Question

On December 1, 2022, GAZA Company purchased Equipment from Ispanya by 100,000 Euro payable on March 31, 2023. At the same time GAZA enteredinto

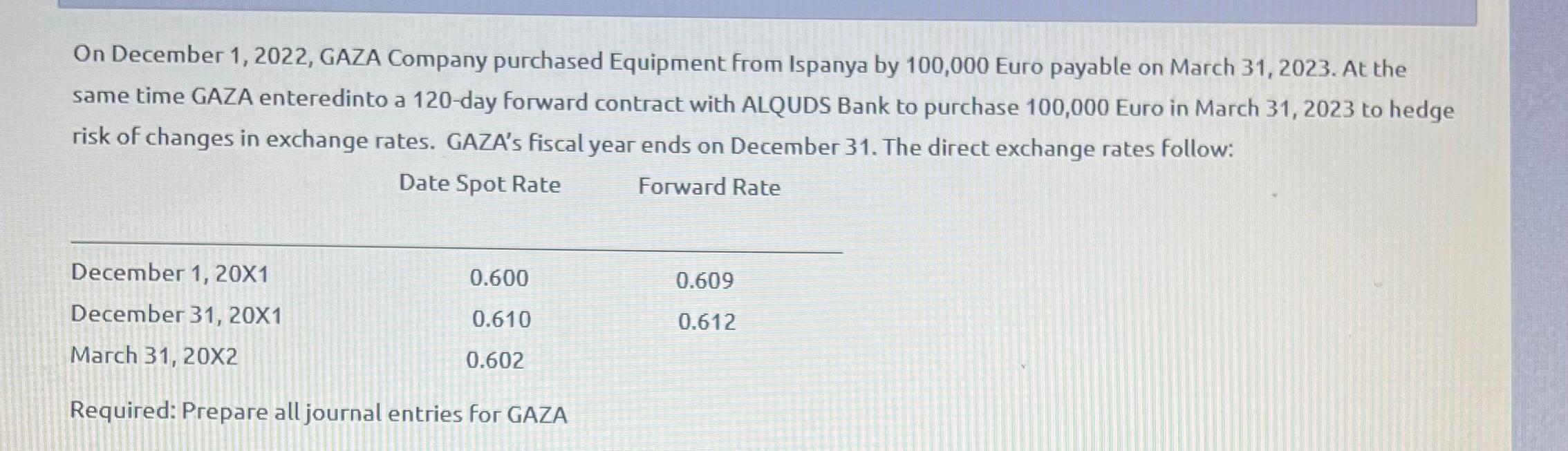

On December 1, 2022, GAZA Company purchased Equipment from Ispanya by 100,000 Euro payable on March 31, 2023. At the same time GAZA enteredinto a 120-day forward contract with ALQUDS Bank to purchase 100,000 Euro in March 31, 2023 to hedge risk of changes in exchange rates. GAZA's fiscal year ends on December 31. The direct exchange rates follow: Date Spot Rate Forward Rate December 1, 20X1 December 31, 20X1 March 31, 20X2 Required: Prepare all journal entries for GAZA 0.600 0.610 0.602 0.609 0.612

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided in the image GAZA Company entered into a transaction and a hedge to manage exchange rate risk The following journal entries recorded in GAZA Companys books reflect th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting and Analysis

Authors: David Alexander, Anne Britton, Ann Jorissen

5th edition

978-1408032282, 1408032287, 978-1408075012

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App