Answered step by step

Verified Expert Solution

Question

1 Approved Answer

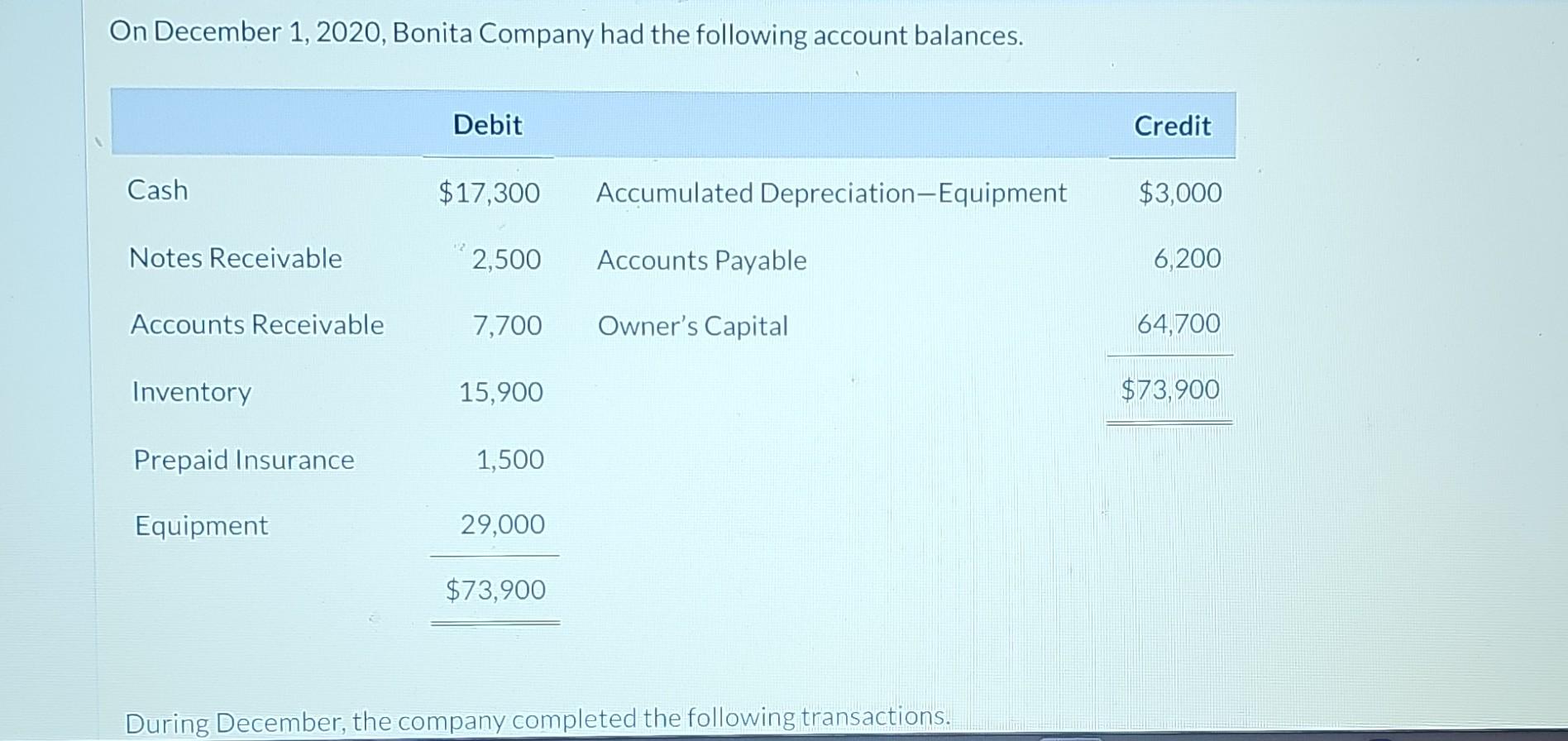

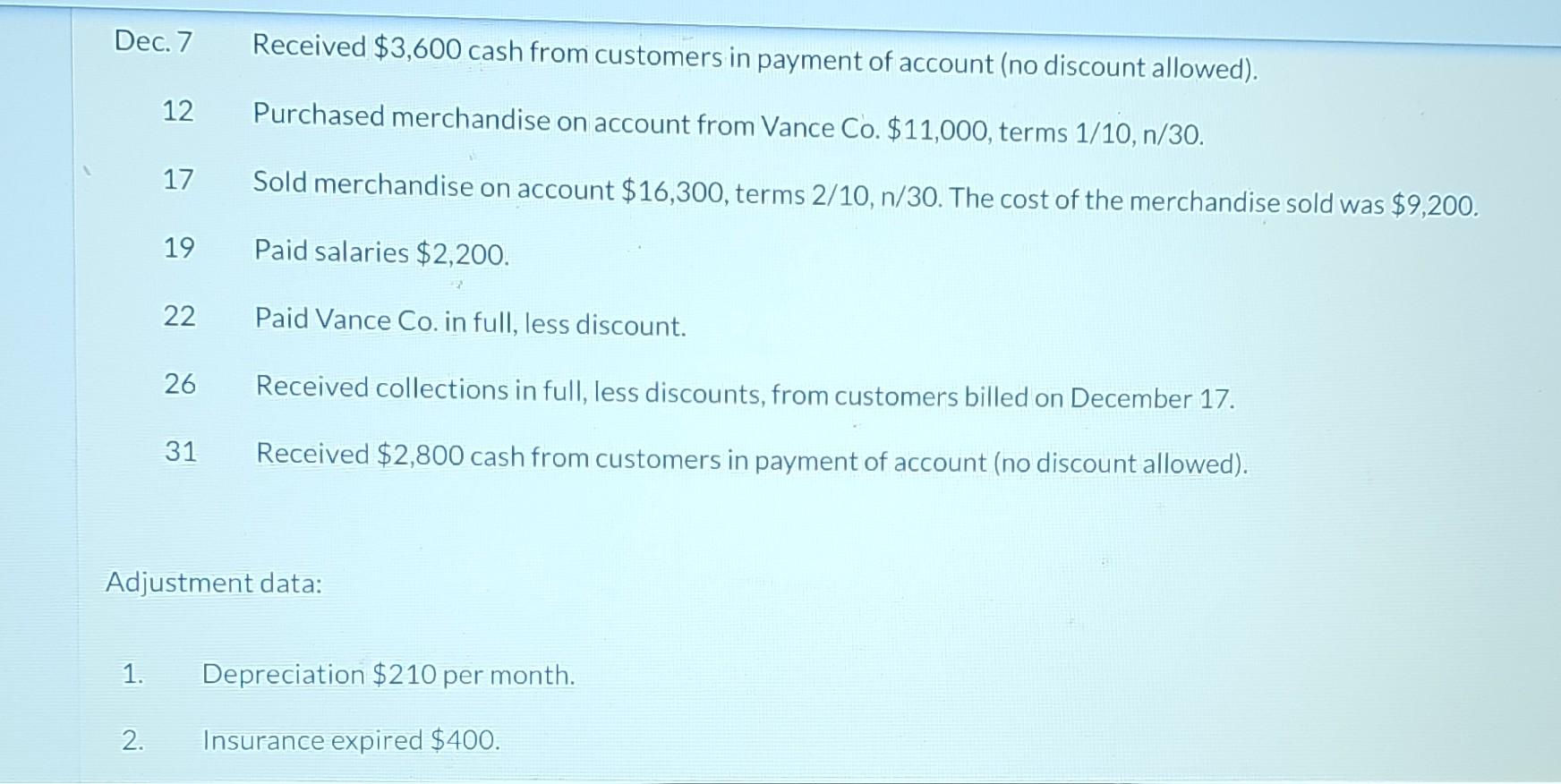

On December 1, 2020, Bonita Company had the following account balances. During December, the company completed the