Answered step by step

Verified Expert Solution

Question

1 Approved Answer

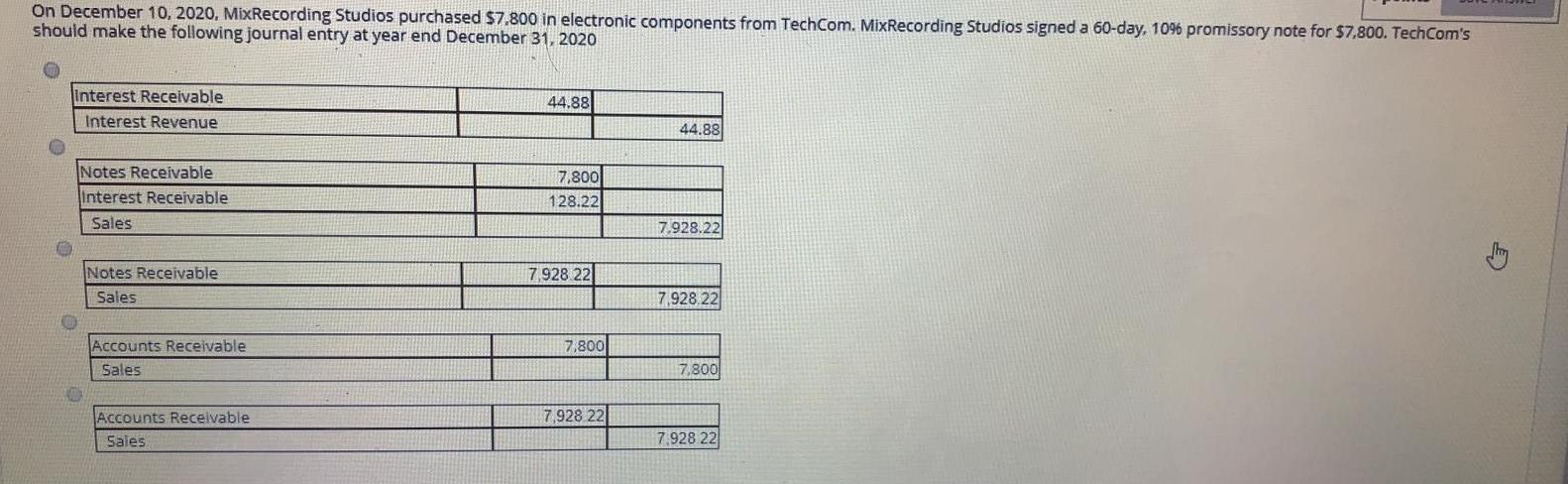

On December 10, 2020, MixRecording Studios purchased $7.800 in electronic components from TechCom. MixRecording Studios signed a 60-day, 10% promissory note for $7.800. TechCom's should

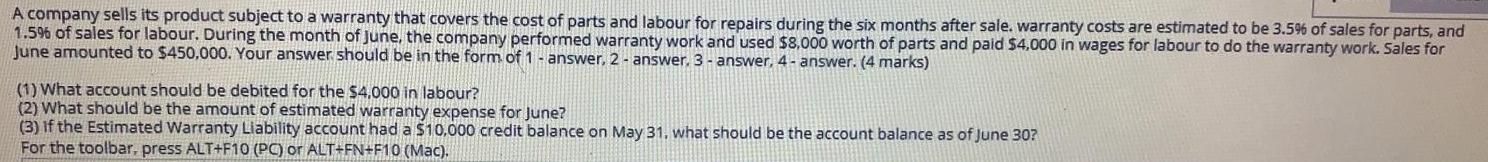

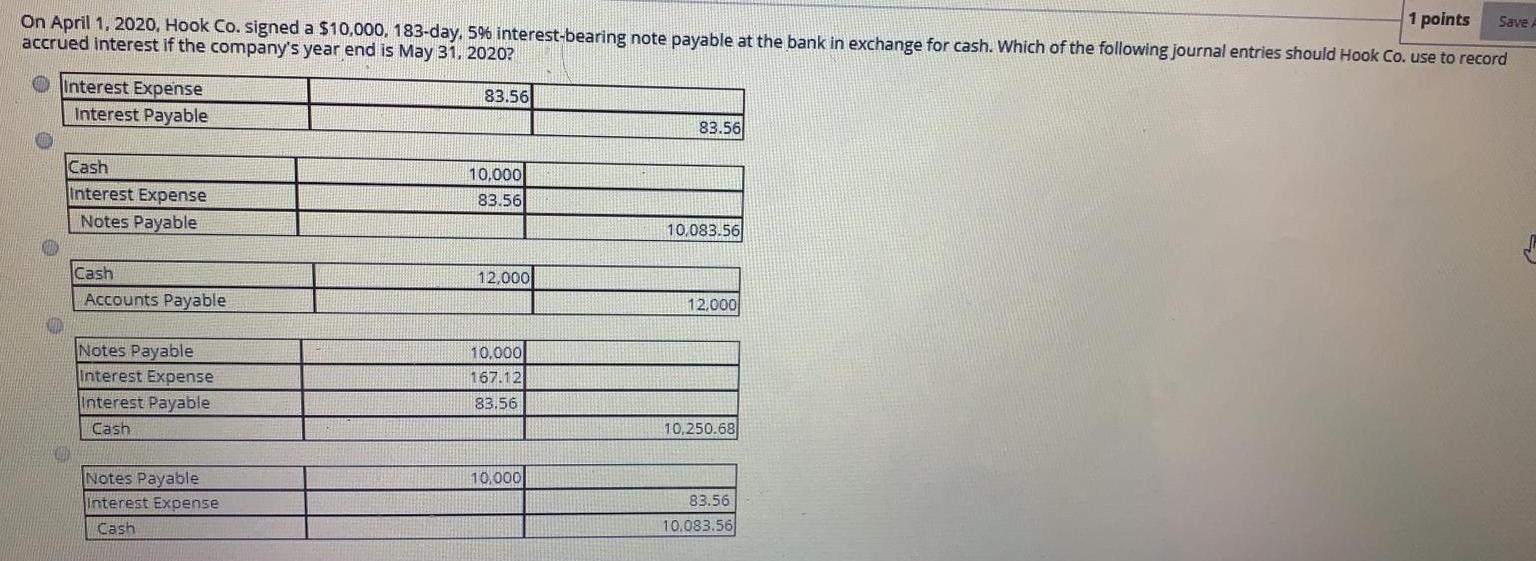

On December 10, 2020, MixRecording Studios purchased $7.800 in electronic components from TechCom. MixRecording Studios signed a 60-day, 10% promissory note for $7.800. TechCom's should make the following journal entry at year end December 31, 2020 Interest Receivable Interest Revenue 44.88 44.88 Notes Receivable Interest Receivable Sales 7,800 128.22 7.928.22 7928 22 Notes Receivable Sales 7.928.22 7,800 Accounts Receivable Sales 7.800 7,928 22 Accounts Receivable Sales 7.928 22 1 points Save On April 1, 2020, Hook Co. signed a $10,000, 183-day, 5% interest-bearing note payable at the bank in exchange for cash. Which of the following journal entries should Hook Co. use to record accrued interest if the company's year end is May 31, 2020? O Interest Expense Interest Payable 83.56 83.56 Cash Interest Expense Notes Payable 10,000 83.56 10,083.561 12,000 Cash Accounts Payable 12,000 Notes Payable Interest Expense Interest Payable Cash 10.000 167.12 83.56 10.250.68 10,000 Notes Payable Interest Expense Cash 83.56 10.083.56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started