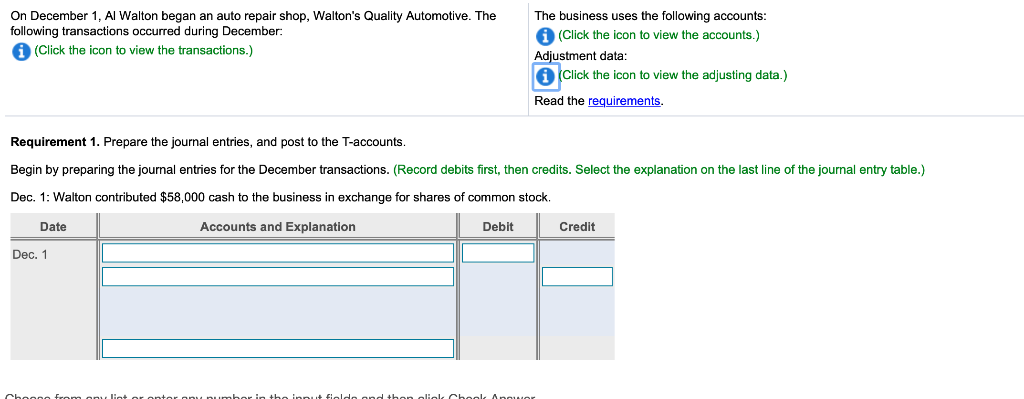

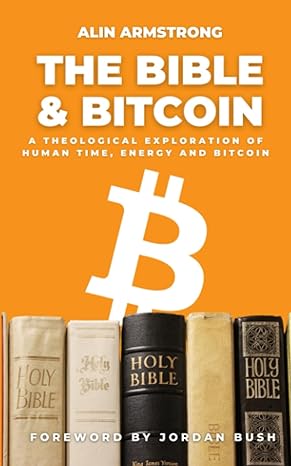

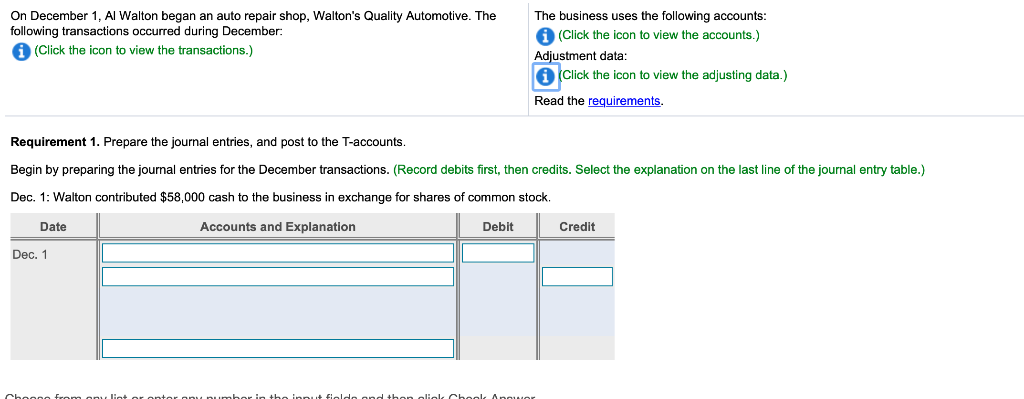

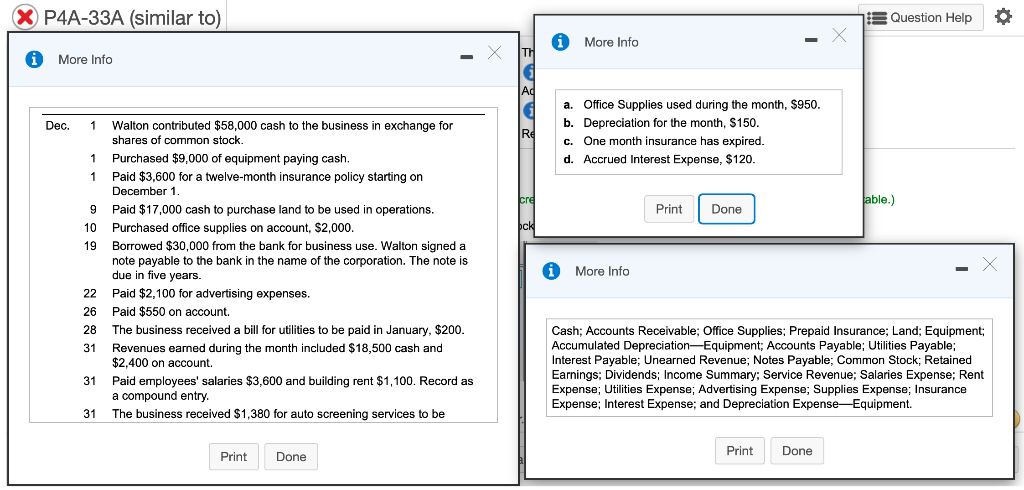

On December 1, Al Walton began an auto repair shop, Walton's Quality Automotive. The following transactions occurred during December: (Click the icon to view the transactions.) The business uses the following accounts: i (Click the icon to view the accounts.) Adjustment data: Click the icon to view the adjusting data.) Read the requirements. Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the journal entries for the December transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 1: Walton contributed $58,000 cash to the business in exchange for shares of common stock. Date Accounts and Explanation Debit Credit Dec. 1 Eielda and than alial, C beage fram anu list er anter any aumbar in tha is Apeer P4A-33A (similar to) Question Help More Info More Info Office Supplies used during the month, $950. b. Depreciation for the month, $150. Dec. Walton contributed $58,000 cash to the business in exchange for shares of common stock. 1 Re c. One month insurance has expired. d. Accrued Interest Expense, $120. Purchased $9,000 of equipment paying cash. 1 Paid $3.600 for a twelve-month insurance policy starting on 1 December 1 able.) Paid $17,000 cash to purchase land to be used in operations. Print Done 9 1C Purchased office supplies on account, $2,000. 19 Borrowed $30,000 from the bank for business use. Walton signed a note payable to the bank in the name of the corporation. The note is due in five years. More Info Paid $2,100 for advertising expenses. 22 Paid $550 on account. 26 be paid in January, $200. 28 The business received a bill for utilities Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Equipment; Accumulated Depreciation-Equipment; Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Payable; Common Stock; Retained Earnings; Dividends; Income Summary; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense; Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense-Equipment 31 Revenues earmed during the month included $18,500 cash and $2.400 on account. 31 Paid employees' salaries $3,600 and building rent $1,100. Record as compound entry. 