following transactions. Dec. 7 Received $3,600 cash from

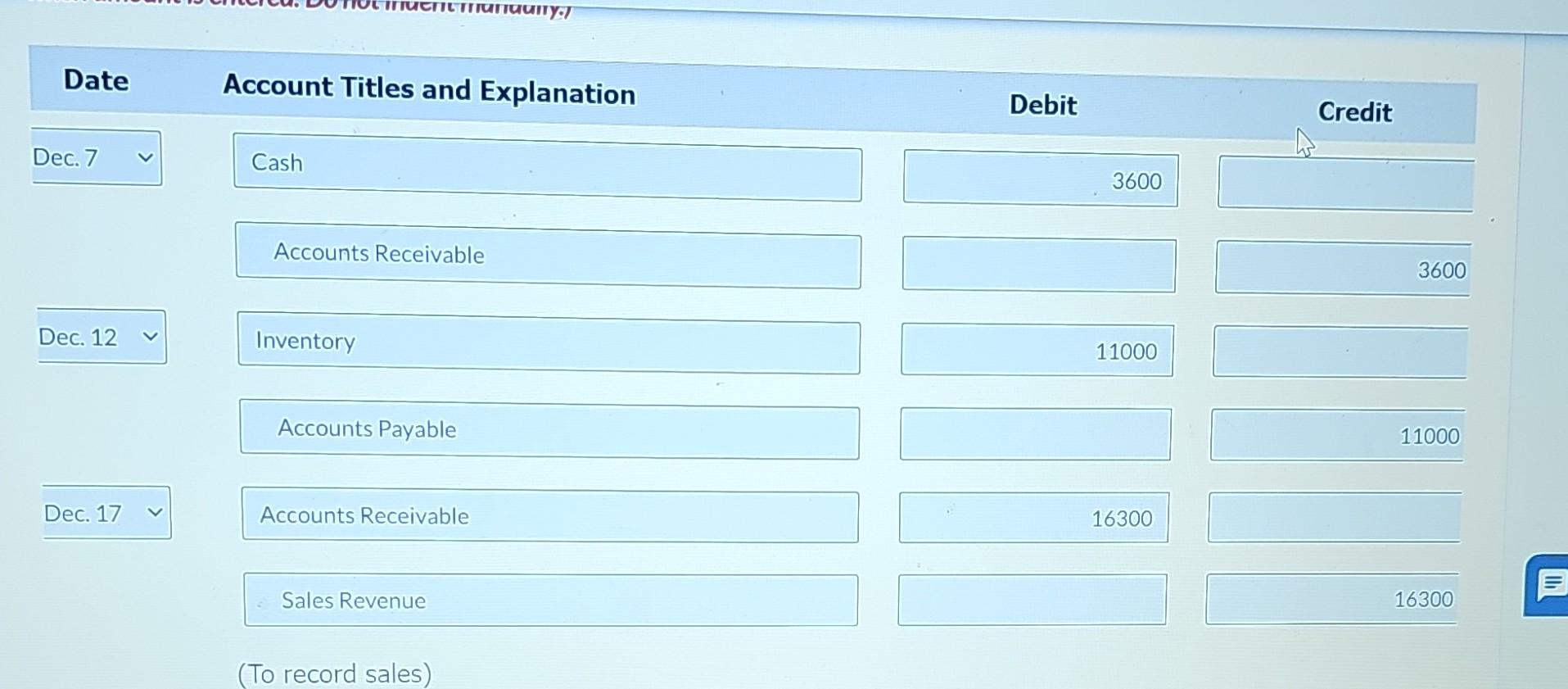

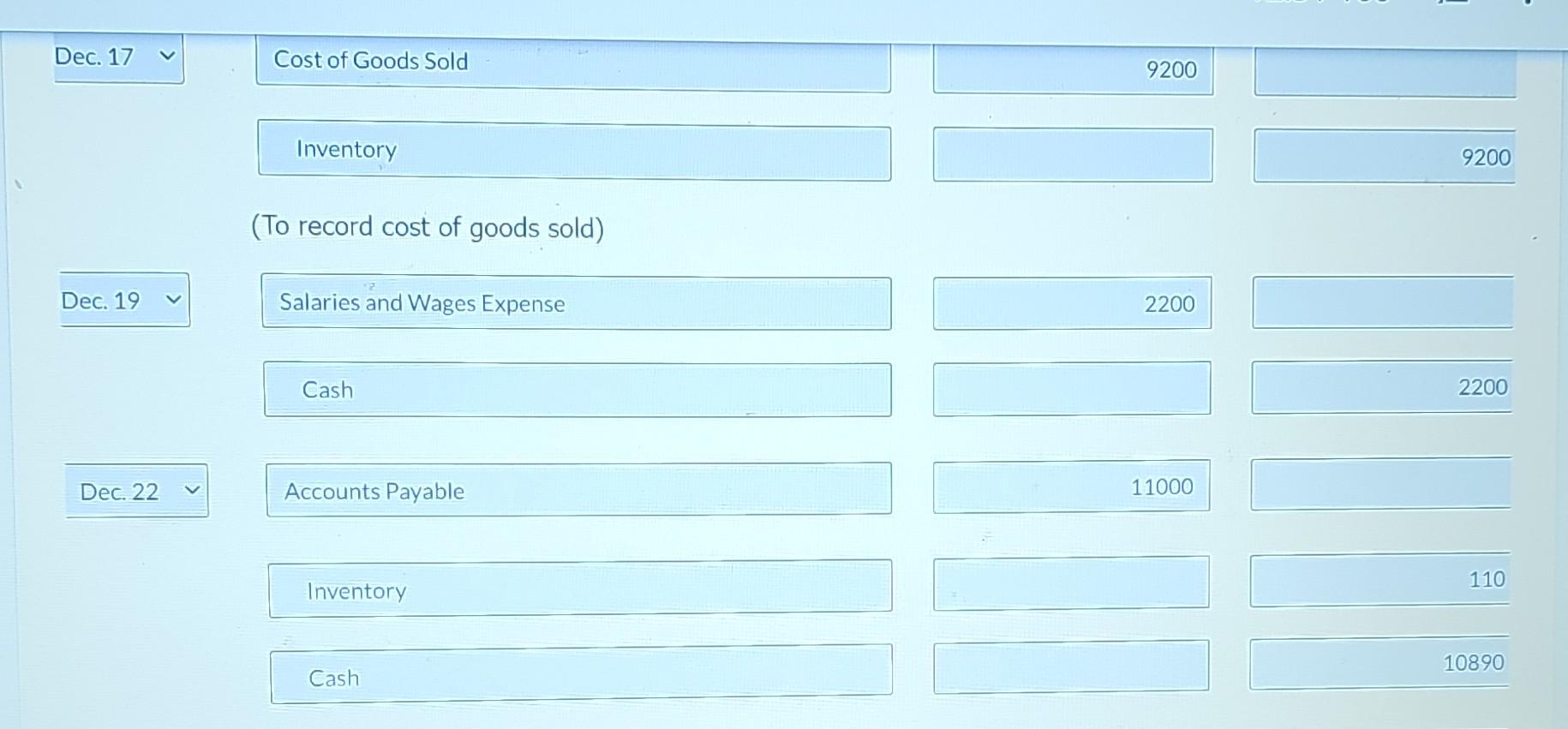

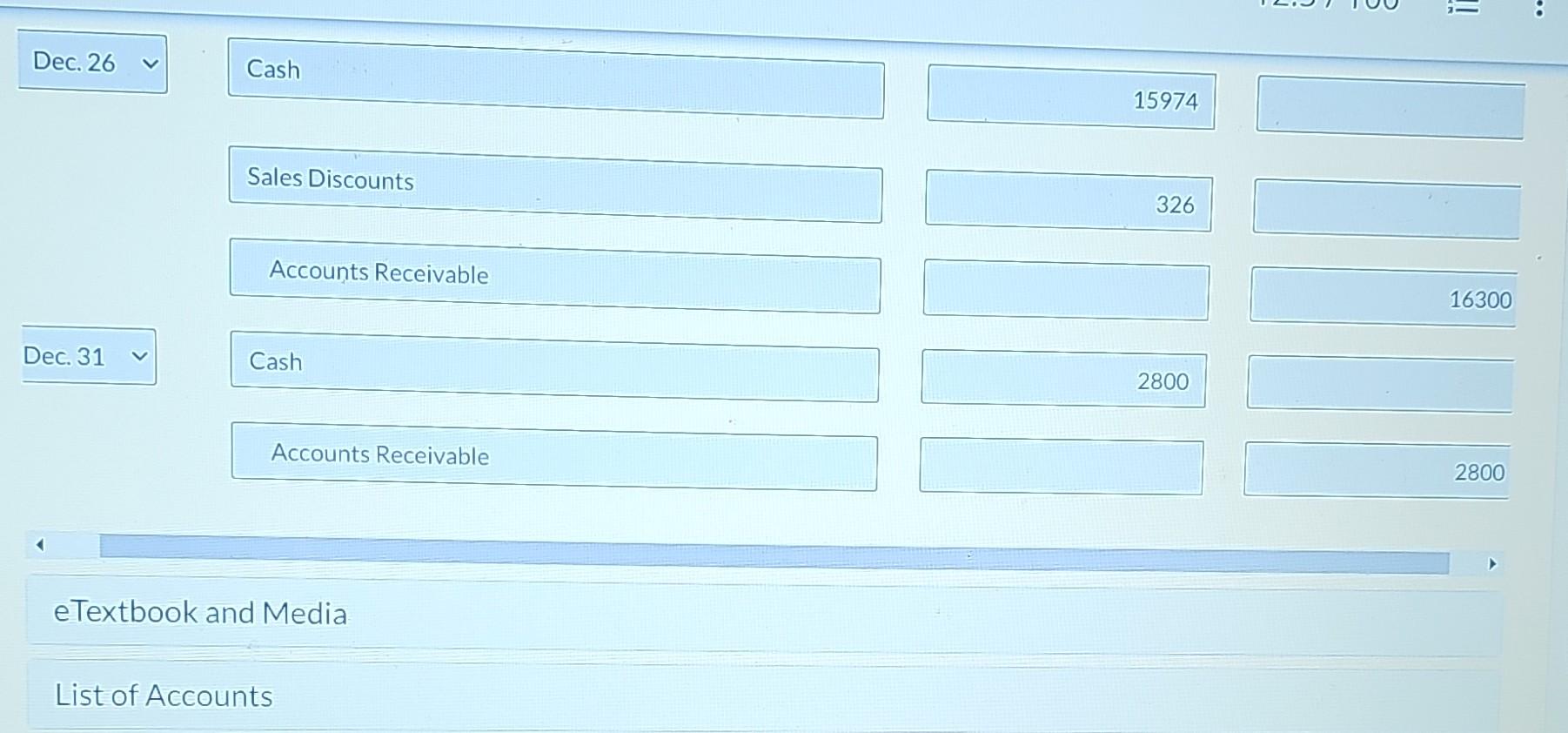

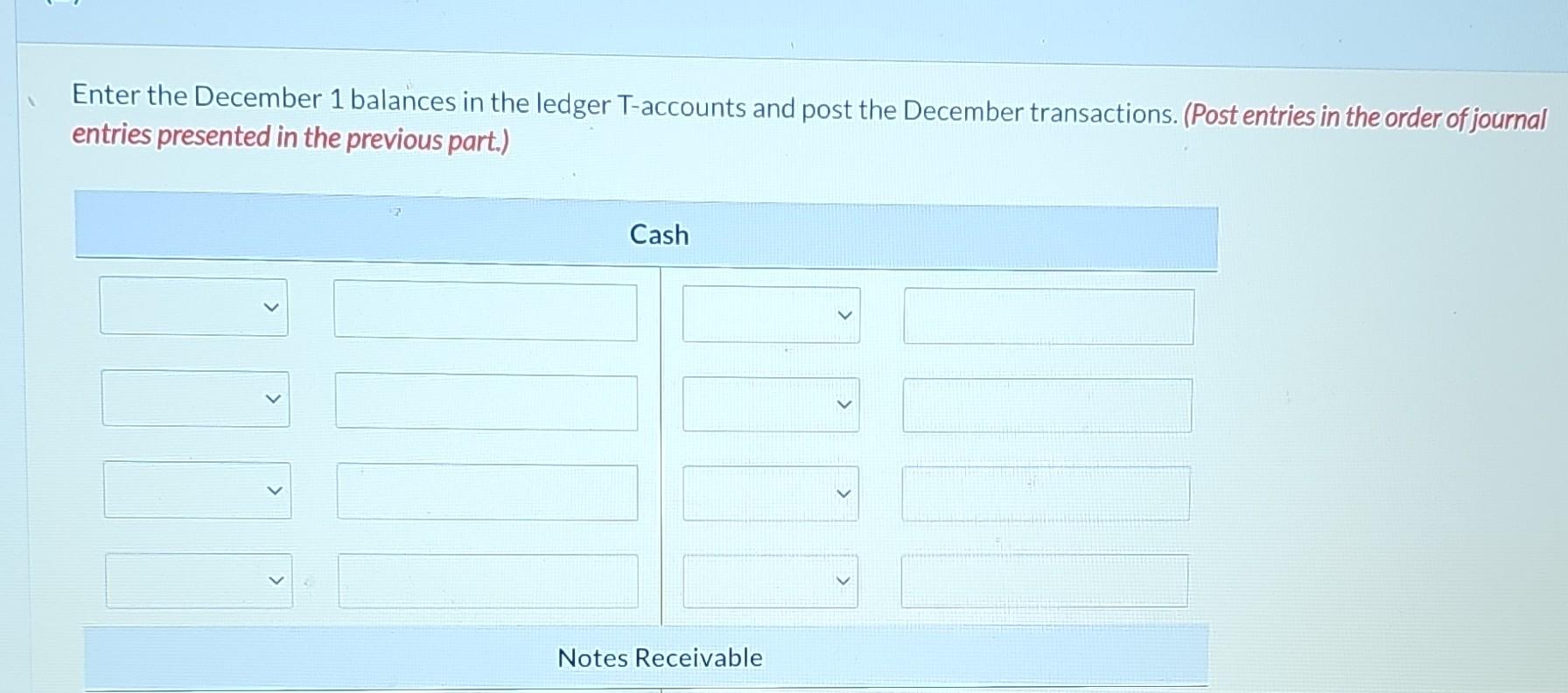

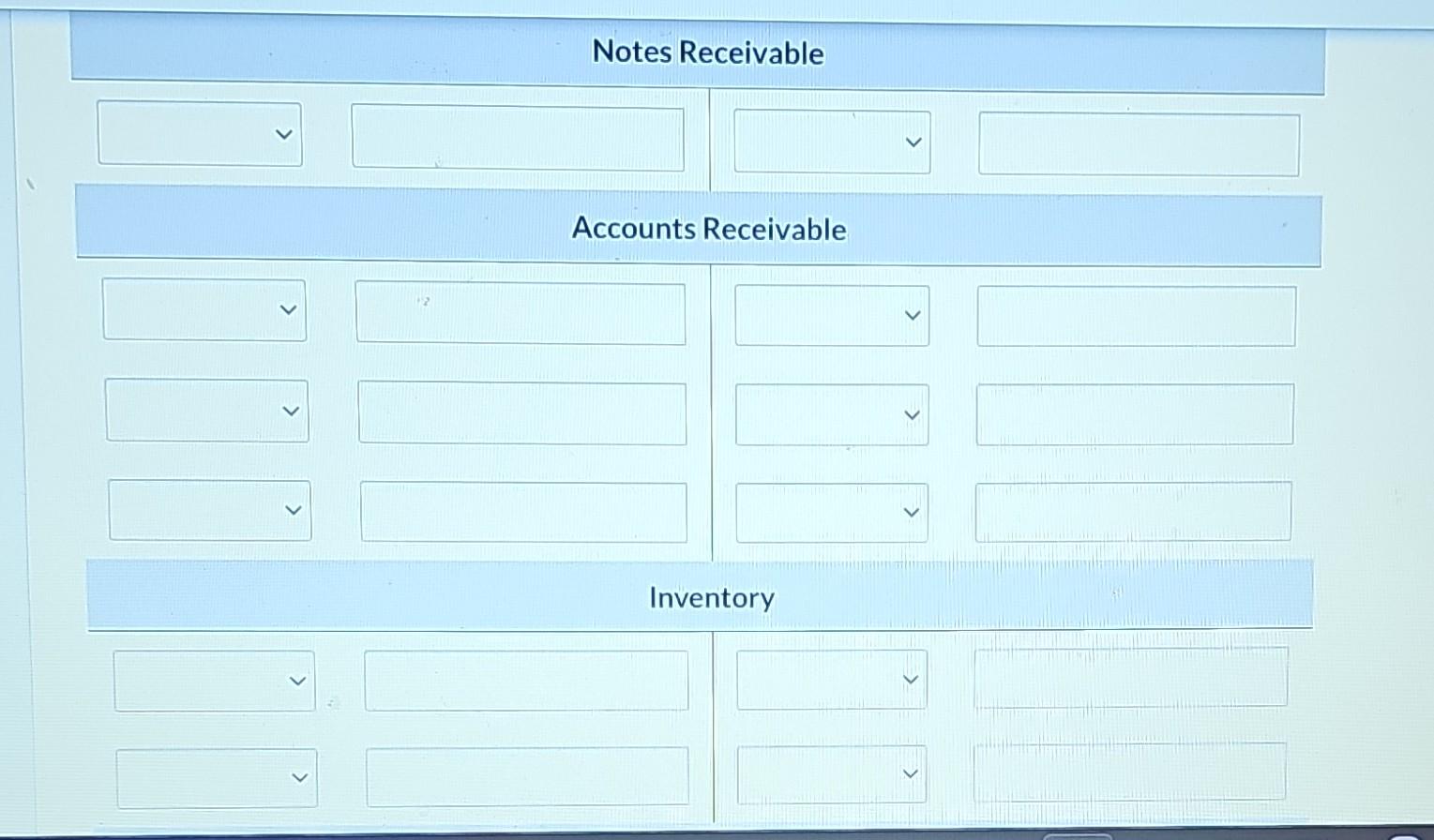

