Answered step by step

Verified Expert Solution

Question

1 Approved Answer

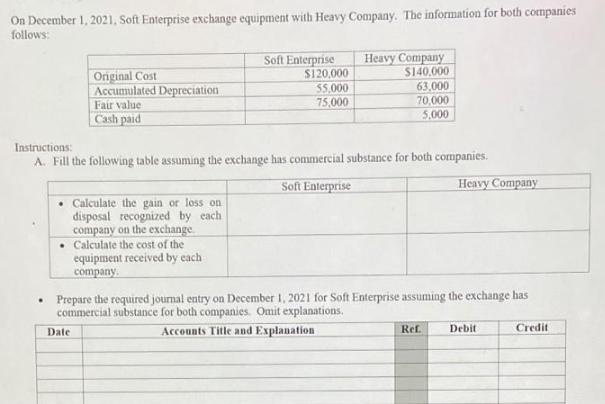

On December 1, 2021, Soft Enterprise exchange equipment with Heavy Company. The information for both companies follows: Soft Enterprise Heavy Company Original Cost $120,000

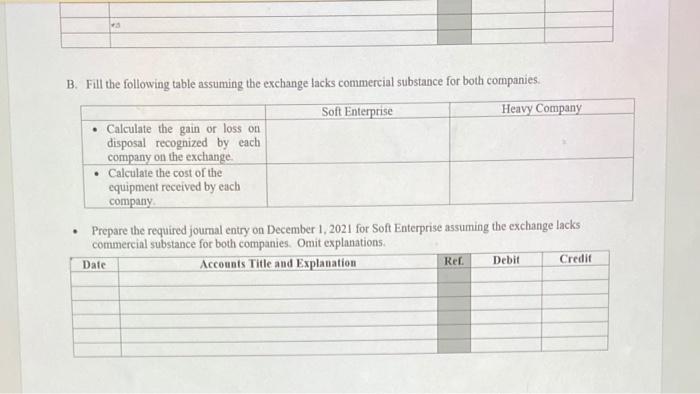

On December 1, 2021, Soft Enterprise exchange equipment with Heavy Company. The information for both companies follows: Soft Enterprise Heavy Company Original Cost $120,000 $140,000 Accumulated Depreciation 55,000 63,000 Fair value 75,000 70,000 Cash paid 5,000 Instructions: A. Fill the following table assuming the exchange has commercial substance for both companies. Soft Enterprise Heavy Company Calculate the gain or loss on disposal recognized by each company on the exchange Calculate the cost of the equipment received by each company. Prepare the required journal entry on December 1, 2021 for Soft Enterprise assuming the exchange has commercial substance for both companies. Omit explanations. Date Accounts Title and Explanation Ref. Debit Credit 43 B. Fill the following table assuming the exchange lacks commercial substance for both companies. Soft Enterprise Heavy Company Calculate the gain or loss on disposal recognized by each company on the exchange. Calculate the cost of the equipment received by each company. Prepare the required journal entry on December 1, 2021 for Soft Enterprise assuming the exchange lacks commercial substance for both companies. Omit explanations. Date Accounts Title and Explanation Ref. Debit Credit

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Exchange has commercial substance Soft Enterprise Heavy Company Calculate the gain or loss on dispos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started