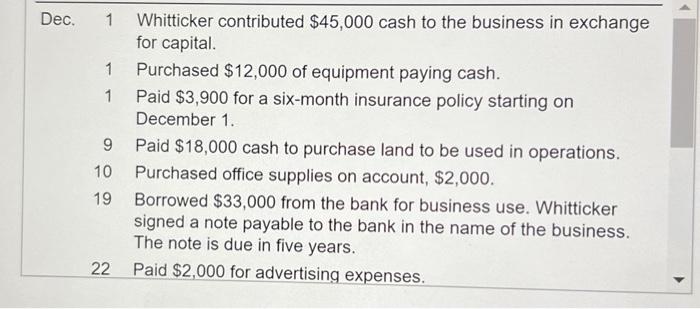

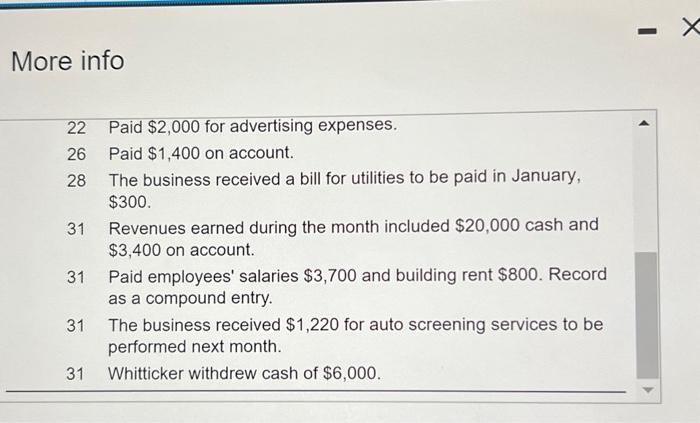

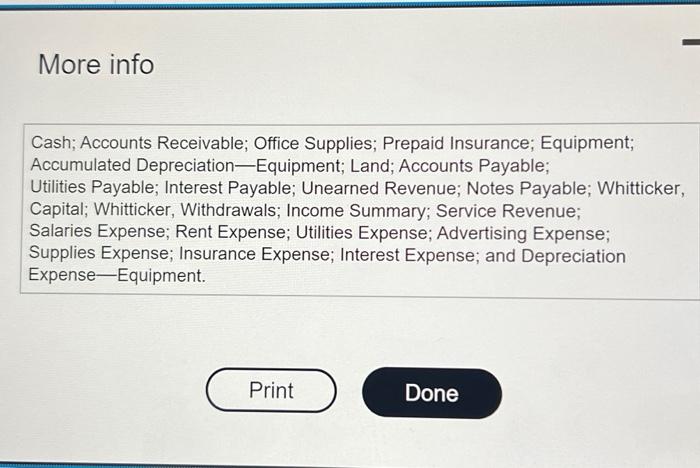

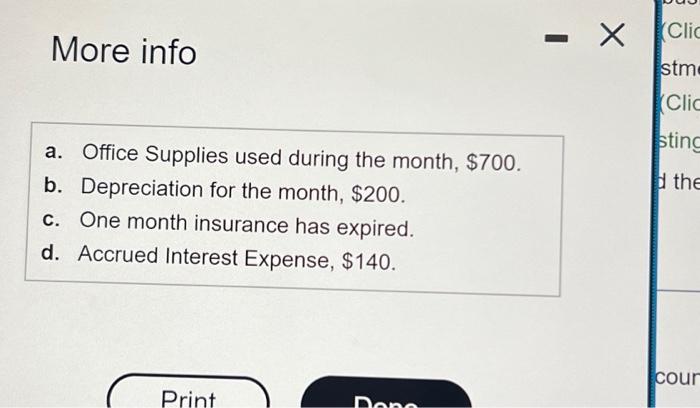

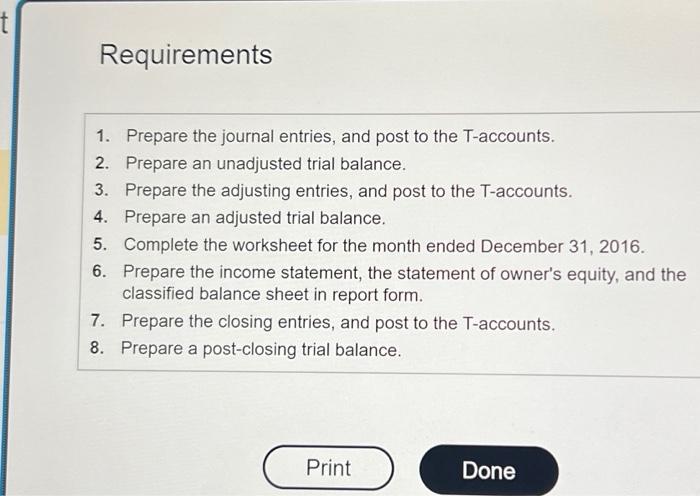

On December 1, Ike Whitticker began an auto repair shop, Whitticker's Quality Automotive. The following transactions occurred during December: (Click the icon to view the transactions.) The business uses the following accounts: (Click the icon to view the accounts.) Adjustment data: (Click the icon to view the adjusting data.) Read the requirements. Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the journal entries for the December transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 1 Whitticker contributed $45,000 cash to the business in exchange for capital. 1 Purchased $12,000 of equipment paying cash. 1 Paid $3,900 for a six-month insurance policy starting on December 1. 9 Paid $18,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $2,000. 19 Borrowed $33,000 from the bank for business use. Whitticker signed a note payable to the bank in the name of the business. The note is due in five years. 22 Paid $2,000 for advertising expenses. More info More info Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Equipment; Accumulated Depreciation-Equipment; Land; Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Payable; Whitticker, Capital; Whitticker, Withdrawals; Income Summary; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense; Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense-Equipment. More info a. Office Supplies used during the month, $700. b. Depreciation for the month, $200. c. One month insurance has expired. d. Accrued Interest Expense, \$140. Requirements 1. Prepare the journal entries, and post to the T-accounts. 2. Prepare an unadjusted trial balance. 3. Prepare the adjusting entries, and post to the T-accounts. 4. Prepare an adjusted trial balance. 5. Complete the worksheet for the month ended December 31, 2016. 6. Prepare the income statement, the statement of owner's equity, and the classified balance sheet in report form. 7. Prepare the closing entries, and post to the T-accounts. 