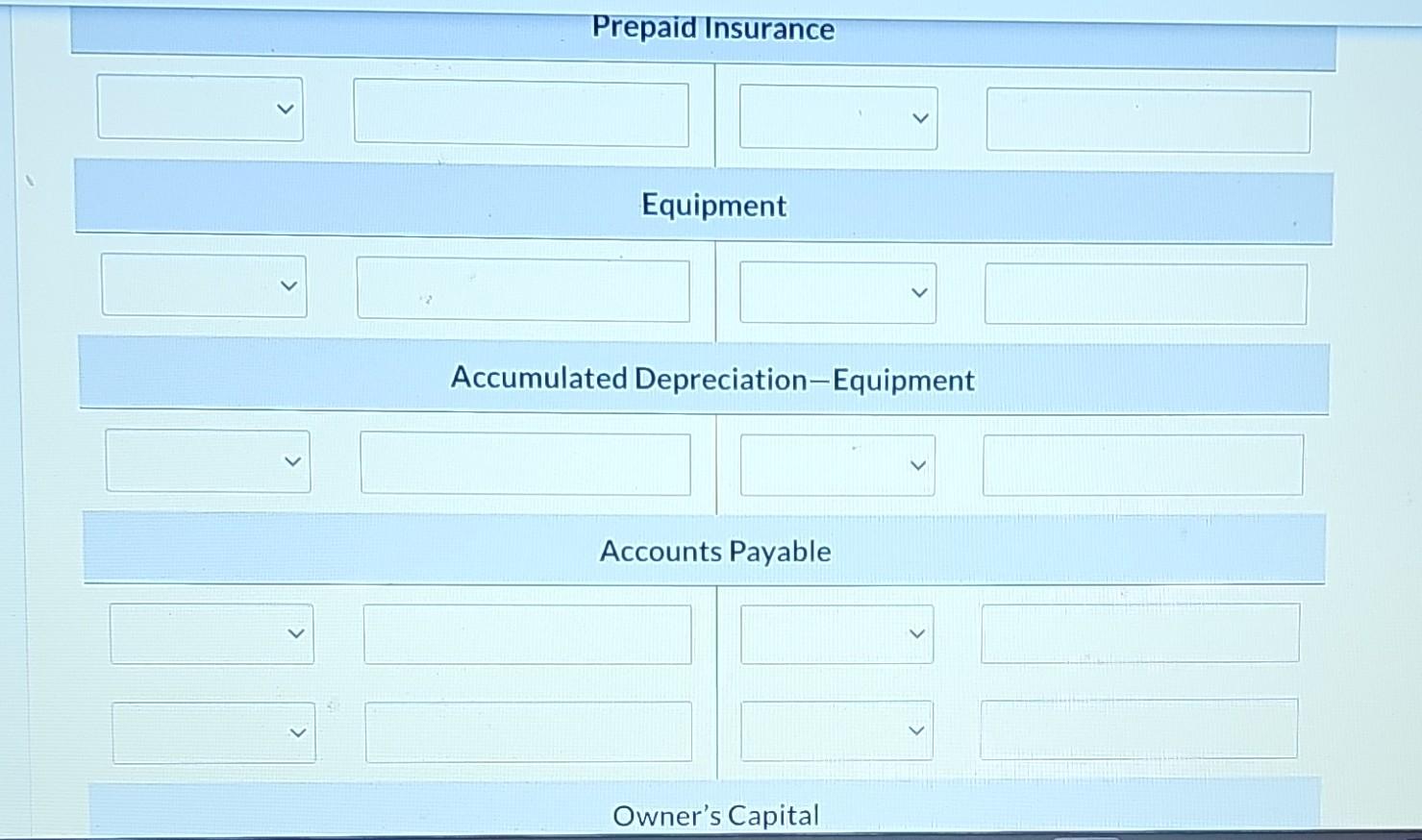

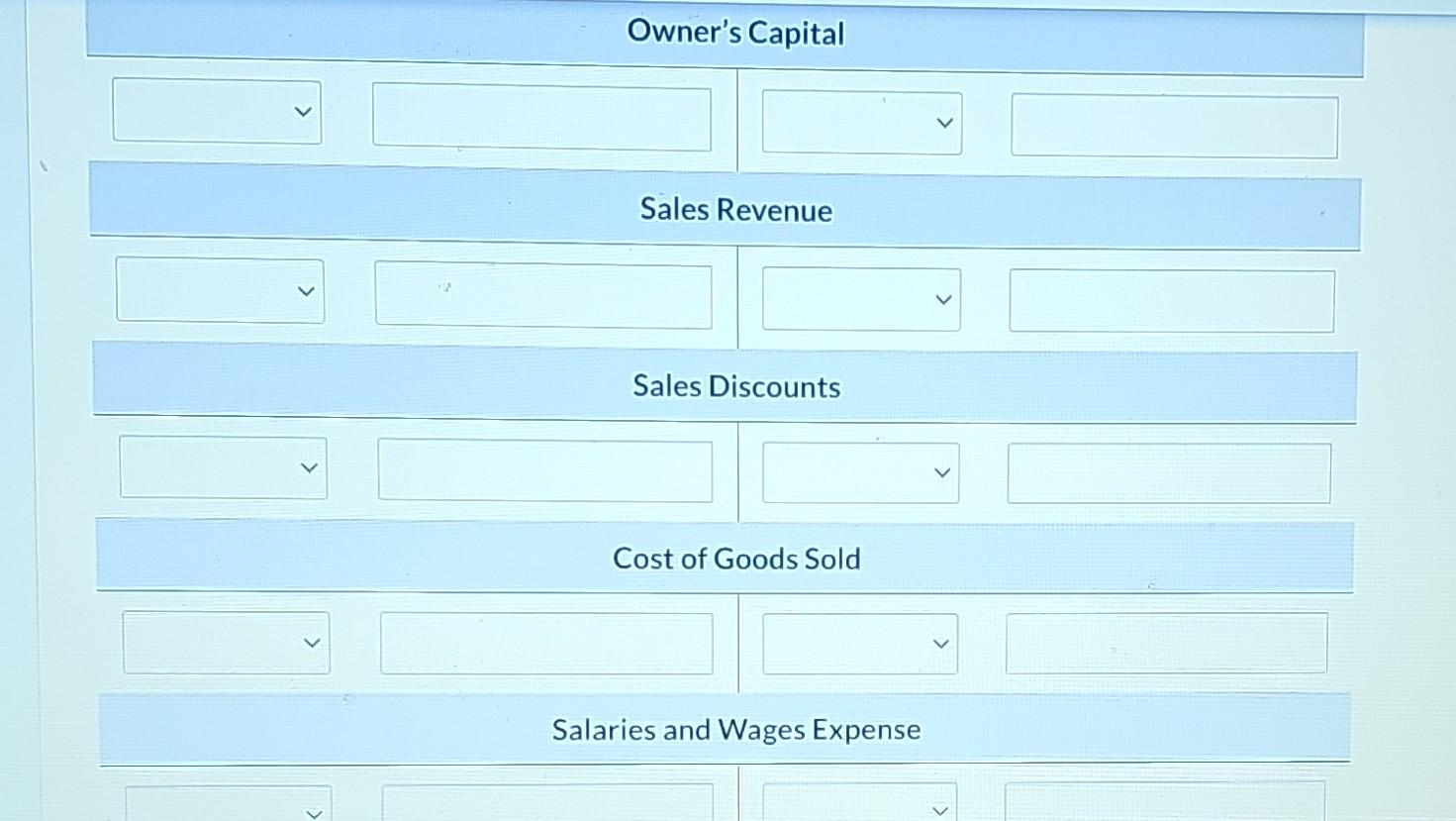

On December 1, 2020, Bonita Company had the following account balances. During December, the company completed the following transactions. Dec. 7 Received $3,600 cash from customers in payment of account (no discount allowed). 