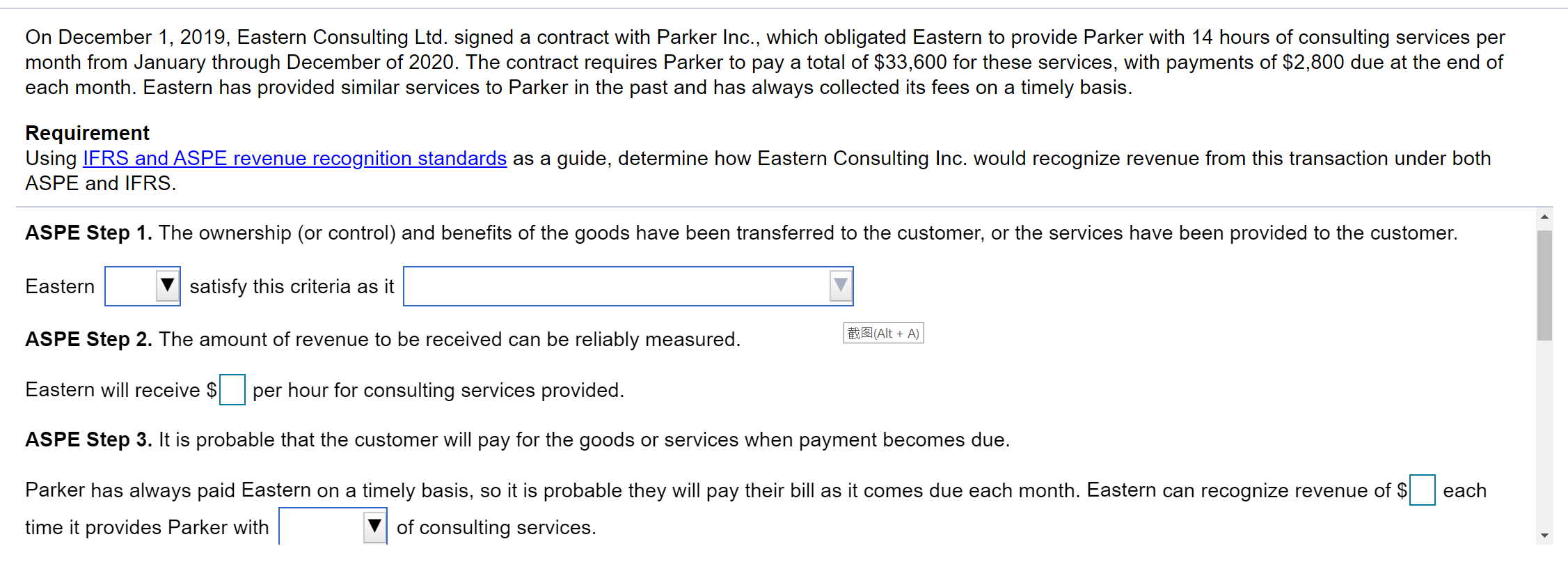

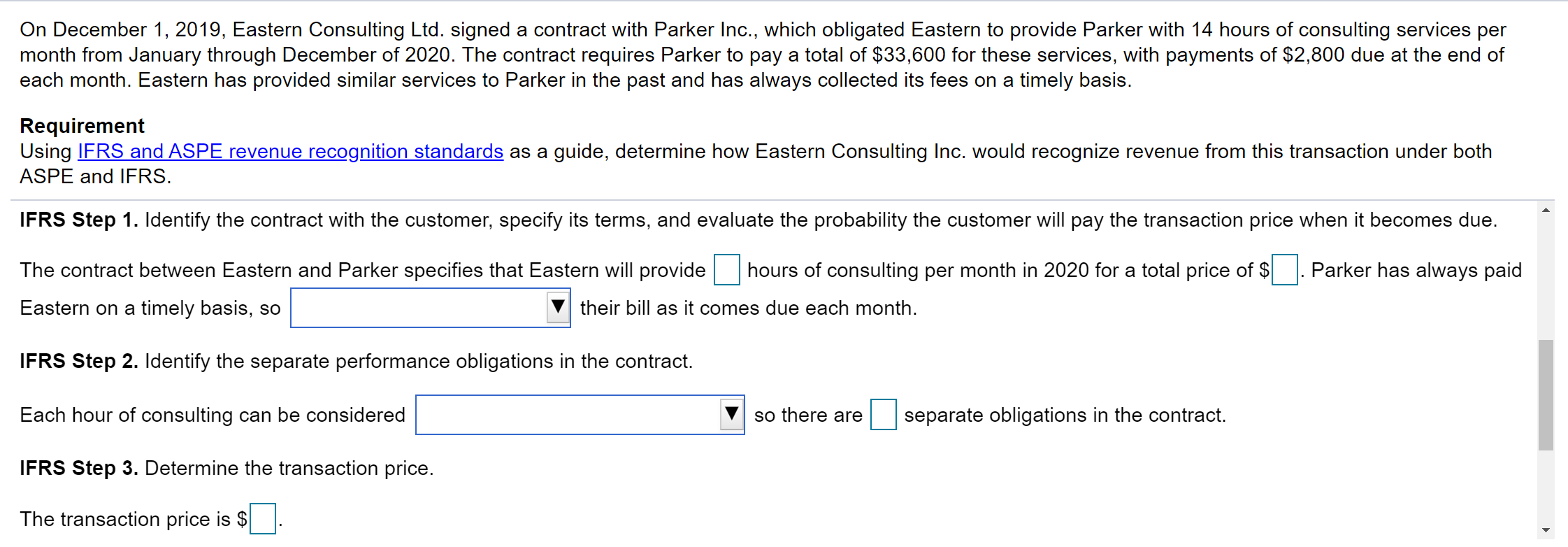

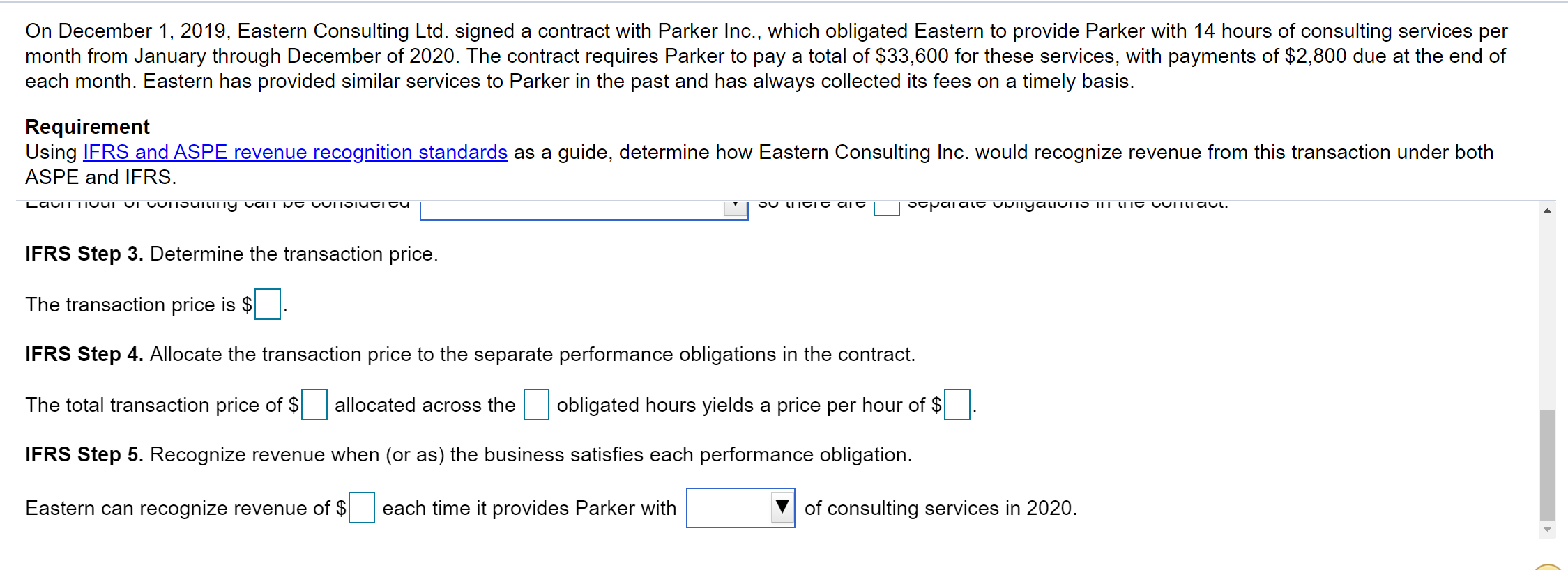

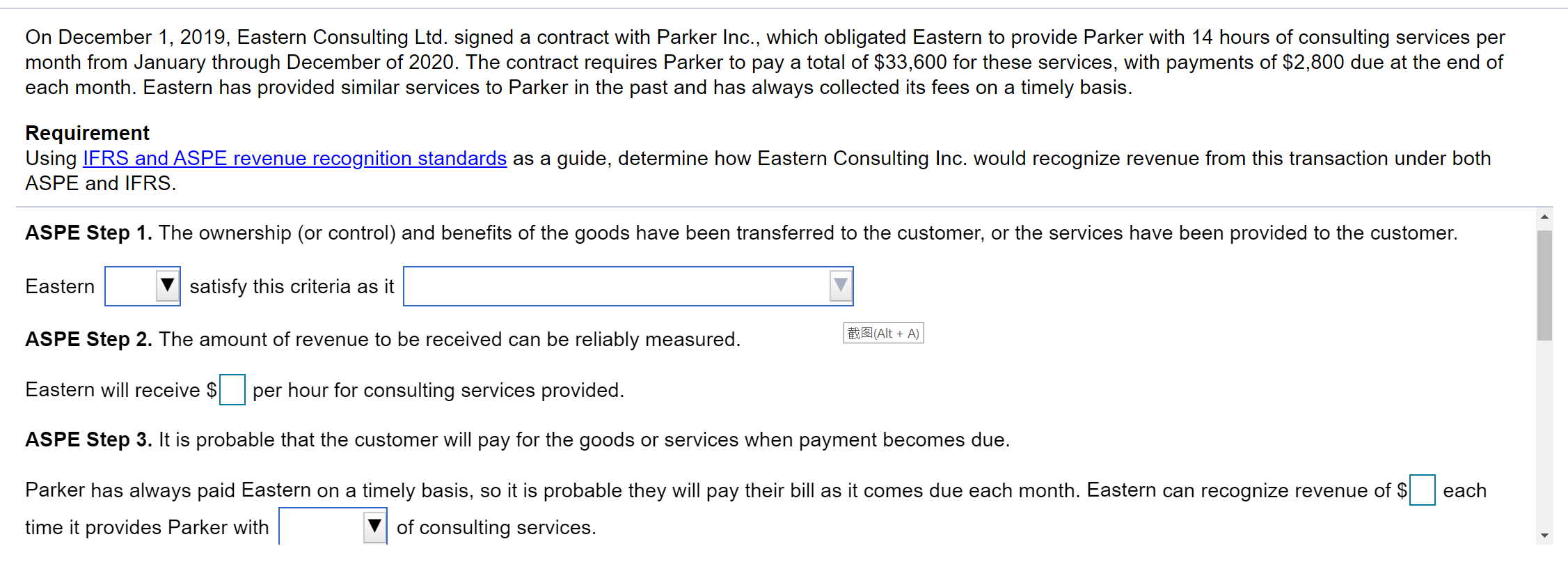

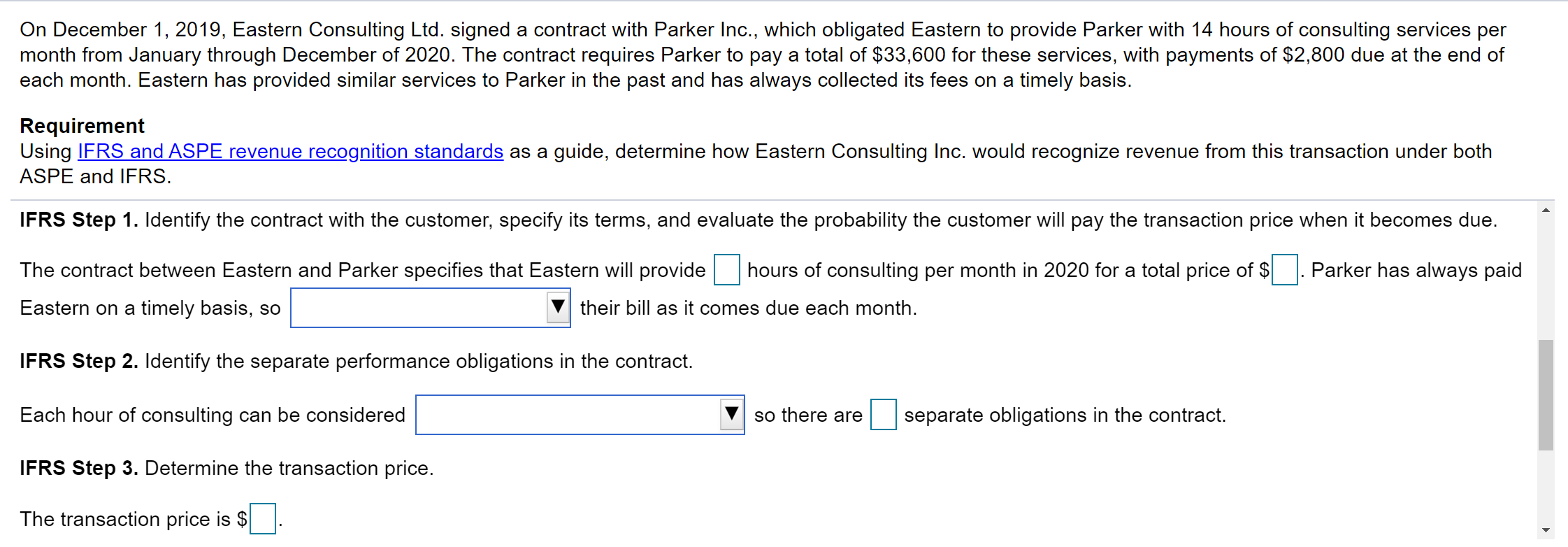

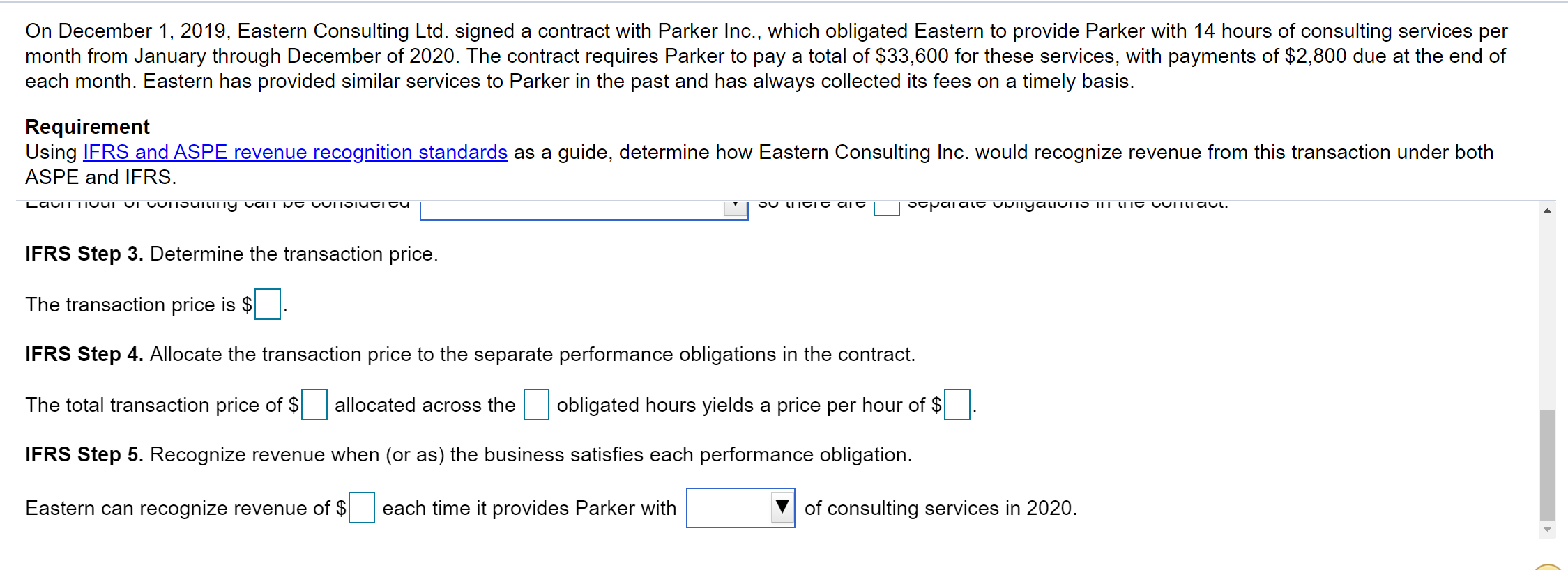

On December 1, 2019, Eastern Consulting Ltd. signed a contract with Parker Inc., which obligated Eastern to provide Parker with 14 hours of consulting services per month from January through December of 2020. The contract requires Parker to pay a total of $33,600 for these services, with payments of $2,800 due at the end of each month. Eastern has provided similar services to Parker in the past and has always collected its fees on a timely basis. Requirement Using IFRS and ASPE revenue recognition standards as a guide, determine how Eastern Consulting Inc. would recognize revenue from this transaction under both ASPE and IFRS. ASPE Step 1. The ownership (or control) and benefits of the goods have been transferred to the customer, or the services have been provided to the customer. Eastern satisfy this criteria as it ASPE Step 2. The amount of revenue to be received can be reliably measured. (Alt + A) Eastern will receive $| per hour for consulting services provided. ASPE Step 3. It is probable that the customer will pay for the goods