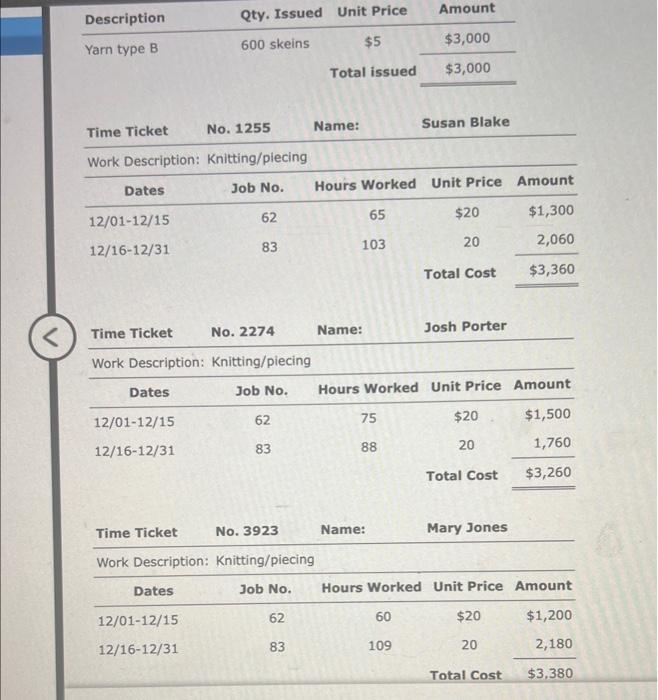

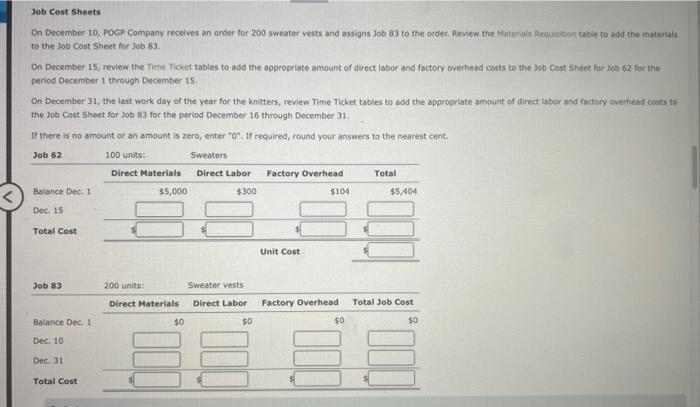

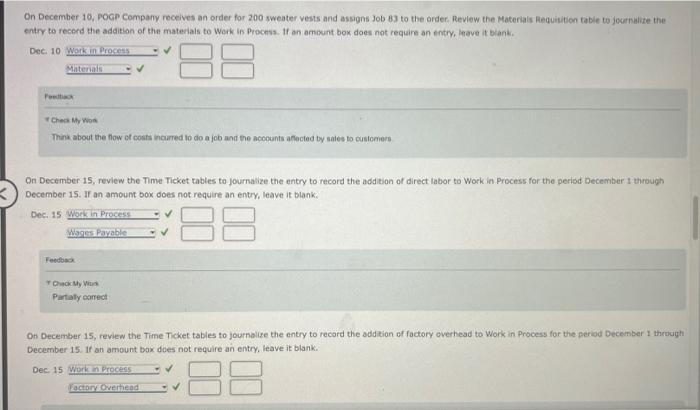

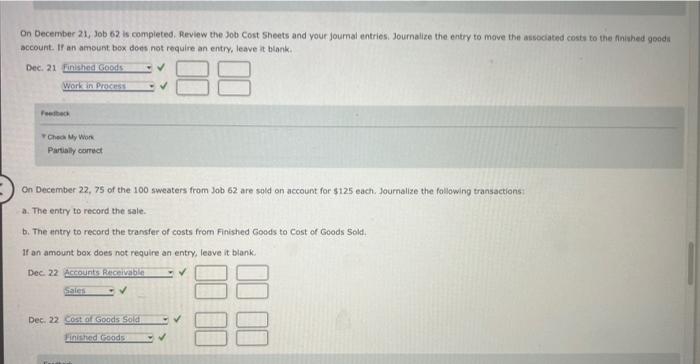

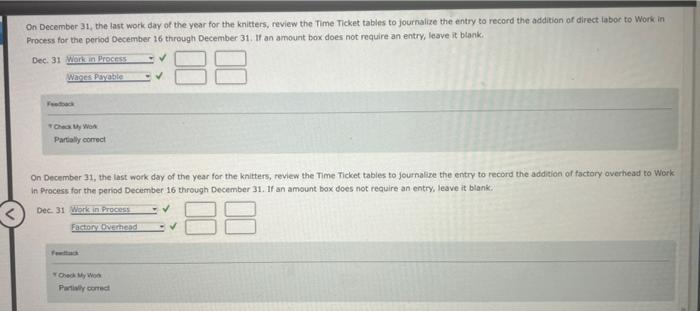

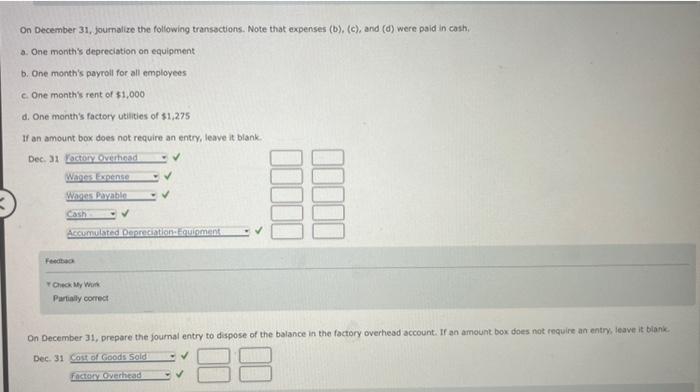

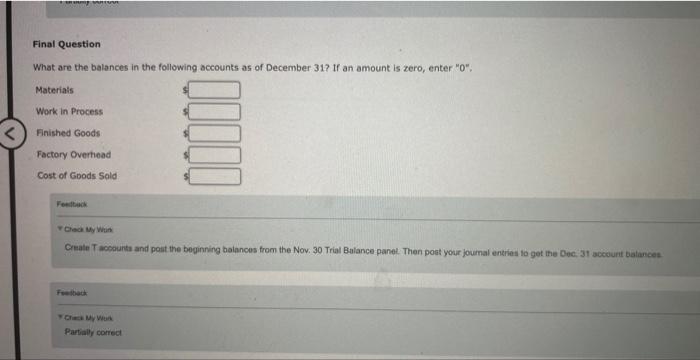

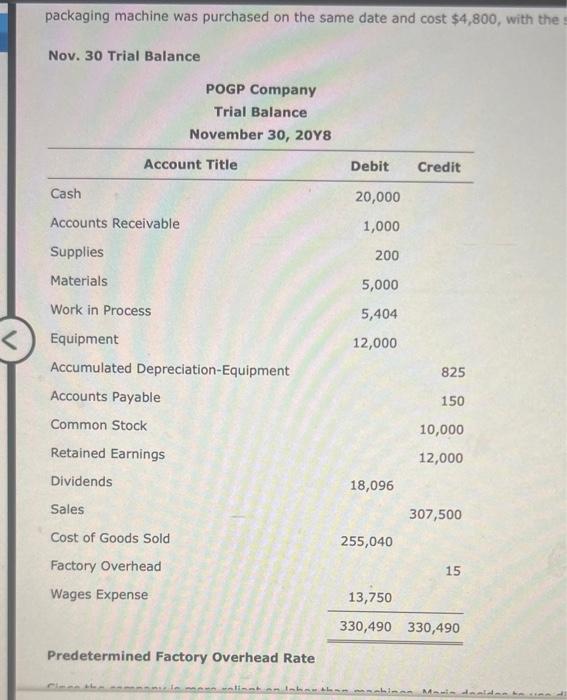

On December 10, PoGP Company receives an order for 200 sweater vests and assigns Job- 83 to the order. Revicw the Materiais Requilition table te add the matnrais to the Job Cost Sheet for Job 83 . On December 15, review the Time Ticket tables to add the appropriate amount of direct labor and factory overhead costs to the Job Cost 5 acet for Job 62 for the period December 1 through December 15 . On December 31, the last work day of the year for the knitters, review Time Ticket tables to add the approprlate amount of direct labor and factory oveinead costs to the lob Cost 5 heet for Job 63 for the period December 16 through December 31 . If there is no amount or an amount is zero, enter " 0. If required, round your answers to the nearest cent. On December 10, PoCp Company receives an order for 200 sweater vests and assigns Job 83 to the order. Review the Materials Requitibon table to journalite the entry to recerd the addieion of the materiais to Work in Procnss. If an amount box does not require an entry, leave it blank. T Chea My Woi Thin about the flow of cosh incurred to do a fob and the acoounts aflected by sales to cusconiers On December 15, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 1 through December 15. If an amount box does not require an entry, leave it blanki: T Ciack My Wis Partaly eanect On December 15, review the Time Ticket tables to journalize the entry to recard the addition of factory overhead to Work in Process for the periad