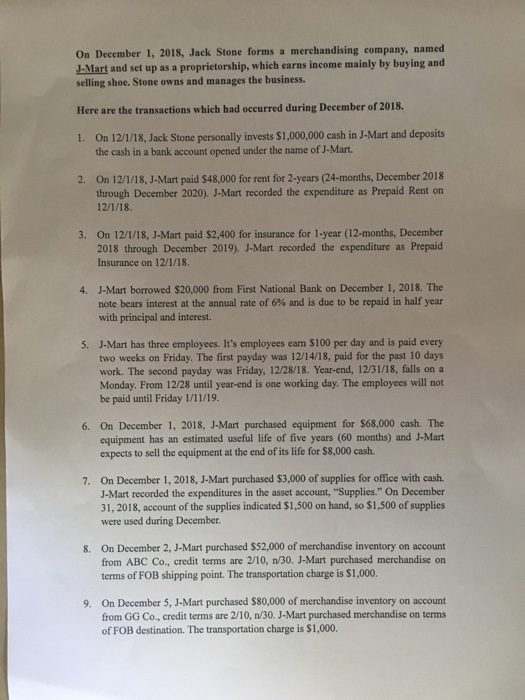

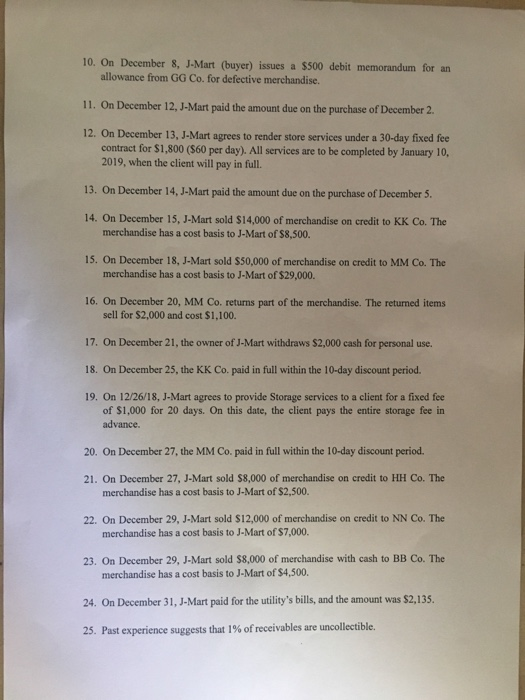

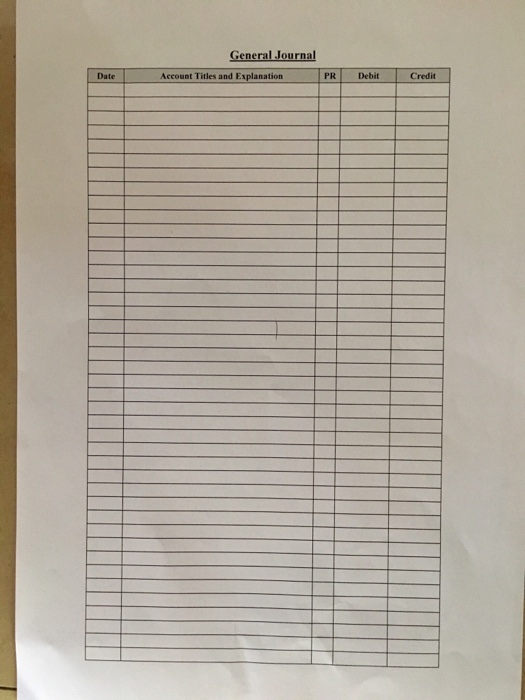

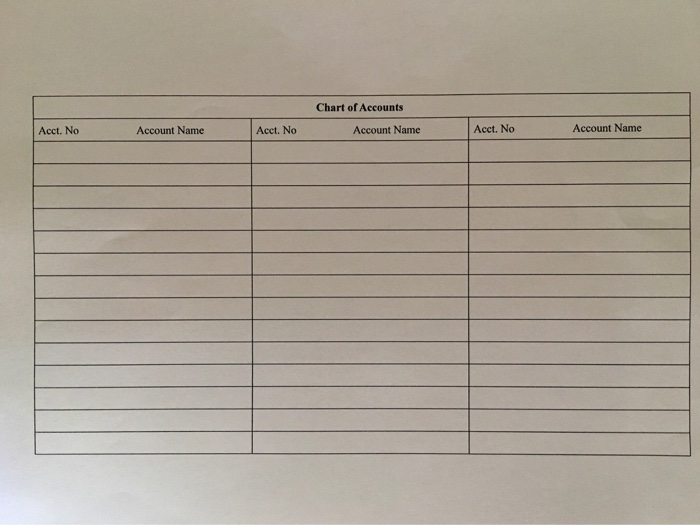

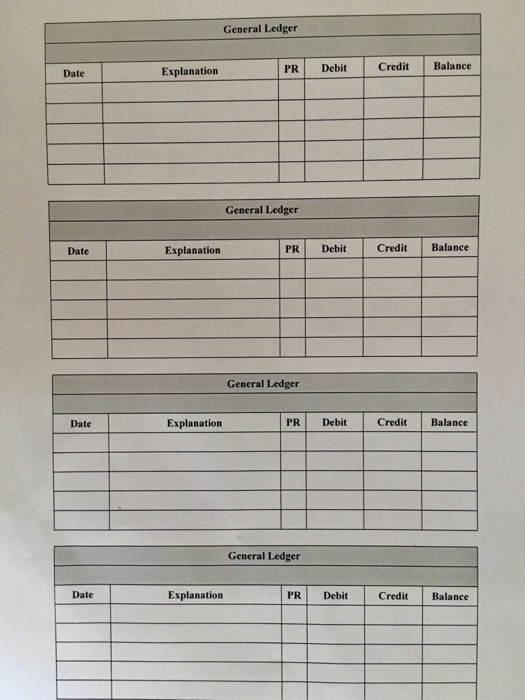

On December 1, 2018, Jack Stone forms a merchandising company, named proprietorship, which earns income mainly by buying and J-Mart and set up as a selling shoe. Stone owns and manages the business. Here are the transactions which had occurred during December of 2018. On 12/1/18, Jack Stone personally invests $1,000,000 cash in J-Mart and deposits 1. the cash in a bank account opened under the name of J-Mart. On 12/1/18, J-Mart paid $48,000 for rent for 2-years (24-months, December 2018 through December 2020 ). J-Mart recorded the expenditure as Prepaid Rent on 2. 12/1/18. 3. On 12/1/18, J-Mart paid $2,400 for insurance for 1-year (12-months, Dec 2018 through December 2019). J-Mart recorded the expenditure as Prepaid aber Insurance on 12/1/18. 4. J-Mart borrowed $20,000 from First National Bank on December 1, 2018. The note bears interest at the annual rate of 6% and is due to be repaid in half year with principal and interest. 5. J-Mart has three employees. It's employees earn $100 per day and is paid every two weeks on Friday. The first payday was 12/14/18, paid for the past 10 days work. The second payday was Friday, 12/28/18. Year-end, 12/31/18, falls on a Monday, From 12/28 until year-end is one working day. The employees will not be paid until Friday 1/11/19. 6. On December 1, 2018, J-Mart purchased equipment for $68,000 cash. The equipment has an estimated useful life of five years (60 m expects to sell the equipment at the end of its life for $8,000 cash. and J-Mart On December 1, 2018, J-Mart purchased $3,000 of supplies for office with cash. J-Mart recorded the expenditures in the asset account, "Supplies." On December 31, 2018, account of the supplies indicated $1,500 on hand, so $1,500 of supplies 7. were used during December. 8. On December 2, J-Mart purchased $52,000 of merchandise inventory on account from ABC Co., credit terms are 2/10, n/30. J-Mart purchased merchandise on terms of FOB shipping point. The transportation charge is $1,000. On December 5, J-Mart purchased $80,000 of merchandise inventory from GG Co., credit terms are 2/10, n/30. J-Mart purchased merchandise on terms of FOB destination. The transportation charge is $1,000. on account 9. 