Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 1, 2020, Tammy Company made a basket purchase of land, a building, and equipment for $320,000. Appraised values at the time of

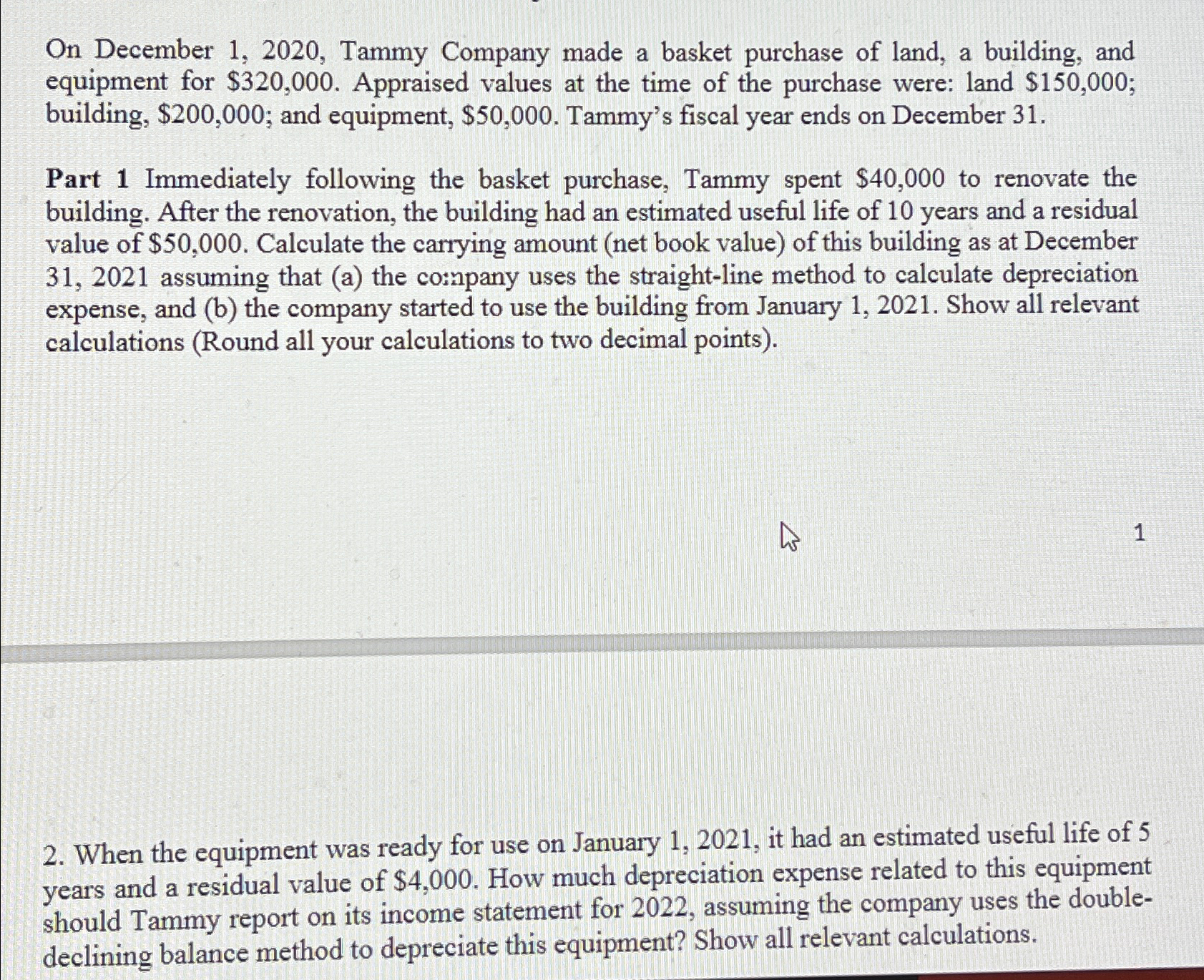

On December 1, 2020, Tammy Company made a basket purchase of land, a building, and equipment for $320,000. Appraised values at the time of the purchase were: land $150,000; building, $200,000; and equipment, $50,000. Tammy's fiscal year ends on December 31. Part 1 Immediately following the basket purchase, Tammy spent $40,000 to renovate the building. After the renovation, the building had an estimated useful life of 10 years and a residual value of $50,000. Calculate the carrying amount (net book value) of this building as at December 31, 2021 assuming that (a) the company uses the straight-line method to calculate depreciation expense, and (b) the company started to use the building from January 1, 2021. Show all relevant calculations (Round all your calculations to two decimal points). 13 1 2. When the equipment was ready for use on January 1, 2021, it had an estimated useful life of 5 years and a residual value of $4,000. How much depreciation expense related to this equipment should Tammy report on its income statement for 2022, assuming the company uses the double- declining balance method to depreciate this equipment? Show all relevant calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started