or services when payment becomes due. each Parker has always paid Eastern on a timely basis, so it is probable they will pay their bill as it comes due each month. Eastern can recognize revenue of $ time it provides Parker with of consulting services. On December 1, 2019, Eastern Consulting Ltd. signed a contract with Parker Inc., which obligated Eastern to provide Parker with 14 hours of consulting services per month from January through December of 2020. The contract requires Parker to pay a total of $33,600 for these services, with payments of $2,800 due at the end of each month. Eastern has provided similar services to Parker in the past and has always collected its fees on a timely basis. Requirement Using IFRS and ASPE revenue recognition standards as a guide, determine how Eastern Consulting Inc. would recognize revenue from this transaction under both ASPE and IFRS. IFRS Step 1. Identify the contract with the customer, specify its terms, and evaluate the probability the customer will pay the transaction price when it becomes due. Parker has always paid The contract between Eastern and Parker specifies that Eastern will provide hours of consulting per month in 2020 for a total price of $ Eastern on a timely basis, so their bill as it comes due each month. IFRS Step 2. Identify the separate performance obligations in the contract. Each hour of consulting can be considered so there are separate obligations in the contract. IFRS Step 3. Determine the transaction price. The transaction price is $ On December 1, 2019, Eastern Consulting Ltd. signed a contract with Parker Inc., which obligated Eastern to provide Parker with 14 hours of consulting services per month from January through December of 2020. The contract requires Parker to pay a total of $33,600 for these services, with payments of $2,800 due at the end of each month. Eastern has provided similar services to Parker in the past and has always collected its fees on a timely basis. Requirement Using IFRS and ASPE revenue recognition standards as a guide, determine how Eastern Consulting Inc. would recognize revenue from this transaction under both ASPE and IFRS. LavilliVUI VI VUITSUILITY van NC VUITJIUCICU SU LIICIE ai separate UnNyali ITO ILT LLIC UUTILI aut. IFRS Step 3. Determine the transaction price. The transaction price is $ IFRS Step 4. Allocate the transaction price to the separate performance obligations in the contract. The total transaction price of $ allocated across the obligated hours yields a price per hour of $ IFRS Step 5. Recognize revenue when (or as) the business satisfies each