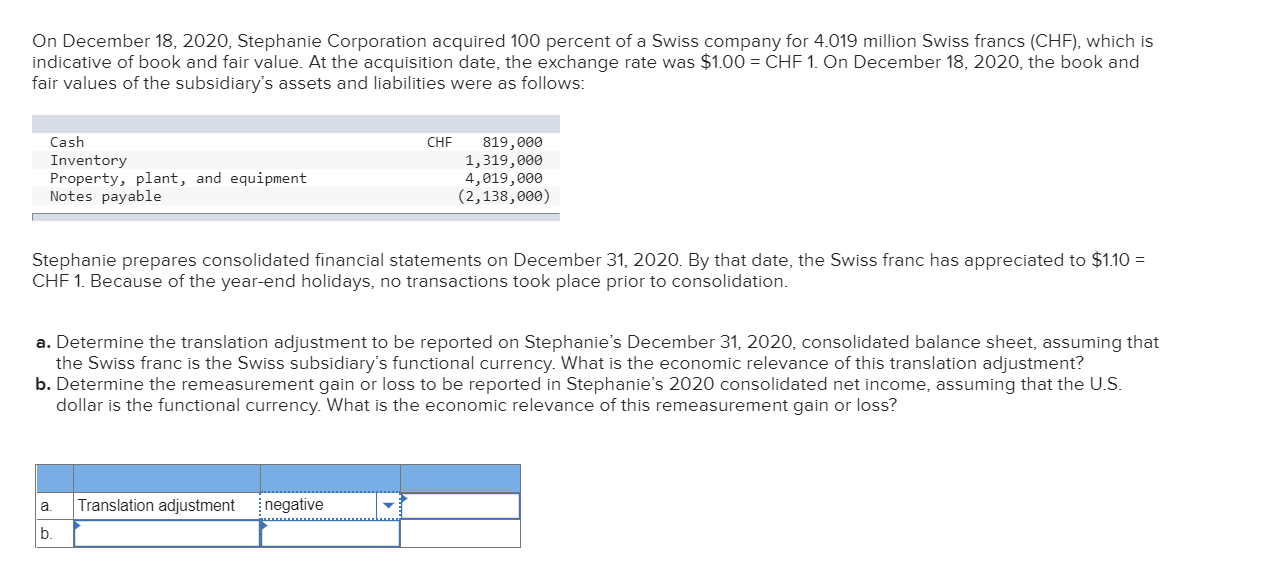

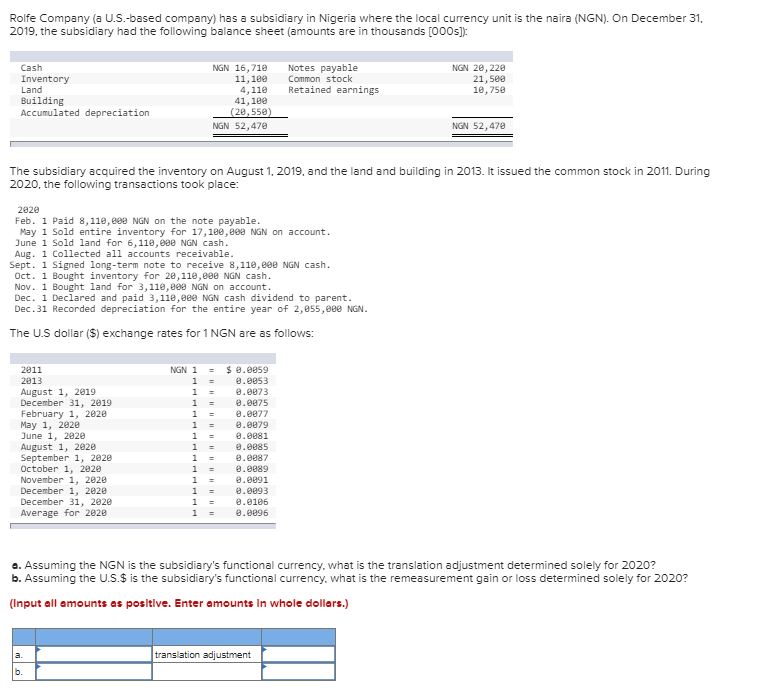

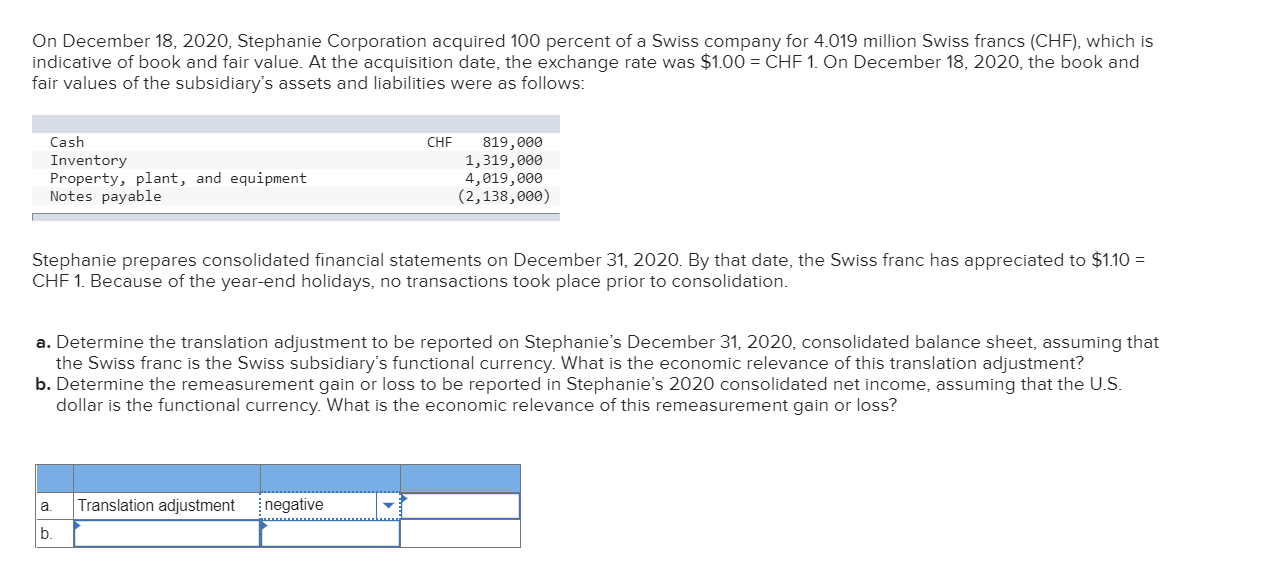

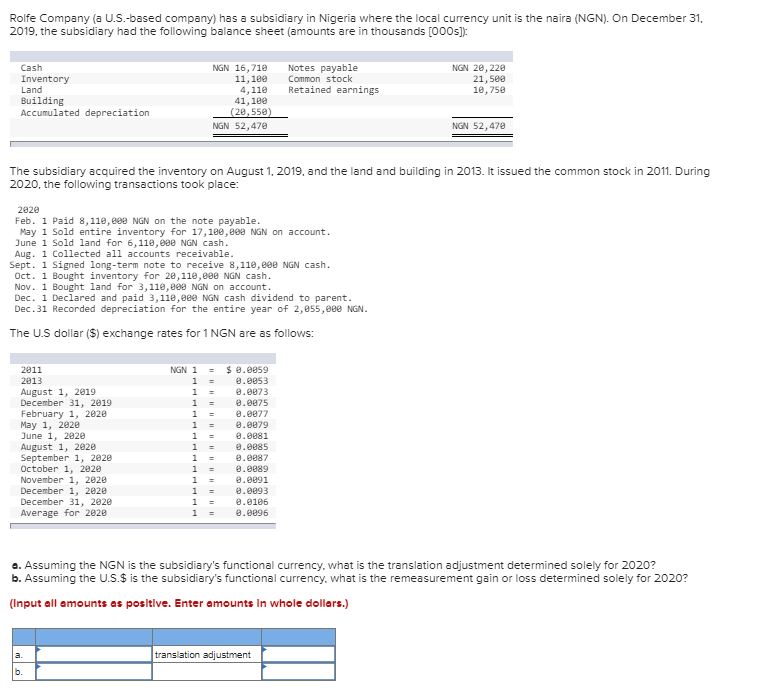

On December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.019 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00=CHF1. On December 18 , 2020, the book and fair values of the subsidiary's assets and liabilities were as follows: Stephanie prepares consolidated financial statements on December 31,2020 . By that date, the Swiss franc has appreciated to $10= CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. a. Determine the translation adjustment to be reported on Stephanie's December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in Stephanie's 2020 consolidated net income, assuming that the U.S. dollar is the functional currency. What is the economic relevance of this remeasurement gain or loss? Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31 , 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: 220 Feb. I Paid 8,110, 60 NGN on the note payable. May 1 Sold entire inventory for 17, 180, 8 NGN on account. June 1 sold land for 6,110, 0 NGN cash. Aug. 1 collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,110,600 NGN cash. oct. 1 Bought inventory for 20,110,6e NGN cash. Nov. 1 Bought land for 3,11,80 NGN on account. Dec. 1 Declared and paid 3,116, 6NGN cash dividend to parent. Dec.31 Recorded depreciation for the entire year of 2, 855,080 NGN. The U.S dollar (\$) exchange rates for 1NGN are as follows: a. Assuming the NGN is the subsidiary's functional currency, what is the translation adjustment determined solely for 2020 ? b. Assuming the U.S.\$ is the subsidiary's functional currency, what is the remeasurement gain or loss determined solely for 2020 ? (Input all emounts as positive. Enter amounts In whole dollers.)