Answered step by step

Verified Expert Solution

Question

1 Approved Answer

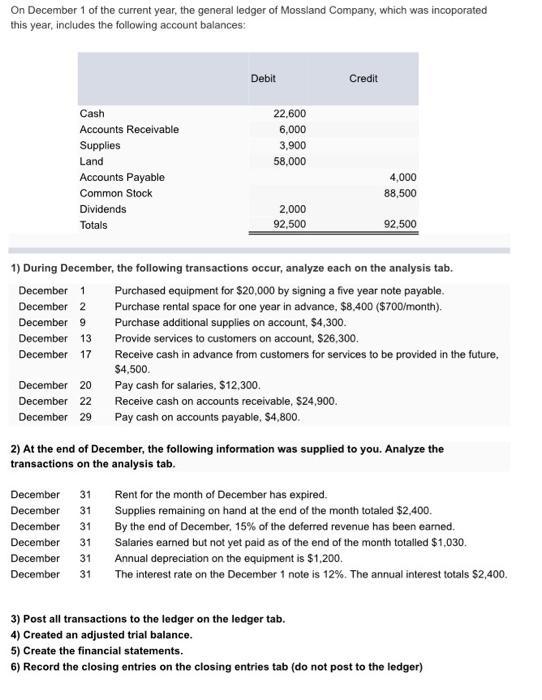

On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit

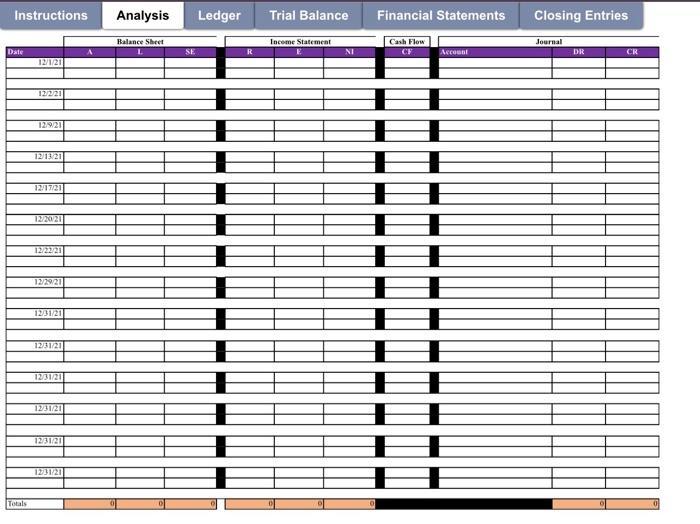

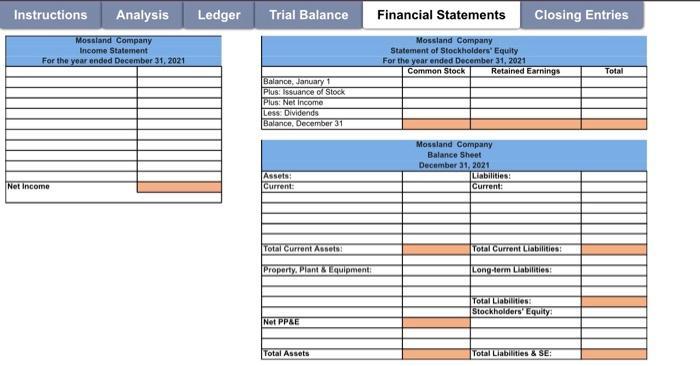

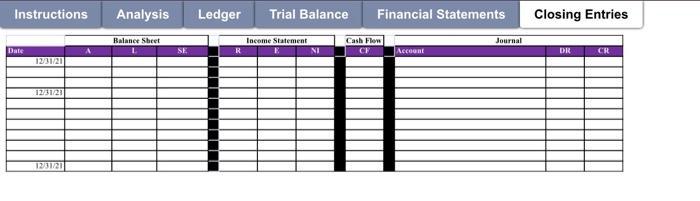

On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Mossland Company Balance Sheet Income Statement Cash Flow Journal Date A L SE R E NI CF Accounts Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started