10. On December 8, J-Mart (buyer) issues a $500 debit memorandum for an allowance from GG Co. for defective merchandise. 11. On December 12, J-Mart paid the amount due on the purchase of December 2. 12. On December 13, J-Mart agrees to render store services under a 30-day fixed fee contract for $1,800 ($60 per day). All services are to be completed by January 10, 2019, when the client will pay in full. 13. On December 14, J-Mart paid the amount due on the purchase of December 5. 14. On December 15, J-Mart sold $14,000 of merchandise on credit to KK Co. The merchandise has a cost basis to J-Mart of $8,500. 15. On December 18, J-Mart sold $50,000 of merchandise on credit to MM Co. The merchandise has a cost basis to J-Mart of $29,000. 16. On December 20, MM Co. returns part of the merchandise. The returned items sell for $2,000 and cost $1,100. 17. On December 21, the owner of J-Mart withdraws $2,000 cash for personal use. 18. On December 25, the KK Co. paid in full within the 10-day discount period. 19. On 12/26/18, J-Mart agrees to provide Storage services to a client for a fixed fee of $1,000 for 20 days. On this date, the client pays the entire storage fee in advance. 20. On December 27, the MM Co. paid in full within the 10-day discount period. 21, On December 27, J-Mart sold $8,000 of merchandise on credit to HH Co. The merchandise has a cost basis to J-Mart of $2,500. 22. On December 29, J-Mart sold $12,000 of merchandise on credit to NN Co. The merchandise has a cost basis to J-Mart of $7,000. 23. On December 29, J-Mart sold $8,000 of merchandise with cash to BB Co. The merchandise has a cost basis to J-Mart of $4,500. 24. On December 31, J-Mart paid for the utility's bills, and the amount was $2,135 25. Past experience suggests that 1% of receivables are uncollectible. General Journal Account Titles and Explanation PR Debit Credit Date Chart of Accounts Account Name Account Name Account Name Acct. No Acct. No Acct. No General Ledger Balance Credit Debit PR Explanation Date General Ledger Balance Credit PR. Debit Explanation Date General Ledger PR Debit Credit Balance Explanation Date General Ledger Date Explanation PR Debit Credit Balance