8. Prepare a post-closing trial balance. On December 1, Ike Whitticker began an auto repair shop, Whitticker's Quality Automotive. The following transactions occurred during December: (Click the icon to view the transactions.) The business uses the following accounts: (Click the icon to view the accounts.) Adjustment data: (Click the icon to view the adjusting data.) Read the requirements. Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the journal entries for the December transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 1 Whitticker contributed $45,000 cash to the business in exchange for capital. 1 Purchased $12,000 of equipment paying cash. 1 Paid $3,900 for a six-month insurance policy starting on December 1. 9 Paid $18,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $2,000. 19 Borrowed $33,000 from the bank for business use. Whitticker signed a note payable to the bank in the name of the business. The note is due in five years. 22 Paid $2,000 for advertising expenses. More info More info Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Equipment; Accumulated Depreciation-Equipment; Land; Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Payable; Whitticker, Capital; Whitticker, Withdrawals; Income Summary; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense; Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense-Equipment. More info a. Office Supplies used during the month, $700. b. Depreciation for the month, $200. c. One month insurance has expired. d. Accrued Interest Expense, \$140. Requirements 1. Prepare the journal entries, and post to the T-accounts. 2. Prepare an unadjusted trial balance. 3. Prepare the adjusting entries, and post to the T-accounts. 4. Prepare an adjusted trial balance. 5. Complete the worksheet for the month ended December 31, 2016. 6. Prepare the income statement, the statement of owner's equity, and the classified balance sheet in report form. 7. Prepare the closing entries, and post to the T-accounts. 8. Prepare a post-closing trial balance