Question

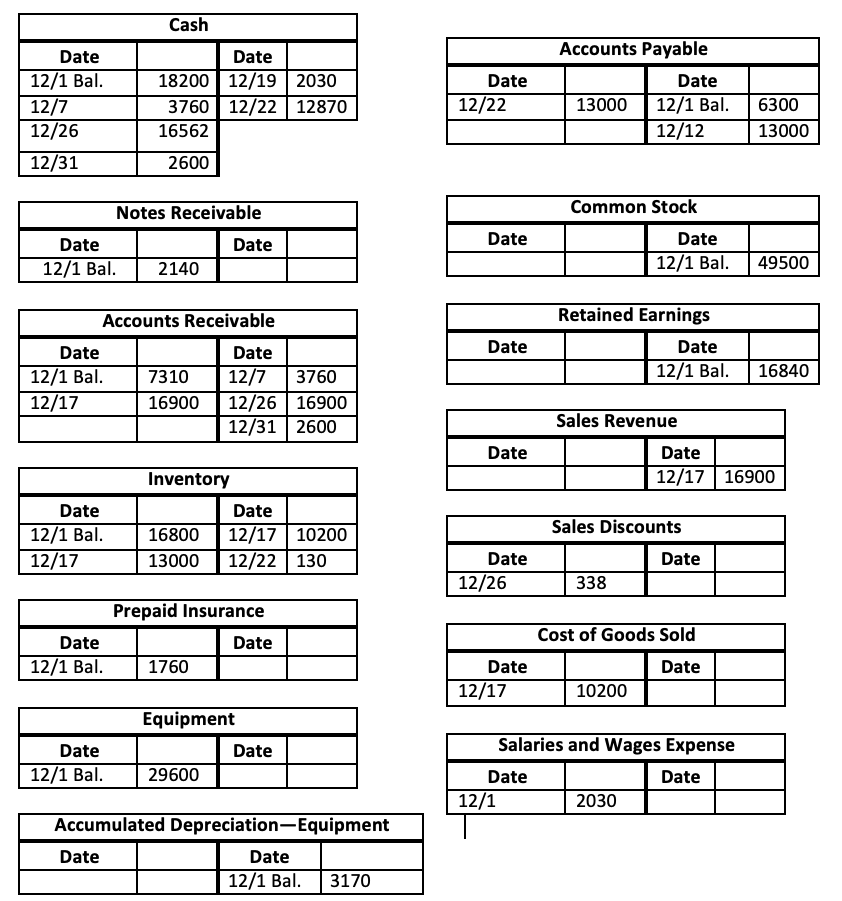

On December 1, 2022 Ivanhoe Company had the following account balances. Debits Credits Cash $18200 Accumulated Depreciation- Equipment $3170 Notes Receivable 2140 Accounts Payable 6300

On December 1, 2022 Ivanhoe Company had the following account balances.

| Debits | Credits | ||

|---|---|---|---|

| Cash | $18200 | Accumulated Depreciation- Equipment | $3170 |

| Notes Receivable | 2140 | Accounts Payable | 6300 |

| Accounts Receivable | 7310 | Common Stock | 49500 |

| Inventory | 16800 | Retained Earnings | 16840 |

| Prepaid Insurance | 1760 | ||

| Equipment | 29600 | ||

| = $75,810 | = $75,810 |

During December, the company completed the following transactions.

| Dec. | 7 | Received $3,760 cash from customers in payment of account (no discount allowed). | |

| 12 | Purchased merchandise on account from Green Co. $13,000, terms 1/10, n/30. | ||

| 17 | Sold merchandise on account $16,900, terms 2/10, n/30. The cost of the merchandise sold was $10,200. | ||

| 19 | Paid salaries $2,030. | ||

| 22 | Paid Green Co. in full, less discount. | ||

| 26 | Received collections in full, less discounts, from customers billed on December 17. | ||

| 31 | Received $2,600 cash from customers in payment of account (no discount allowed). |