December 1 thedugi December 15. If an amount bax does not require an entry, leave it blank. Dee 15 On December 21, Job 62 is completed. Review the Job Cost Sheets and your joumal entriesi Journalize the entry to move the associated costs to the finiahed geada account. If an amount bex dees not require an entry, leave it blank. Dec. 21 * Chear My Work Pantialy camect Cn December 22, 75 of the 100 sweaters from Job 62 are sold on account for 3125 each, Journalize the following transactionsi a. The entry to record the sale. b. The entry to record the transfer of costs from Finished Goods to Cost of Goods Sold. On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct iabor to Work in Process for the period December 16 through December 31 . If an amount box does not require an entry, leave it blank. Dec. 31 Fastack Tcina vy wou Partaly correct On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addiaion of factory averhead to Work In Process for the periad December 16 through December 31. If an amount box does not require an entry, leave it blank. On December 31, journalize the following transactions. Note that expenses (b), (c), and (d) were paid in cash. a. One month's depreciation on equipment b. One month's payroil for all employees c. One monthis rent of $1,000 d. One month's factory utilities of $1,275 If an amount box does not require an entry, leave it blank. Dec 7 Check My wis: Parially conrect On December 31, prepare the journal entry to dispose of the balance in the foctory overheod account. If an amount box does not require an entry: ieave it blank. Final Question What are the balances in the following accounts as of December 31? If an amount is zero, enter "0", Fexitank * Cleck My win packaging machine was purchased on the same date and cost $4,800, with the Nov. 30 Trial Balance