performance obligation. Eastern can recognize revenue of $ each time it provides Parker with of consulting services in 2020. On December 1, 2019, Eastern Consulting Ltd. signed a contract with Parker Inc., which obligated Eastern to provide Parker with 14 hours of consulting services per month from January through December of 2020. The contract requires Parker to pay a total of $33,600 for these services, with payments of $2,800 due at the end of each month. Eastern has provided similar services to Parker in the past and has always collected its fees on a timely basis. Requirement Using IFRS and ASPE revenue recognition standards as a guide, determine how Eastern Consulting Inc. would recognize revenue from this transaction under both ASPE and IFRS. ASPE Step 1. The ownership (or control) and benefits of the goods have been transferred to the customer, or the services have been provided to the customer. Eastern satisfy this criteria as it ASPE Step 2. The amount of revenue to be received can be reliably measured. (Alt + A) Eastern will receive $| per hour for consulting services provided. ASPE Step 3. It is probable that the customer will pay for the goods or services when payment becomes due. each Parker has always paid Eastern on a timely basis, so it is probable they will pay their bill as it comes due each month. Eastern can recognize revenue of $ time it provides Parker with of consulting services. On December 1, 2019, Eastern Consulting Ltd. signed a contract with Parker Inc., which obligated Eastern to provide Parker with 14 hours of consulting services per month from January through December of 2020. The contract requires Parker to pay a total of $33,600 for these services, with payments of $2,800 due at the end of each month. Eastern has provided similar services to Parker in the past and has always collected its fees on a timely basis. Requirement Using IFRS and ASPE revenue recognition standards as a guide, determine how Eastern Consulting Inc. would recognize revenue from this transaction under both ASPE and IFRS. IFRS Step 1. Identify the contract with the customer, specify its terms, and evaluate the probability the customer will pay the transaction price when it becomes due. Parker has always paid The contract between Eastern and Parker specifies that Eastern will provide hours of consulting per month in 2020 for a total price of $ Eastern on a timely basis, so their bill as it comes due each month. IFRS Step 2. Identify the separate performance obligations in the contract. Each hour of consulting can be considered so there are separate obligations in the contract. IFRS Step 3. Determine the transaction price. The transaction price is $ On December 1, 2019, Eastern Consulting Ltd. signed a contract with Parker Inc., which obligated Eastern to provide Parker with 14 hours of consulting services per month from January through December of 2020. The contract requires Parker to pay a total of $33,600 for these services, with payments of $2,800 due at the end of each month. Eastern has provided similar services to Parker in the past and has always collected its fees on a timely basis. Requirement Using IFRS and ASPE revenue recognition standards as a guide, determine how Eastern Consulting Inc. would recognize revenue from this transaction under both ASPE and IFRS. LavilliVUI VI VUITSUILITY van NC VUITJIUCICU SU LIICIE ai separate UnNyali ITO ILT LLIC UUTILI aut. IFRS Step 3. Determine the transaction price. The transaction price is $ IFRS Step 4. Allocate the transaction price to the separate performance obligations in the contract. The total transaction price of $ allocated across the obligated hours yields a price per hour of $ IFRS Step 5. Recognize revenue when (or as) the business satisfies each performance obligation. Eastern can recognize revenue of $ each time it provides Parker with of consulting services in 2020