12 Purchased merchandise on account from Vance Co. $11,000, terms 1/10, n/30. 17 Sold merchandise on account $16,300, terms 2/10,n/30. The cost of the merchandise sold was $9,200. 19 Paid salaries $2,200. 22 Paid Vance Co. in full, less discount. 26 Received collections in full, less discounts, from customers billed on December 17. 31 Received $2,800 cash from customers in payment of account (no discount allowed). Adjustment data: 1. Depreciation $210 per month. 2. Insurance expired $400. Date Account Titles and Explanation Debit Credit Dec. 7 Cash Accounts Receivable 3600 Dec. 12 Inventory 11000 Accounts Payable Dec. 17 Accounts Receivable 16300 Sales Revenue 16300 (To record sales) Dec. 17 Cost of Goods Sold 9200 Inventory 9200 (To record cost of goods sold) Dec. 19 Salaries and Wages Expense 2200 Cash 2200 Dec. 22 Accounts Payable 11000 Inventory Cash 10890 Dec. 26 Cash 15974 Sales Discounts 326 Accounts Receivable Dec. 31 Cash 2800 Accounts Receivable 2800 eTextbook and Media List of Accounts Enter the December 1 balances in the ledger T-accounts and post the December transactions. (Post entries in the order of journal entries presented in the previous part.) Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Owner's Capital Owner's Capital Sales Revenue Sales Discounts Cost of Goods Sold Salaries and Wages Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started