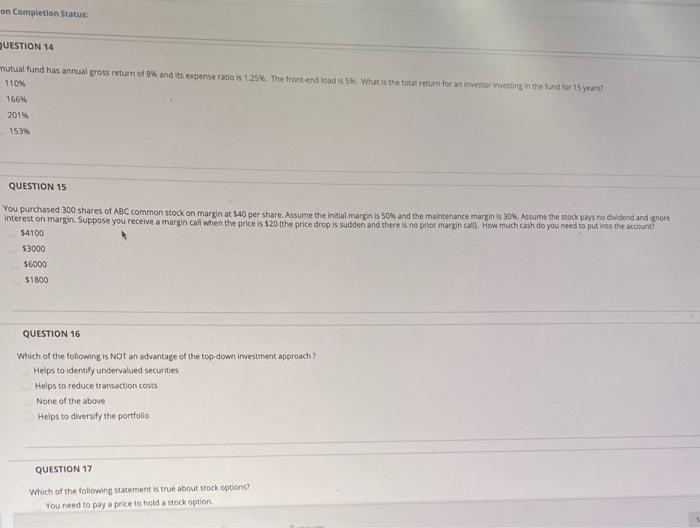

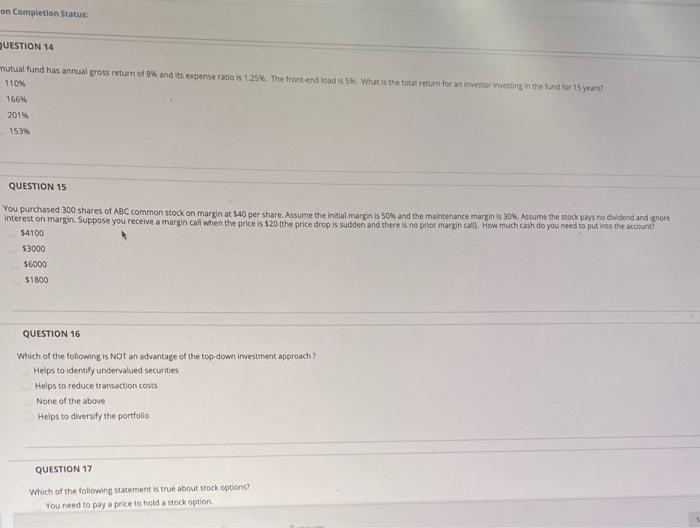

on Completion Status: QUESTION 14 mutual fund has annual gross return of 8% and its expense ratio is 125 The front end load is What

on Completion Status: QUESTION 14 mutual fund has annual gross return of 8% and its expense ratio is 125 The front end load is What is the total return for an investor investing in the fund for 15 years 110% 166% 2014 153% QUESTION 15 You purchased 300 shares of ABC common stock on margin at $40 per share. Assume the initial margin is som and the maintenance margin is 30%. Assume the stock pays no dividend and wore interest on margin. Suppose you receive a margin call when the price is $20 (the price drop is sudden and there is no prior margin cal). How much cash do you need to put into the account 54100 53000 56000 $1800 QUESTION 16 Which of the following is NOT an advantage of the top-down investment approach? Helps to identify undervalued securities Helps to reduce transaction costs None of the above Helps to diversify the portfolio QUESTION 17 Which of the following statement is true about stock options? You need to pay a price to hold a stock option

on Completion Status: QUESTION 14 mutual fund has annual gross return of 8% and its expense ratio is 125 The front end load is What is the total return for an investor investing in the fund for 15 years 110% 166% 2014 153% QUESTION 15 You purchased 300 shares of ABC common stock on margin at $40 per share. Assume the initial margin is som and the maintenance margin is 30%. Assume the stock pays no dividend and wore interest on margin. Suppose you receive a margin call when the price is $20 (the price drop is sudden and there is no prior margin cal). How much cash do you need to put into the account 54100 53000 56000 $1800 QUESTION 16 Which of the following is NOT an advantage of the top-down investment approach? Helps to identify undervalued securities Helps to reduce transaction costs None of the above Helps to diversify the portfolio QUESTION 17 Which of the following statement is true about stock options? You need to pay a price to hold a stock option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started