31 The business received $1,380 for auto screening services to be Print Done Print Done On December 1, Al Walton began an auto repair shop, Walton's Quality Automotive. The following transactions occurred during December: (Click the icon to view the transactions.) The business uses the following accounts: i (Click the icon to view the accounts.) Adjustment data: Click the icon to view the adjusting data.) Read the requirements. Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the journal entries for the December transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 1: Walton contributed $58,000 cash to the business in exchange for shares of common stock. Date Accounts and Explanation Debit Credit Dec. 1 Eielda and than alial, C beage fram anu list er anter any aumbar in tha is Apeer P4A-33A (similar to) Question Help More Info More Info Office Supplies used during the month, $950. b. Depreciation for the month, $150. Dec. Walton contributed $58,000 cash to the business in exchange for shares of common stock. 1 Re c. One month insurance has expired. d. Accrued Interest Expense, $120. Purchased $9,000 of equipment paying cash. 1 Paid $3.600 for a twelve-month insurance policy starting on 1 December 1 able.) Paid $17,000 cash to purchase land to be used in operations. Print Done 9 1C Purchased office supplies on account, $2,000. 19 Borrowed $30,000 from the bank for business use. Walton signed a note payable to the bank in the name of the corporation. The note is due in five years. More Info Paid $2,100 for advertising expenses. 22 Paid $550 on account. 26 be paid in January, $200. 28 The business received a bill for utilities Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Equipment; Accumulated Depreciation-Equipment; Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Payable; Common Stock; Retained Earnings; Dividends; Income Summary; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense; Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense-Equipment 31 Revenues earmed during the month included $18,500 cash and $2.400 on account. 31 Paid employees' salaries $3,600 and building rent $1,100. Record as compound entry. 31 The business received $1,380 for auto screening services to be Print Done Print Done