Journalize the December transactions. (Assume a perpetual inventory system.)

| Date | Account Titles and Explanation | Debit | Credit |

| Dec. 7 | Cash | 3760 | |

| Accounts Receivable | 3760 | ||

| Dec. 12 | Inventory | 13000 | 13000 |

| Accounts Payable | |||

| Dec. 17 | Accounts Receivable | 16900 | |

| Sales Revenue | 16900 | ||

| (To record sales revenue) | |||

| Dec. 17 | Cost of Goods Sold | 10200 | |

| Inventory | 10200 | ||

| (To record cost of goods sold) | |||

| Dec. 19 | Salaries and Wages Expense | 2030 | |

| Cash | 2030 | ||

| Dec. 22 | Accounts Payable | 13000 | |

| Cash | 12870 | ||

| Inventory | 130 | ||

| Dec. 26 | Cash | 16562 | |

| Sales Discount | 338 | ||

| Accounts Receivable | 16900 | ||

| Dec. 31 | Cash | 2600 | |

| Accounts Receivable | 2600 |

Enter the December 1 balances in the ledger T accounts and post the December transactions. (Post entries in the order of journal entries presented above.

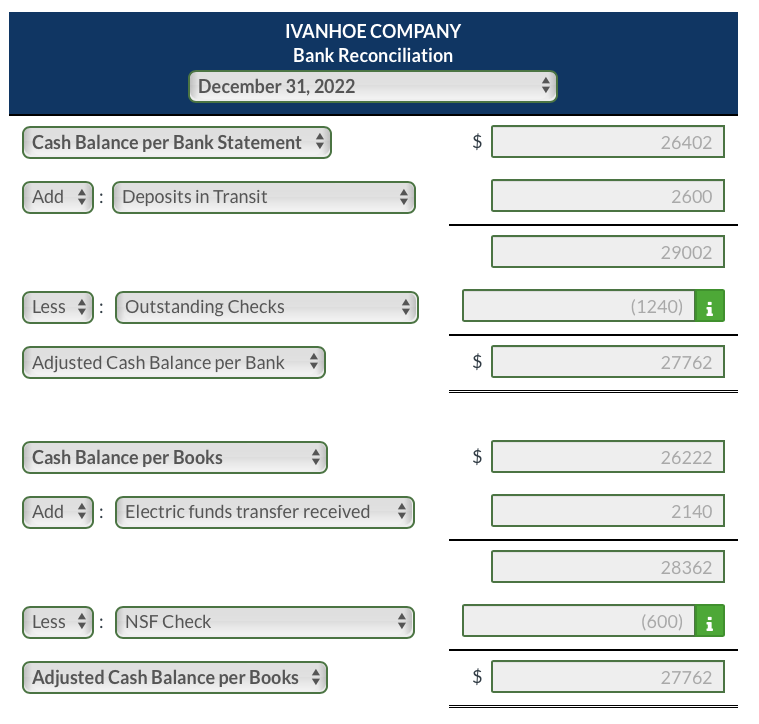

The statement from Lyon County Bank on December 31 showed a balance of $26,402. A comparison of the bank statement with the Cash account revealed the following facts.

| 1. | The bank collected the $2,140 note receivable for Ivanhoe Company on December 15 through electronic funds transfer. | |

| 2. | The December 31 receipts were deposited in a night deposit vault on December 31. These deposits were recorded by the bank in January. | |

| 3. | Checks outstanding on December 31 totaled $1,240. | |

| 4. | On December 31, the bank statement showed a NSF charge of $600 for a check received by the company from M. Lawrence, a customer, on account. |

Prepare a bank reconciliation as of December 31 based on the available information.(Hint: The cash balance per books is $26,222. This can be proven by finding the balance in the Cash account from parts (a) and (b).) (List items that increase balance as per bank & books first.)

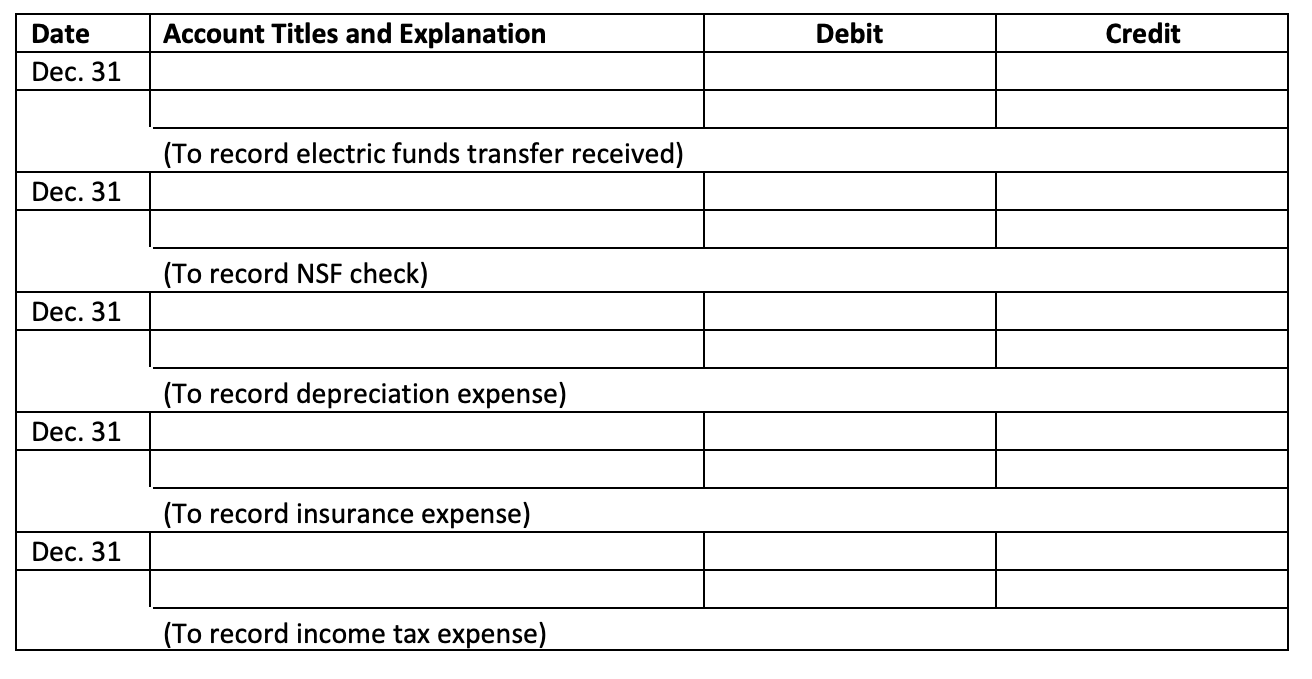

Adjustment data:

| 1. | The amount of depreciation is $110. | |

| 2. | Insurance expired $440. | |

| 3. | Income tax expense was $310. It was unpaid at December 31. |

PLEASE ANSWER: Journalize the adjusting entries resulting from the bank reconciliation and adjustment data. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) List of Accounts:

List of Accounts:

- Accounts Payable

- Accounts Receivable

- Accumulated Depreciation-Equipment

- Bank Charges Expense

- Cash

- Cash Over and Short

- Common Stock

- Cost of Goods Sold

- Depreciation Expense

- Entertainment Expense

- Equipment

- Freight-In

- Freight-Out

- Income Tax Expense

- Income Taxes Payable

- Insurance Expense

- Interest Receivable

- Interest Revenue

- Inventory

- Miscellaneous Expense

- No Entry

- Notes Receivable

- Petty Cash

- Postage Expense

- Prepaid Insurance

- Retained Earnings

- Salaries and Wages Expense

- Sales Discounts

- Sales Revenue

- Service Revenue

- Supplies

- Supplies Expense

- Travel Expense

- Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started